Conversational AI for Insurance: Claiming the Opportunity

By William Bowen

- Updated: August 27, 2025

Insurance has always been about timing. You don’t need help after the storm hits, you need it when the sky’s turning. Same with claims, questions, and policy changes. People want answers now, not a week later. Not after sitting on hold.

That kind of urgency puts a lot of pressure on teams – the teams already expected to deliver 24/7 service, reduce costs, prevent fraud, and keep the whole system moving, all while staying compliant and personal. That’s why so many providers are turning to conversational AI for insurance.

The goal isn’t to replace agents with AI. It’s to give them a break from the repetitive work and support them in an industry that’s brimming with unique challenges.

The results speak for themselves. Conversational AI in insurance is helping companies cut support costs by up to 30%, while speeding up resolution times and improving customer satisfaction.

As consumers continue to demand more from insurance providers, AI and conversational messaging solutions are becoming increasingly crucial to business success. Here’s the opportunity today’s leaders can take advantage of, and why it pays to act now.

In this article:

What is Conversational AI in Insurance?

Let’s start with the basics: what is conversational AI?

Conversational AI (artificial intelligence) is a set of technologies that enables machines to understand and respond to human language. It basically allows computers and bots (like AI-powered chatbots and virtual agents), to mimic intuitive conversations with human beings.

Notably, conversational AI is different from the standard, rules-based chatbots you might be familiar with. When it comes to understanding the difference between conversational AI vs chatbot solutions, the most important thing to remember is that not all chatbots leverage artificial intelligence.

There are plenty of “rule-based” chatbots out there that simply respond to input based on pre-configured rules and decision trees. Conversational AI is different. It takes advantage of large language models, natural language processing and understanding, and speech recognition to really understand people, and respond creatively.

Today’s leading conversational AI companies are creating solutions that don’t just react – they adapt and learn. Every discussion they have helps them become more effective, not just at chatting with customers, but lead profiling and conversation optimization.

Many of today’s tools also span across communication channels, delivering multilingual and multimodal support to insurance clients, however they choose to connect with a company.

Find the right communication platform for your insurance business.

Learn moreComply with regulations

Connect your existing number

Optimize with AI

Simplify routine messaging

Types of Insurance Conversational AI

As AI in call centers, sales departments, and customer service teams evolves, it’s taking on new forms. Conversational AI for insurance companies now includes a wide variety of tools like:

- AI-Powered Chatbots: Intelligent, text-based bots that learn from customer interactions. Smarter. Faster. More natural.

- Voice Assistants: Use speech recognition to help over the phone or through IVRs. Ideal for on-the-go policyholders.

- Self-Learning Agents: These improve over time. The more you use them, the better they get. They can even help companies predict and prevent churn.

- Task-Specific Assistants: Dedicated bots that handle things like quote generation, document uploads, or identity checks.

- Large Language Models (LLMs): These are your powerhouse engines, trained on massive datasets. Tools like Teneo Adaptive Answers use these models to deliver hyper-personalized responses at scale.

This is the toolkit behind the best conversational AI for insurance platforms today. Smart, flexible, and tuned for the realities of the industry.

