The Big Shift Happening with AI in Finance

By William Bowen

- Published: August 22, 2025

Technology has played a pretty important role in the finance industry for a while now, shaping everything from banking to trading. But if there’s one trend that’s really driving rapid growth, it’s the rise of AI in finance.

From intuitive conversational AI chatbots for customer service to agentic AI solutions automating everything from risk analysis to investment portfolio creation, artificial intelligence is shaking up the financial industry like never before.

In fact, reports show that the market for artificial intelligence in finance will grow to a value of around $190.33 billion by 2030 - that’s a CAGR of 30.6%.

So, why the rapid growth - and why now? Simply put, financial companies need a more intuitive way to support customers, analyze trends, leverage data, and cut costs - and artificial intelligence delivers.

Here’s everything you need to know about the benefits of AI for finance, the opportunities companies are exploring, and the trends we’re inching towards.

In this article:

The Evolution of AI in Finance

Like most industries, the finance sector has been experimenting with artificial intelligence for some time. Plenty of major companies use AI in financial services processes that involve analyzing data, risks, and market opportunities.

But the opportunities in this industry have evolved in recent years, thanks to the rise of more advanced technologies and models.

For instance, improvements in machine learning and data analytics now mean that financial institutions can process vast volumes of information faster and more accurately than ever. This drives better decision-making across countless domains, from credit assessments to customer service.

For instance, AI-driven algorithms can analyze intricate patterns in transaction data, improving fraud detection and prevention efforts.

Elsewhere, conversational AI in financial services gives companies access to intuitive bots that can deliver 24/7 customer support across channels, adapt to different customer preferences, and personalize recommendations.

In the investment space, hedge fund and asset managers are using AI tools to execute trades with speed and precision, using real-time market data to inform strategies and increase gains.

These transformations are having a profound impact on global financial markets, helping institutions to manage risks more effectively, boost economic stability, and deliver better customer experiences at scale.

Think AI is just for answering FAQs? Think again.Learn how to use AI agents to optimize workflows, stay compliant, and deliver better customer experiences.

Compelling AI Use Cases in Financial Services

The use cases for AI in financial services are constantly evolving, particularly as we branch into new areas, like agentic AI, conversational AI, and generative AI.

Right now, the main applications of AI in finance typically focus on a few key areas, like improving customer experiences, enhancing data analytics, and boosting compliance. Let’s take a closer look at just some of the opportunities financial leaders are exploring.

Customer Service: AI for Personalized Banking

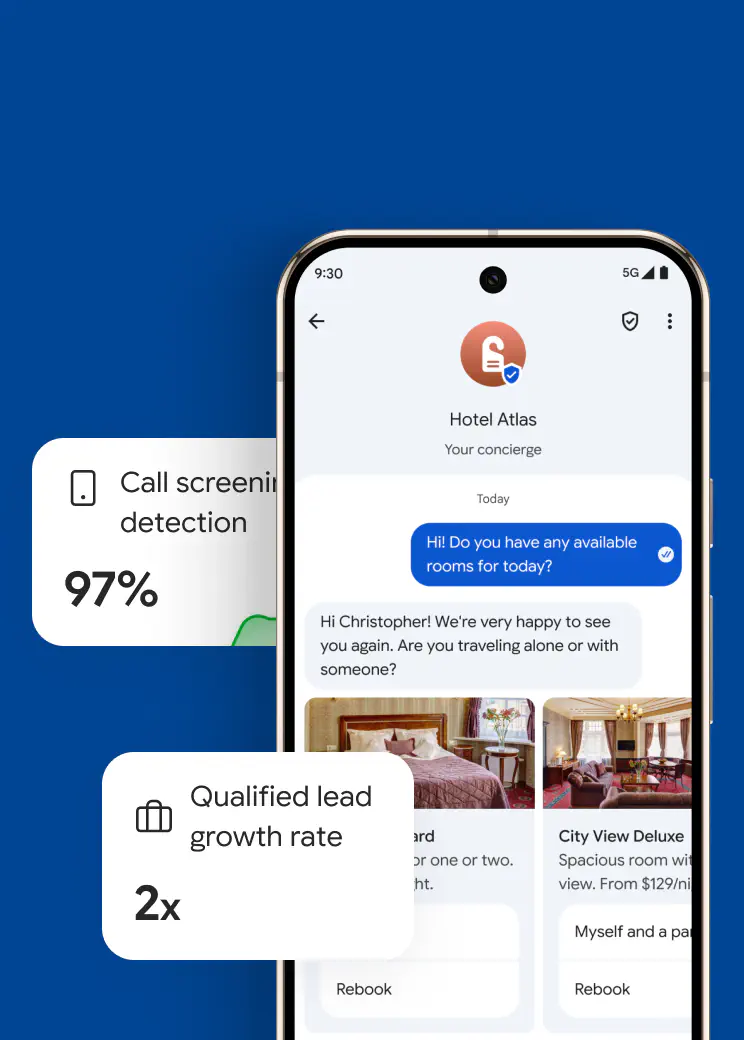

One of the biggest use cases for artificial intelligence in any industry is transforming customer service. Countless companies are already investing in the top AI tools for customer service - from intelligent IVR systems that seamlessly manage calls, to conversational AI chatbots that handle 24/7 requests.

