How to Leverage AI for Insurance Agents to Create Better Client Relationships

By William Bowen

- Published: January 8, 2025

The adoption of AI for insurance agents is increasing rapidly, particularly as insurance teams search for ways to enhance customer service, reduce risk, and improve productivity.

For years, forward-thinkers in the insurance space have experimented with emerging forms of artificial intelligence for various types of tasks. For instance, many agencies use AI to help them assess risk, compile data for claims, and analyze trends.

Now, however, new forms of AI, like conversational artificial intelligence, generative AI bots, and advanced machine learning systems are introducing new opportunities to organizations.

With AI, insurance agents can now detect fraudulent claims faster, streamline the underwriting process, increase sales, and even deliver personalized service to clients at scale.

Here’s your guide to the rise of AI in the insurance industry.

In this article:

The Evolution of AI in Insurance

As mentioned above, AI isn’t an entirely new concept for the insurance industry. Many organizations have used some manner of artificial intelligence for a while now, to help boost productivity and efficiency, minimize the risk of errors, and even deliver 24/7 service through chatbots.

Increasingly, however, the value of AI for insurance agents has grown more evident, particularly as new types of intelligent tools emerge. We now have AI tools that can help companies collect and nurture SMS leads, automate marketing campaigns, personalize customer service, and detect and mitigate risks faster than ever before.

The evolution of new AI technologies is spurring rapid adoption across the sector. In fact, in 2024, Precedence Research found the market value for AI in insurance was already a massive $8.13 billion.

Want to learn more about how AI can help scale your insurance agency?

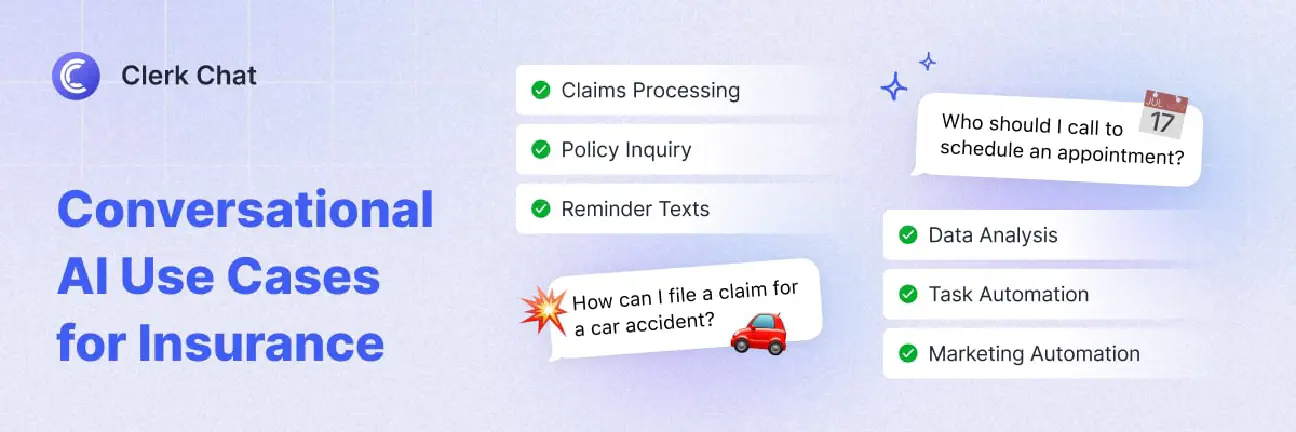

Let’s take a closer look at some of the major use cases for AI insurance agent integration today:

1. Automating Processes with AI

One of the biggest benefits of AI in any industry, is that it has the potential to automate repetitive processes that would otherwise consume the time of human employees. Intelligent tools can help insurance agents to handle claims processing, quoting, and policy-serving tasks faster than ever.