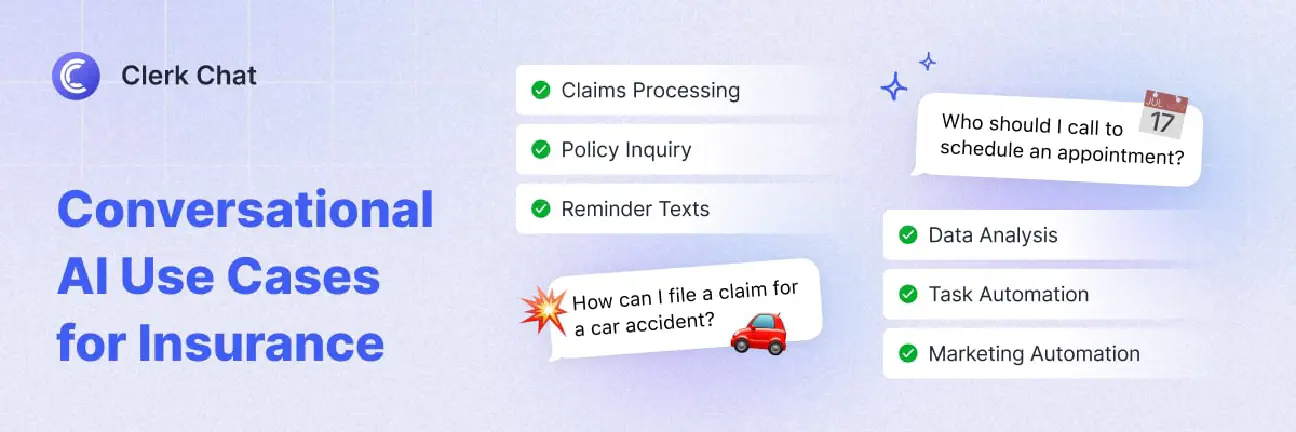

The Use Cases for Conversational AI in Insurance

In virtually every industry, conversational AI has emerged as a valuable tool for enhancing customer experiences, optimizing marketing and sales strategies, and improving operational efficiency. For instance, conversational AI for finance teams is allowing banks and investment companies to deliver personalized financial recommendations and guidance to customers across various platforms.

Conversational AI for insurance can deliver a lot of the same benefits. It empowers organizations to deliver intuitive self-service experiences to customers, streamline marketing strategies, and even give companies access to valuable data and insights.

Just some of the best ways teams use AI-powered virtual assistants, and conversational AI today include:

Claims Process Automation

Filing a claim has never been anyone’s favorite task. It’s emotional. It’s time sensitive. Usually, when things go wrong, the blame almost always falls on the insurer.

That’s where conversational AI in insurance really earns its keep. Instead of filling out PDFs or waiting on hold, a customer can send a message like “I had a fender bender yesterday”, and the system takes it from there. It walks them through the claim, uploads photos, handles document verification, pulls policy details, and gives them a clear next step.

It’s not just faster for customers. It’s faster for your team. One case study found that AI cut claims-related call times by over 31% per interaction. Multiply that across thousands of calls, and it’s easy to see the upside.

Customer Onboarding & Policy Management

First impressions matter. If it’s a pain to sign up, switch providers, or update personal details, people will leave, or worse, never convert.

With AI-powered two-way messaging apps, customers can reach out to companies with questions about new and existing policies, and access 24/7 support and guidance. Chatbots can immediately direct customers to the right service, or provide them with details on their policies, without human intervention.

Some of the best AI for insurance agents can even streamline tasks like risk assessment, or support staff with tricky underwriting processes.

Personalized Marketing & Cross-Selling

Most insurance marketing isn’t great. It’s often generic, poorly timed, and disconnected from what the customer actually needs.

But conversational AI changes all that. It’s not just ideal for personalizing customer service, or streamlining support, it makes marketing more powerful too.

Instead of blasting everyone with the same offer via an SMS blast service, smart systems can identify upsell opportunities based on policy history, behavior, or life events. Someone just got married? The system might recommend life insurance. Bought a new car? Time to bundle.

Fraud Detection & Risk Assessment

Some red flags are easy to spot. Others aren’t. But conversational AI can catch the subtler ones, things like sentiment shifts during a claim, unusual activity patterns, or mismatched speech behavior in voice calls.

Tools like voice-enabled chatbots can even flag suspicious behavior in real-time, helping prevent fraud before it spreads.

One emerging solution, UnlikelyAI, has reached 99% accuracy in claims classification, far outpacing traditional AI models.