The financial services industry is no different. AI-powered conversational banking agents and bots aren’t just helping companies to automate everyday customer service tasks, like answering FAQs. They’re guiding customers through processes, like troubleshooting log-in issues or setting up international money transfers.

For example, the Bank of America virtual assistant (Erica) has managed more than 50 million banking interactions over the years.

What makes cutting-edge AI solutions so valuable for customer service is that they can personalize each interaction. Advanced models can extract insights from previous interactions and customer profiles to suggest relevant services or products to a customer (like a new account option).

Some companies using AI in customer service are even using their tools to deliver proactive support, automatically reaching out to customers when they need to update a profile or change the details on an automatic payment.

The result is better, more intuitive customer experiences throughout the entire journey, improving relationships between financial services companies and their clients.

Risk Management: Predicting and Mitigating Risks

AI isn’t just improving customer service in financial services, it can also help companies address some major risk-related challenges. The financial sector is often volatile and dynamic, and AI solutions can help companies stay one step ahead of issues.

AI models can process mountains of data, from market reports, SMS archiving tools, previous conversations, and more to develop insights.

Some finance AI models can predict market volatility, identify which potential customers are most likely to pose the highest credit risk, and even foresee upcoming financial threats. For example, US banks often use AI for stress testing, simulating various economic scenarios to determine resilience levels based on different conditions. This can help to improve financial stability and strengthen entire economies.

AI solutions can also constantly “monitor” activities in the financial services landscape, highlighting potential compliance issues before they lead to massive fines. This is crucial in an industry where regulatory compliance is constantly evolving.

Fraud Detection: AI as the Financial Watchdog

The insights offered by AI in finance don’t just help companies side-step problems, but also maintain financial stability. They can also make financial systems more secure, helping to fight back against cyber threats, fraudulent activities, and bad actors. Around 71% of financial institutions are now using AI to fight back against fraud.

With artificial intelligence in financial services, companies have a way to constantly monitor every interaction and transaction in real-time for signs of suspicious activities. Machine learning algorithms can even use historical data to pinpoint red flags that human beings would generally miss.

Plus, AI-powered tools can help companies implement better safeguards for their customers, too. For instance, an AI SMS solution can automatically generate and issue one-time passwords for a company using MFA (Multi-Factor Authentication) to improve account security, or alert customers of suspicious activity on their accounts.

Credit Scoring and Lending: Smarter Decisions

AI for financial services companies is also having an impact on how companies deliver services and products to customers. For instance, in the “lending” space, AI systems can rapidly identify credit scores and immediately offer insights into which customers pose the greatest risk, and what kind of services might suit their financial situation.

Where traditional credit scoring tools often rely on limited data, AI-driven models can incorporate a range of indicators into decision-making processes. For instance, a company using agentic AI in banking can tell their system to combine traditional credit score data with insights into a customer’s recent financial behaviors, to determine whether they’re suitable for a loan. This can help lenders make more informed decisions and potentially improve access to credit for some underserved groups.

Plus, AI tools can enable faster loan approvals. After a system automates the evaluation process, it can use a finance SMS platform to automatically send a message to a customer, asking them for additional details, or inviting them to fill out an application. Once the application is ready, that same system can send it to the right member of staff for approval, and send a confirmation message back to the customer.

Algorithmic Trading: AI on the Trading Floor

If you’re in the finance industry and you’re just looking at the benefits of conversational AI for customer support, or credit analysis, you could be missing out. In the trading space, AI-driven algorithmic trading is becoming more popular among everyday investors and large corporations alike.

Algorithmic systems can analyze market data at incredible speed, automatically executing trades at the perfect time to boost returns. According to recent estimates, about 75% of the trades that take place in the US are powered by algorithms.

As AI in finance continues to evolve, these algorithms will become even more sophisticated. They’ll be able to account for the individual risk levels of each investor, consider new market trends in real-time, and even offer valuable suggestions to traders through conversational interfaces. This could seriously reduce the barrier to entry for financial trading.

Automating Finance Tasks with AI

We’ve already discussed some of the things artificial intelligence in financial services can automate - like answering common customer questions or conducting risk assessments. But there are plenty of other opportunities for companies looking for ways to boost the efficiency and productivity of their teams.

For instance, in the marketing space, AI tools can automatically analyze previous campaigns and customer profiles to create custom SMS messages advertising new products to specific groups. These tools can even regularly follow up with clients, keeping them informed about new opportunities and addressing concerns, while adhering to SMS regulations.