Companies can even use AI to send automated text messages to customers, following up with them on claims progress, policy renewal requirements, and more. Alternatively, they can use bots to manage AI lead follow-up processes automatically, checking in with customers after a pre-determined time.

Not only does automation reduce the manual workload for insurance agents, but it can help to reduce the risk of errors too, while freeing agents up to focus on strategic decision-making and building deeper relationships with policyholders.

2. Transforming Policyholder Engagement

Staying connected with policyholders is crucial for any insurance company that wants to retain its clients and increase their lifetime value. However, it’s often hard to find the time in a busy industry to follow-up with each client, suggest the right products for their needs, and drive sales.

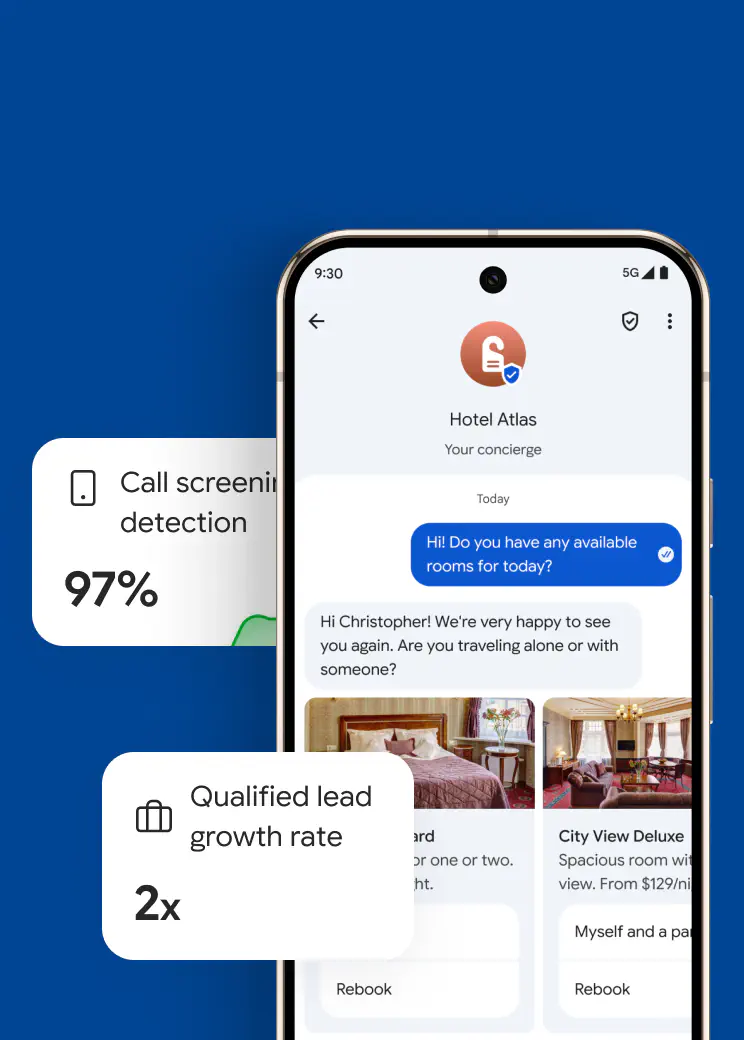

AI can help with this. With a chatbot for insurance agents, or a virtual assistant, companies can instantly share information with policyholders at various points in their consumer journey. The right bot can send documents and help information to new customers when they sign up for a policy automatically. Innovative solutions can even target online, email, and SMS leads with personalized product recommendations, based on profile data.

For instance, a bot with access to machine learning algorithms could compare the profile of a new customer to that of existing policyholders, and immediately detect opportunities to promote specific products, like life insurance, car insurance, or health insurance to different consumers.

3. Improving Customer Experience

AI chatbots for insurance agents aren’t just great at proactively engaging leads and following up with customers. They’re also fantastic at ensuring insurance companies can deliver personalized, convenient, and consistent service and support to policyholders.