Multilingual Support & Voice Insurance Integration

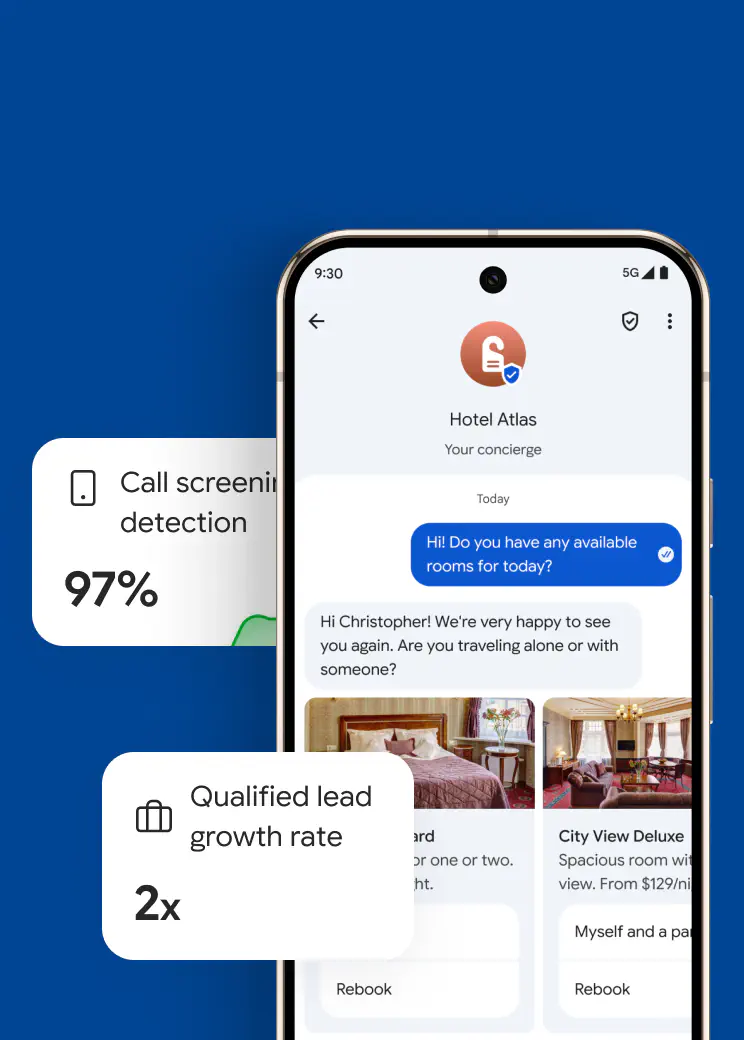

In a multilingual market, accessibility is crucial. Conversational AI for insurance lets insurers meet people in the language and format they’re most comfortable with.

That means a Spanish-speaking customer can file a claim in their native language. A hearing-impaired policyholder can get help via SMS. A busy parent can ask Alexa when their next premium is due.

AI customer service solutions don’t just make insurance teams faster and more effective at dealing with customer service, they ensure they can support more people, at scale.

Customer Engagement and Experience

With conversational AI for customer support delivering 24/7 service, fast answers, and ensuring people don’t have to repeat themselves across channels, customers stay engaged, and loyal. Even better, your agents get to spend their time where it counts: helping people, not just answering the same five questions all day.

AI assist tools can deliver complex workflow assistance to team members, leading to measurable agent performance improvements. Intelligent tools can also use customer feedback analysis and sentiment analysis to guide companies toward building better service strategies.

On top of that, conversational AI makes it easier to keep customer engaged. It can handle everything from personalized customer onboarding, to leveraging text message appointment reminder services to keep clients informed about upcoming appointments or policy renewals.

Optimizing Insurance: Conversational AI Benefits

Whether you’re using it for routine task automation, multilingual support, or sales strategies, conversational AI for insurance has a lot to offer. Many companies see immediate wins just by embedding AI in customer communications wherever friction points emerge.

The most significant benefits?

