Why Finance Teams are Adopting Conversational AI

By William Bowen

- Updated: December 18, 2025

Think conversational AI in financial services is just for the big banks of the world? Think again. The truth is people expect the same level of responsiveness from any financial services provider as they do from their group chat. When someone reaches out because their card is locked, a payment didn’t go through, a document is missing, or a charge looks unfamiliar, they expect a fast, clear response.

Not just fast, in fact, 72% of customers want immediate service in finance. And that expectation isn’t unreasonable. Money is personal. When something goes sideways, people want reassurance quickly, whether they’re dealing with a bank, a wealth advisor, a lender, or an insurance provider.

The trouble is that customer behavior (and their expectations) have jumped ahead of the infrastructure most financial services teams still rely on. It’s a mix of communication volume spiking, regulations tightening, and customer patience evaporating. It’s a storm that old tools weren’t built to survive.

That’s why conversational AI in banking and finance is having its moment. We’re not talking about simple chatbots, we’re talking about agentic systems that are easy to use, can hold a coherent conversation across voice and messaging, follow compliance rules and regulations, while making customers feel like their financial provider is finally meeting them where they are.

What is conversational AI in financial services?

The real progress in conversational AI in financial services is happening with systems that understand people the way real employees do: listening, interpreting, remembering context, and responding like they’re part of the team, whether the conversation is about a bank account, an insurance claim, an investment question, or a loan application.

Old-fashioned chatbots were limited. They used decision trees to respond to queries using rule-based algorithms. Conversational AI, on the other hand, can actually understand what customers are saying, even when the message is incomplete or slightly off topic.

Chatbots follow scripts. Conversational AI carries a conversation.

Under the hood, conversational AI pulls from Natural Language Processing (NLP), Natural Language Understanding (NLU), speech recognition, and machine learning to make sense of the (very human) way people communicate.

It works across the channels customers use daily:

- SMS

- Voice

- RCS

- In-app chat

- Messaging apps

All stitched together so a customer doesn’t have to start from scratch every time they switch channels.

Then there’s agentic AI, which is where banking finally breaks out of the “FAQ machine” mindset. These are AI agents for financial services that don’t just answer, they act. They move workflows forward. They can handle things like:

- Scheduling appointments

- Gathering intake details

- Re-engaging a lead with automated text messages

- Following up on missing documents

- Routing a conversation to the right human

- Updating CRM records

This is the baseline: real conversations, real actions, and a huge step up from the support bots financial services teams tolerated for far too long.

What is conversational AI in financial services?

AI systems that can hold real, compliant conversations with customers across voice and messaging channels, while understanding context, following regulations, and knowing when to escalate to a human.

Why financial services are turning to conversational AI

Banks have quietly entered their “too many messages, not enough humans” era. Customers reach out constantly with tiny, rapid-fire questions that pile up faster than teams can respond, while regulators tighten expectations and customer experience (CX) leaders try to hold everything together. It isn’t sustainable.

That’s ultimately why conversational AI for finance is becoming essential.

In 2024, NVIDIA found that the number of financial companies investing in conversational AI increased by 350% year-over-year, primarily because:

Communication volume is drowning teams.

It’s not big, dramatic issues, it’s the relentless drip of everyday banking interactions. Things like:

- “Can you confirm this payment?”

- “Where’s my statement?”

- “Did my transfer go through?”

They seem small until you multiply them by tens of thousands of customers. Financial institutions are essentially operating 24/7 inboxes that never stop filling. AI customer communication for banks and financial institutions helps teams manage the load.

Customers now expect near-instant replies

Consumer patience has changed. If a delivery app can give real-time updates, customers don’t understand why a financial services provider still sends an email: “We’ll get back to you soon.” The experience gap is widening.

People want:

- Real-time answers

- Clear, transparent communication

- Confidence that someone understands the inquiry

When the topic is money, something deeply personal and potentially emotional, waiting doesn’t feel acceptable.

Compliance pressure keeps increasing

Regulators aren’t being vague. They want:

- Full conversation archives

- Clear opt-ins and opt-outs

- Verifiable identity

- Zero off-channel messaging

Financial institutions must be able to prove the communication trail, they’re exposed. When messages are scattered across voice, email, SMS, and a patchwork of internal tools, compliance teams spend half their lives chasing transcripts instead of actually supervising.