AI tools can also automate tasks such as data entry, conversation summarization, and transcription. For instance, a company using SMS with CRM systems can create a bot that automatically uploads transcribed notes from a previous conversation to a customer’s profile. Some bots can even translate conversations with global customers or redact sensitive information from transcripts for compliance purposes.

Think AI is just for answering FAQs? Think again.Learn how to use AI agents to optimize workflows, stay compliant, and deliver better customer experiences.

The Benefits of AI for Finance Teams

Overall, AI in finance is driving a new era for growing companies, opening the door to conversational commerce opportunities, enhanced data insights, and better customer experiences. Although there are challenges to address, particularly regarding privacy and security concerns, AI in financial services can deliver:

- Improved Efficiency: With AI automating repetitive tasks, like data analysis or text message archiving for financial services teams, human staff members have more time to focus on the things that matter, like complex customer support.

- Cost Reductions: AI tools don’t just reduce the need for additional staff members; they can cut costs by helping companies to mitigate and avoid risks. Some solutions can even increase revenue by identifying emerging opportunities.

- Higher Customer Satisfaction: Conversational AI for insurance, finance, and banking teams drives better customer experiences through 24/7, personalized service. Customers can get help whenever they need it, tailored to their specific concerns, goals, and interests.

- Valuable Insights: AI tools are brilliant at assessing huge amounts of data to extract insights and trends. They can help streamline decision-making processes, give businesses the tools they need to predict opportunities in advance, and even highlight new trends and patterns as they emerge.

- Enhanced Compliance: With AI tools monitoring everything from TCPA compliance adherence to potential security risks, companies can more easily navigate compliance. They can ensure all of their team members are following regulatory requirements and minimize the risk of fines.

For some companies, finance AI solutions even improve collaboration between teams, helping bridge communication gaps between global workers with translation, summarizing meetings, and Microsoft Teams SMS threads, and keeping everyone on the same page.

The Future of AI in Financial Services

The potential for AI in finance is already incredible, but there’s still plenty of room for growth. Already, companies are beginning to discover new ways to use cutting-edge tools, like tapping into generative AI for financial analysis or marketing campaign creation.

Innovative organizations are exploring the difference between agentic AI vs AI agents - building fully autonomous bots that can plan, reason, and adapt in real-time.

We’re even seeing stronger integrations between AI tools and things like CRM platforms (such as Salesforce), ERP systems, and planning tools, helping to drive better predictive analytics opportunities in the finance sector.

In the years ahead, new opportunities could emerge as technology advances. For instance, combining finance AI solutions with blockchain technology could open the door to higher transparency and security in areas like decentralized finance (DeFi).

Breakthroughs in quantum computing could empower developers to create bots capable of solving complex financial problems faster than ever before. They could also drive new advancements in agentic AI in insurance, finance, trading, and banking.

Financial firms are beginning to explore quantum-AI integrations in bots to optimize portfolios, refine trading algorithms, and enhance risk management strategies.

There are some risks too - regulatory frameworks are evolving to address the potential challenges of AI in finance, exploring how intelligent tools might pose new issues with consumer protection and ethics. However, the future is bright, particularly for companies that take a cautious approach to building and implementing AI solutions.

Embracing Artificial Intelligence in Finance

The role of AI in finance is evolving, and it’s still difficult to see exactly where the next couple of years will take us. However, it’s becoming increasingly apparent that artificial intelligence will play a role in how finance companies make decisions, support their customers, and navigate an increasingly complicated market.

For companies keen to take advantage of the rising opportunities that artificial intelligence has to offer, there is good news. You don’t necessarily need to build a model from scratch or hire a team of developers to bring your AI dreams to life.

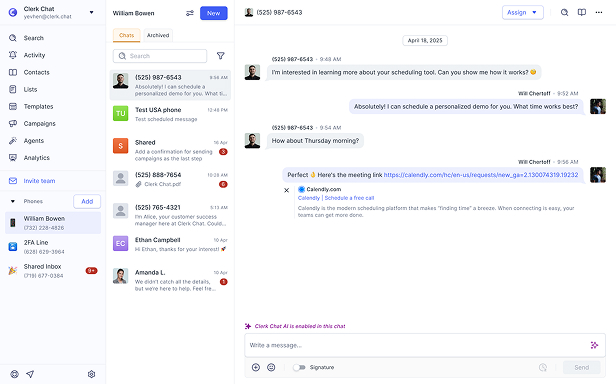

Platforms like Clerk Chat offer an easy way to dive into the benefits of AI, with flexible AI agents that can help businesses with tasks ranging from lead generation to customer support, sales, and beyond.

Don’t be the only company not experimenting with artificial intelligence in financial services. Take your next step into the future with Clerk Chat today.

Will’s latest superpower is building innovative AI solutions to add value for clients. He's passionate about all things AI, entrepreneurship, and enjoys staying active with sports and outdoor activities.

In this article:

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.