Better Experiences for Customers

Using conversational AI, insurance companies can deliver personalized, intuitive support to customers at scale, without significant costs. Chatbots and virtual assistants enhanced with conversational AI can deliver guidance to customers 24/7, helping them submit claims, track down the perfect policy, or even make changes to their accounts.

Intuitive AI solutions can even draw on data about a customer and your market, to provide more personalized insurance product recommendations to specific customers. Plus, with conversational SMS tools, you can deliver instant, multilingual support to customers through their preferred channel, in a range of languages.

A More Efficient Team

Not every question needs a human response. In fact, in insurance, most of them don’t.

Things like “Where’s my claim?” or “How do I reset my password?” take up a huge chunk of your team’s time. AI takes those off their plate, so real agents can focus on complex, high-value conversations.

You’re not cutting headcount. You’re using operational efficiency to give your people space to actually help. Right now, the tools are only getting better at managing more tasks. Conversational AI insurance agents can handle standard claims, store data for auditing purposes and leverage insights for HIPAA compliant texting.

They can enable claims processing automation, assist with lead profiling and conversion optimization, and even handle aspects of fraud detection and prevention.

Significant Cost Reductions

Let’s be blunt: customer service is expensive. Especially when it’s slow. But when AI handles the front lines, your overhead drops. Calls get shorter. Wait times shrink. Errors go down.

The cost savings don’t just come from the ability companies have to reduce headcount either. Since AI tools are excellent at analyzing data and surfacing insights, they can help companies spot roadblocks and bottlenecks that are wasting time and money.

Those data-driven insights lead to decisions about customer engagement, service delivery, and even staffing that don’t just reduce expenses, they also increase revenue potential.

Smarter Fraud Detection, Safer Compliance

AI isn’t just faster, it’s sharper. It can flag odd behavior in real time. Detect mismatches in tone and content. Spot patterns in claims that don’t line up with the data.

Some systems even use biometric voice authentication to verify a caller’s identity, which means fewer security questions, and a lot less fraud. This technology also helps with regulatory compliance.

With the right architecture in place, conversations can be logged, flagged, and reviewed without extra lift. You’re not just moving faster, you’re staying safe.

Implementation Challenges and Best Practices

Conversational AI for insurance is powerful, but it’s not always plug-and-play. Similar to companies using AI for financial customer service tasks, or healthcare support, insurance companies face their own challenges.

They’re often dealing with legacy systems, sensitive customer data, regulatory compliance rules that change by the quarter, and teams that are already juggling a lot. So even though the upside of conversational AI in insurance is huge, getting started takes planning.

Here are the challenges to prepare for:

Challenge 1: Integration Complexity

Most insurance providers are still running on a mix of old and new tech. That’s not a dealbreaker, but it does mean any new AI tools have to work with what you’ve already got.

The best insurance conversational AI platforms offer flexible APIs, sandbox environments, and pre-built seamless integration with existing systems. Don’t settle for solutions that require tearing up your stack, or place limitations on model fine-tuning and training.

If the integration capabilities of your chosen platform don’t cover everything, make sure the company you work with offers the right implementation support to help.

Challenge 2: Data Privacy and Security

You can’t cut corners here. Insurance means handling sensitive financial and personal data, and any AI system you bring in has to respect that.

Make sure your solution supports end-to-end encryption, data security protocols, and is certified for compliance frameworks like SOC 2, HIPAA, PCI, and TCPA. Look for vendors who offer regular compliance and architecture reviews, not just one-time audits.

Make sure your training data is clean. The better the data, the better (and safer) the results.

Challenge 3: Staff Readiness & Change Management

People don’t resist AI because they’re scared of tech. They resist it because they don’t trust it, or they don’t know how it fits into their workflow.

That’s where support matters. Choose a provider that offers onboarding help, knowledge transfer, and change management resources, especially if you’re launching across departments or locations.

Start with a pilot project or PoC (proof of concept), test your assumptions, and refine before scaling. Phased rollouts give you more space to learn and adapt.