Consider the difference between chatbots vs conversational AI, for instance. In the past, traditional rule-based chatbots could only deliver pre-determined responses to customer queries when they used the right keywords in a question. Now, conversational AI in customer service allows bots to actually understand diverse customer requests, and assist users with a wide range of tasks.

An effective bot can guide customers through the process of making a claim, setting up a new policy, or just troubleshooting an issue – often faster than a human agent. Plus, the same bot can transfer contextual information from discussions with customers to agents when an issue needs to be escalated to a human being, leading to faster and more intuitive issue resolution.

4. Optimizing Decision Making with Intelligent Insights

One of the biggest opportunities offered by AI for insurance agents is the ability to rapidly assess, evaluate, and draw insights from huge volumes of data. In the past, analyzing vast amounts of data about market trends, consumer preferences, and opportunities would have taken weeks, or even months to do manually.

Now, AI tools allow companies to consolidate all of their data into a single ecosystem, and rapidly access insights they can use to create new policies, products, or customer service strategies. Some innovative AI tools can even help companies to segment contacts into different groups, enabling more personalized marketing and advertising strategies.

Plus, there are machine-learning-powered solutions that can provide access to predictive analytics, helping agents to make informed decisions about targeting strategies and product offerings. AI can even help companies improve their marketing ROI, providing insights into the best times to send certain AI text messages or notifications to customers based on their needs.

5. Reducing Risks and Mitigating Fraud

AI for insurance agents also helps companies rapidly detect and minimize potential risks. Advanced algorithms in AI tools can analyze data patterns to detect anomalies that may indicate potentially fraudulent claims or activities among consumers.

These tools can even help companies to create profiles for potential “bad actors,” so they can more easily identify potential risks in real-time in the future. Insurance agents can also use AI-driven tools to assess risk more effectively, which helps to ensure policies are priced appropriately and delivered to trustworthy individuals.

AI can help companies navigate other risks too. For instance, an AI-powered agent built into a platform like Clerk Chat can help companies to track customers that “opt-out” of receiving messages, and prevent them from sending texts that would cause issues with TCPA compliance.

TCPA

The Telephone Consumer Protection Art addresses telephone marketing calls and certain telemarketing practices, including text messages.

The Benefits of AI in Insurance

Obviously, the benefits of AI for insurance agents are constantly evolving, as new tools and technologies continue to emerge. For the time being, however, the biggest advantages forward-thinking companies are seeing include:

- Improved customer satisfaction: As mentioned above, intelligent tools, like an AI chatbot for insurance agents, give companies an excellent opportunity to enhance the customer experience, offering 24/7 service to customers across territories and countries.

- Increased revenue: With conversational AI for insurance, companies can send personalized product and policy recommendations to customers in an instant. They can upsell and cross-sell existing customers, and increase their chances of converting new policyholders.

- Greater retention rates: With automated solutions and AI, companies can maintain stronger connections with customers. They can automatically send onboarding documents to new policyholders, use appointment SMS campaigns to remind customers of upcoming meetings, and even help customers renew policies faster.

- Improved efficiency and productivity: With conversational and generative AI tools, insurance agents can automate time-consuming tasks like searching through data to validate claims, or entering information into a database. This means human agents have more time to spend on valuable tasks, like connecting with consumers directly, or developing products.

- Enhanced decision-making: With AI to extract data from policy trends, customer conversations, and more, insurance companies can make better decisions. They can access the insights they need to develop more popular policies, improve customer service, and even streamline risk assessments.

- Reduced risk: Speaking of risks in the insurance industry, AI can help companies fight back against fraudulent claims, detect anomalies in customer behavior faster, and effectively determine how to price products and services.

Examples of AI Tools for Insurance Agents

Right now, there are dozens of AI solutions out there for insurance agents to take advantage of. Here are just a few examples of the types of tools insurance companies can tap into this year.