Challenge 4: Bias and Model Limitations

Conversational AI in insurance isn’t perfect. If your models are trained on biased or incomplete data, you’ll see it show up in the results, whether it’s claims prioritization, agent escalation, or customer interactions.

Audit your models regularly. Ask your vendor about explainability tools and bias risks. Make sure there’s a clear escalation path when the system isn’t sure how to respond.

Some of the most promising new platforms, include explainable AI by design. That’s a big plus for teams who need traceability without technical headaches.

Getting Started with Conversational AI for Insurance

Unlocking the benefits of conversational AI in insurance doesn’t have to be complicated. All you really need is a goal, a strategy, and the right technology.

As a leading provider of insurance conversational AI and SMS solutions, here are our top tips for implementing intelligence into your business strategy.

Step 1: Define your Objectives

As mentioned above, in insurance, conversational AI can serve a range of use cases, from helping you to automate and scale your insurance text message marketing strategy, to transforming customer service. Before you dive in with your new technology, you’ll need to decide exactly what you want to accomplish. Ask yourself what matters most to your business right now.

Are you trying to deliver new services, like conversational banking style applications that allow customers to manage their insurance policies from anywhere? Do you want to create and send personalized marketing messages at scale to customers on various channels?

Identify what you want to achieve, and consider what kind of metrics you’ll need to track to ensure your initiatives are successful.

Step 2: Choose the Right Technology

This is where things can start to get trickier. There are plenty of apps out there that can provide access to conversational AI technologies, from build-your-own chatbot solutions, to fully-fledged platforms, like Clerk Chat. The firs thing to focus on is domain expertise.

In other words, look for insurance-specific AI solutions. Tools that are specifically tuned to integrate with your existing technologies, and maintain compliance. Next, make sure the solutions align with your specific use cases.

If you’re trying to boost your marketing and customer service strategies with intelligent SMS, for instance, then you’ll need a fully-fledged platform that allows you to use AI for text messages, create automated campaigns, and even track the results of your messaging strategies.

When assessing your platform options, focus on:

- Ease of use: A convenient platform should make it easy to configure your conversational AI tools with your brand’s specific messaging and tone of voice. It should offer access to convenient templates, and a straightforward dashboard for building campaigns.

- Compliance: Make sure your solution adheres to compliance standards, particularly when it comes to SMS compliance. Ensure you can track messaging opt-in and opt-out rates, schedule messages for appropriate times, and leverage end-to-end encryption.

- Omnichannel: If you’re taking an omnichannel approach with conversational AI for insurance, it makes sense to look for a platform that supports all of the right touchpoints, from SMS to instant messenger apps, social media, email, and even voice.

- Integrations: Check that you can connect your platform with critical tools, like your customer relationship management platform, and archiving solutions for compliance purposes. Integrations with collaboration and scheduling apps can be helpful too.

- Customer service: Look for a provider that offers exceptional customer support. For instance, Clerk Chat offers end-to-end guidance and assistance to all of our customers, whether they’re looking for number porting tips, or help navigating TCPA compliance.

Step 3: Constantly Experiment and Optimize

Once you’ve chosen your conversational AI platform, you’ll need to configure your “bots” and tools based on the use cases you’ve established. Make sure you think carefully about how you’re going to schedule automated messages, and what kind of language you’ll need to use.

Remember, even after you’ve implemented your conversational AI strategy, the work doesn’t stop there. You’ll need to consistently fine-tune and upgrade your system based on what you learn about your customers, evolving security requirements, and new trends.

A good platform offering conversational AI for insurance should give you insights into reports and analytics you can use to optimize your strategy over time. You might even be able to run A/B tests to determine which messages and campaigns drive the best results for your business.

Take advantage of these features, and use them to consistently improve your customer’s experience with your firm, and increase your return on investment.

Conversational AI for Insurance: Noteworthy Vendors

There’s no shortage of conversational AI tools out there, but not all of them are built with the realities of insurance in mind. Between compliance requirements, legacy systems, and customers who need answers right now, you need more than just a chatbot with a pretty UI.

These five platforms stand out because actually solve the kinds of problems insurers face every day. From live claims support to multilingual onboarding, here’s who’s doing it right.

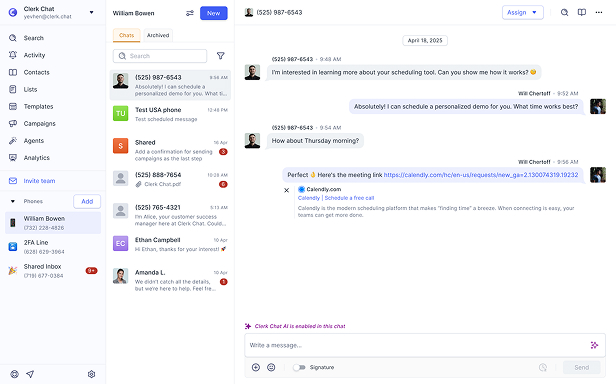

1. Clerk Chat: Built for Speed, Simplicity, and Compliance

If you’ve ever tried to streamline claims through SMS or automate customer service without losing the human touch, Clerk Chat gets it.

It’s fast, flexible, and it’s built specifically to help insurance teams reach people where they already are. Whether you’re sending reminders, answering questions, or helping someone file a claim, Clerk Chat keeps the experience smooth, responsive, and compliant.

It also integrates with all the tools you already use, so you don’t have to start building from scratch.

What stands out:

- Designed for custom insurance workflows, especially claims

- Native support for SMS, voice, and two-way messaging

- Compliant and security-first

- Seamless integrations with a range of tools

- Built-in automation with room for live agent takeover

Best for: Teams who want to connect with customers quickly, without making the process feel robotic. If your customer experience lives on mobile, Clerk Chat is where to start.

Find the right communication platform for your insurance business.

Learn moreComply with regulations

Connect your existing number

Optimize with AI

Simplify routine messaging

2. Avaamo: Best for Large-Scale, Regulated Deployments

Avaamo’s been in the insurance AI game for a while, and it shows. Their platform works across voice, text, and web, with support for dozens of languages and enterprise-grade compliance.

It’s a good fit for companies juggling complex needs: multiple lines of business, multiple customer types, and a big contact center footprint. If you’re looking for cutting-edge machine learning, state-of-the-art language models, and alignment with compliance certifications, Avaamo is a good choice.

What stands out:

- Wide language and channel coverage

- Security features that check all the boxes (HIPAA, PCI)

- Workflow templates built around insurance-specific use cases

Best for: Enterprise carriers that need global reach and serious back-end control.

3. Cognigy: Voice-First Automation That Scales

If your biggest challenge is reducing volume in your call center without breaking the experience, Cognigy is worth a close look. It’s designed for fast-paced, high-volume environments where voice still drives most of the action.

As a company that specializes in AI for customer experience, sales, and marketing, Cognigy has a lot to offer. Their tools can handle routing, identity verification, simple policy tasks, and even natural language IVR giving human agents time to handle the trickier stuff.

What stands out:

- Strong voice automation engine

- Pre-built insurance intents for faster deployment

- Flexible integrations with CRMs and contact center tools

Best for: Carriers looking to reduce call volume while maintaining (or improving) customer experience.

4. Boost.AI: No-Code Chatbot Automation with Enterprise Muscle

If your team needs a customer-facing chatbot that actually understands what people are asking, even when they don’t phrase it perfectly, Boost.ai is worth a serious look. It’s built specifically for enterprise environments like banking and insurance, where accuracy and security matter.

Boost.ai’s natural language understanding engine can handle multiple customer intents at once, guide users through complex workflows like policy changes or claims, and hand off seamlessly when a live agent is needed. It’s also known for being easy to train and manage without data scientist support.