1. Clerk Chat: AI for SMS Communication

Many of the use cases for AI for insurance agents revolve around leveraging intelligent tools to improve customer communications. As mentioned above, companies are using AI tools for everything from creating personalized marketing content for specific customer segments, to streamlining sales strategies, and improving customer service.

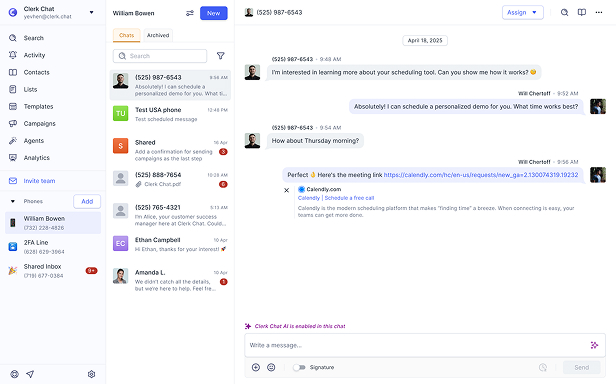

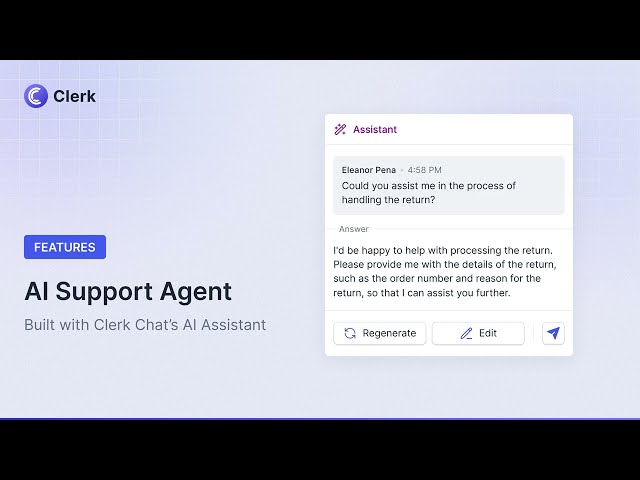

Clerk Chat, the world-leading business SMS platform, offers companies a host of AI-powered tools they can use to strengthen all kinds of customer communications. Companies can use AI to create insurance sales text message templates, personalized to suit different customer groups.

They can take advantage of the Clerk Chat Assistant to provide end-to-end 24/7 service to customers through SMS, WhatsApp, RCS, and chat. This intelligent bot can engage in 2-way texting conversations with customers at any point in their purchasing journey, suggesting products, answering questions, and more.

Plus, with the AI features built into Clerk’s reporting and analytical tools, companies can gain insights that help them to make intelligent decisions about how to create marketing campaigns, when to send messages to customers, and more.

Want to learn more about how AI can help scale your insurance agency?

2. Knowmax: AI Knowledge Management

Knowmax is an AI-guided knowledge management platform that empowers customer-facing teams to deliver more effective service across various touchpoints. It breaks down information silos in the insurance landscape, and ensures agents can access the documentation, tips, and guidance they need to handle any customer interaction faster.

This knowledge base software extends beyond simply unifying articles and FAQs. It gives agents comprehensive next-best-action workflows to follow, as well as visual how-to guides. Plus, companies can use the platform to create complex SOPs (broken down into visual guides), and even training resources for customer service experts.

Insurance companies can even take advantage of Knowmax’s generative AI tools to create omnichannel-ready self-help guides they can distribute across all of their online channels. This helps to improve customer experiences, while also minimizing the number of requests service agents need to handle each day.

3. HubSpot AI (Breeze)

Embedded into HubSpot’s existing suite of tools, such as its CRM platform, as well as service, sales, and marketing hubs, Breeze AI is a comprehensive toolkit of AI solutions for insurance agents. The suite makes it easy for agents to access information with a “Copilot” that can answer questions about policies and customers, based on business data.