What stands out:

- No-code interface for building and scaling bots fast

- Pre-trained insurance models that handle real-world use cases

- Average resolution rates of 80–90% across channels

Best for: Mid-size to enterprise insurers who want to deflect routine volume without losing accuracy, and who value speed-to-launch.

5. Aisera: Generative AI for Complex, High-Volume Workflows

Aisera is best known in IT and HR circles, but its generative AI engine is a powerful fit for large insurers managing thousands of policy-related inquiries, claims updates, or document requests daily. It’s built to automate repetitive questions across departments, not just in customer service, but in operations, billing, and benefits too.

Because Aisera is generative AI-native, it goes beyond scripted flows. It understands natural questions, adapts to the user’s intent, and pulls the right info from knowledge bases or CRMs instantly, all while keeping things secure and compliant.

What stands out:

- Generative AI engine built for cross-functional automation

- Ticket deflection and auto-resolution rates of 70–90%

- Easy integration into large enterprise systems

Best for: Large insurance organizations looking to embed AI into multiple workflows, not just chat, and automate support across departments.

Future Trends for Conversational AI in Insurance

If there’s one thing the last few years have made clear, it’s that digital transformation in insurance is happening fast, and conversational AI is right at the center of it.

Right now, we’re only just beginning to scratch the surface of what AI can offer insurance teams. Going forward, we can expect to see more opportunities emerging, like:

- More Generative AI: Generative AI isn’t just for writing blog posts. In the insurance space, it’s being used to craft claim summaries, explain policy details in plain English, and even respond to complex customer inquiries in a tone that feels human, and accurate.

- Embedded Insurance Gets Smarter: Whether it’s travel coverage built into your flight booking or renter’s insurance offered when you sign a lease, embedded insurance is becoming the norm. Conversational AI is powering the micro-moments that make these policies easy to understand and opt into.

- Predictive Analytics + AI: Most interactions in insurance are reactive, something happens, and the customer reaches out. But with predictive analytics and conversational AI working together, that’s changing. We’re seeing insurance chatbots that can flag when a customer is likely to churn, or when they need an upgrade to their policy.

- Smarter, Safer AI: It’s not just innovation opportunities shaping the insurance chatbot market, or the future of conversational AI. Explainability is becoming more crucial too. Companies are increasingly building AI models that offer transparency and take an ethics-first approach to customer service.

Plus, with agentic AI now gaining ground, we’ll also see more companies taking advantage of intuitive solutions that can help them automate and optimize more insurance tasks than ever before.

Leveraging Conversational AI for Insurance with Clerk Chat

The power of conversational AI for insurance only continues to grow as algorithms and apps become more intelligent and sophisticated. Fortunately, today’s insurance teams don’t need extensive technical expertise or experience to unlock the benefits of AI for their firms.

With an intuitive platform like Clerk Chat, you can take advantage of conversational AI tools, automated workflows for SMS, and powerful analytics, all in one convenient ecosystem.

If you’re looking for insights into what you can do with conversational AI and SMS in the insurance industry, check out our insurance SMS samples here.

Alternatively, get out there and start experimenting with the technology yourself. Whether you’re investing in 24/7 customer support, or stronger customer engagement strategies, conversational AI can help you stand out in a market that’s just growing more complicated.

Will’s latest superpower is building innovative AI solutions to add value for clients. He's passionate about all things AI, entrepreneurship, and enjoys staying active with sports and outdoor activities.

In this article:

- What is Conversational AI in Insurance?

- The Use Cases for Conversational AI in Insurance

- Optimizing Insurance: Conversational AI Benefits

- Implementation Challenges and Best Practices

- Getting Started with Conversational AI for Insurance

- Conversational AI for Insurance: Noteworthy Vendors

- Future Trends for Conversational AI in Insurance

- Leveraging Conversational AI for Insurance with Clerk Chat

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.