Companies can also create dedicated agents within Breeze AI that can handle tasks like planning out marketing strategies, and distributing content across social media. Plus, companies embracing AI for insurance agents can use Breeze to create more intuitive customer profiles, streamline lead qualification, and even identify buyer intent in real-time.

Existing HubSpot users can even tap into Breeze AI to create sales scripts, marketing content, intuitive reports, and predictive sales forecasts. With Clerk Chat’s HubSpot integration, organizations could even combine the insights and features offered by Breeze AI with their SMS marketing strategies or text-based customer service efforts.

Implementing AI into Insurance Workflows: Top Tips

From chatbots, to AI-powered analytical tools and automation systems, there are dozens of ways to implement AI for customer service agents right now. Of course, in any industry, there are certain challenges that need to be addressed before companies can unlock the full value of AI.

Before you dive into your new intelligent strategy, here are some top tips for success.

1. Create AI Policies in Advance

First, make sure you have clear policies in place that govern how you’re going to use AI. Certain processes in the insurance industry are better suited to AI enhancement than others. For instance, you may use AI to create appointment reminder text templates and automate the delivery of SMS messages to customers.

However, you may want to avoid relying exclusively on AI for things like handling complex insurance claims, or discussing policy options with new customers. Make sure you know what you should be automating in your business and where you need to maintain a human touch to strengthen connections with your target audience.

2. Consider Security and Compliance Carefully

AI insurance agent tools rely heavily on access to data. In an environment where companies often collect, store, and manage large amounts of sensitive information, such as payment details and personal identification information, caution is crucial.

You’ll need to ensure that you’re following security and compliance best practices wherever you add AI into workflows. For instance, if you’re using AI to share insights and policy guidance with customers, you may need to invest in an SMS archiving tool for advisors to comply with industry standards, and protect yourself in the case of future audits.

If you’re using AI to streamline and scale text messaging for insurance agents, you’ll still need to ensure you obtain your customer’s consent to text them with promotional messages. You’ll also need to ensure you’re monitoring opt-out rates, tracking where data is stored, and using encryption to keep the data you collect from your customers secure.

3. Avoid Doing Too Much Too Fast

As the potential for AI in the insurance landscape continues to evolve, it’s tempting to dive in and start experimenting with multiple solutions and tools at once. However, attempting to add AI to too many workflows at once could be problematic. It’s best to start with a single use case, focusing on where AI can unlock the most potential for your business, then build out from there.

For instance, if you want to optimize marketing, customer service, and sales strategies at once, with AI-powered SMS tools, Clerk Chat will give you all the resources you need in one package. You can start experimenting with scheduling SMS campaigns, creating content using AI, and delivering 24/7 service to customers, without having to invest in multiple different tools and platforms.

Plus, with a platform like Clerk Chat, you can easily embed AI into your existing workflows, connecting the system with the tools your team already uses, like Microsoft Teams, HubSpot CRM, Salesforce, and your digital archiving tools.

The Future of AI for Insurance Agents

The future of AI for insurance agents is bright, and it’s getting brighter all the time. Going forward, AI will introduce more ways to boost agent efficiency, productivity and performance, while enhancing customer experience for insurance firms.

Already new innovations on IoT systems are unveiling new opportunities that will help agents to gather more data instantly for insurance claims. Additionally, generative AI tools are helping businesses to create more personalized marketing content faster than ever before, whether you’re investing in SMS, email marketing, or social media.

If you’re ready to discover the benefits and opportunities offered by AI in the insurance sector, Clerk Chat gives you an easy way to get started. Contact our team to discover how our AI-powered SMS tools can help you increase sales, enhance team efficiency, optimize customer service, and unlock more ROI from your marketing campaigns.

Will’s latest superpower is building innovative AI solutions to add value for clients. He's passionate about all things AI, entrepreneurship, and enjoys staying active with sports and outdoor activities.

In this article:

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.