Fragmented communication channels break CX and compliance

A customer starts in the app, switches to text, follows up by phone, (65% of customers use multiple channels to interact with banks) yet the bank is expected to treat this like one coherent interaction. Most systems aren’t built for that. The result?

- Customers repeat themselves

- Agents lack context

- Compliance teams have gaps

- Everyone gets frustrated

Conversational AI in banking and finance solves this by stitching channels together so the conversation finally feels continuous.

Modern firms aren’t chasing a trend here; they’re trying to keep up with the reality of customer expectations and regulatory scrutiny.

Conversational AI helps financial services teams:

- Respond instantly across voice and messaging

- Maintain complete, auditable communication records

- Scale customer communication without adding headcount

What conversational AI in finance looks like across channels

You probably don’t have a complexity problem. It’s more likely a volume and consistency challenge. Customers ask small, time-sensitive questions throughout the day, using whatever channel happens to be most convenient at that moment. Traditional systems often treat each of these micro-conversations as a separate event in their CRM or ticketing system, which can make it harder to maintain continuity as conversations move across channels and teams.

Conversational AI in financial services reshapes these interactions. It creates continuity, reduces manual effort, and keeps communication moving forward instead of slowing things down.

Here’s what that actually looks like in practice.

Instant responses to inbound requests

Many financial services conversations don’t require in-depth research. They need speed and clarity.

Questions like:

- “Can you confirm this charge?”

- “What’s the payoff amount?”

- “Did my wire go through?”

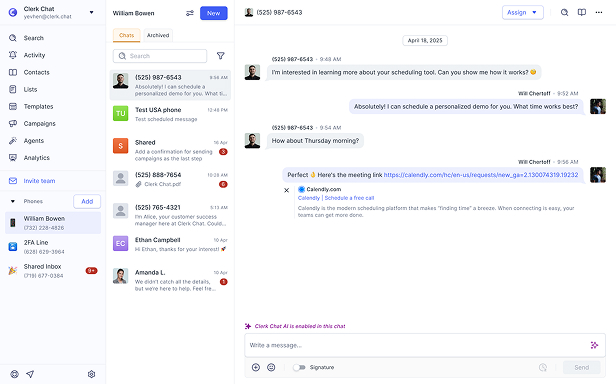

AI customer communication allows teams to respond immediately. Platforms like Clerk Chat make it possible to deploy multiple agents tied to your existing phone number(s). These agents can interpret the request, pull relevant account details, and reply accurately and with context.

The result isn’t just faster responses. It’s smoother conversations that help the customers move forward. Over time, these systems improve as they learn from real interactions, reducing drop-off, shortening response times, and improving satisfaction.

Secure intake and information collection

Banks gather a ridiculous amount of information from customers, most of it arriving in scattered messages, often missing pertinent information. An AI agent can walk someone through verification, income details, document uploads, or mortgage pre-qualification criteria.

It keeps the flow organized:

- Confirms identity

- Collects structured data

- Validates what it’s receiving

- Tracks missing pieces

Because customers can complete steps at their own pace, fewer applications fall apart mid-process. All the while, the pressure on human employees drops.

Intelligent routing and thoughtful human escalation

Automation is only useful when it knows its limits. Effective conversational AI in financial services recognizes when a situation requires human intervention and transitions the conversation.

The AI:

- Summarizes the conversation

- Highlights customer sentiment

- Passes context to the advisor

Your customers don’t have to repeat themselves. Advisors don’t have to reconstruct the story. Your organization gains clean, usable data.

Agentic follow-up and task completion

Agentic AI systems don’t wait for customers to return. They keep work moving.

They can:

- Remind your customers about missing documents or data

- Notify borrowers when rates change

- Check in on an abandoned application

- Trigger internal workflows based on customer milestones

A proactive AI agent is capable of sending alerts each month related to balances, transactions, reminders, and opportunities, and your customer can respond. This kind of proactive communication helps customers stay informed while reducing the manual follow-up burden on teams.

Automatic CRM updates and clean records

Accurate records are essential in financial services. Conversational AI can automatically:

- Write conversation summaries.

- Update CRM records or contact cards.

- Timestamp the conversation.

- Capture the key details.

This reduces administrative overhead for frontline teams and gives compliance teams reliable, complete records. Platforms like Clerk Chat directly integrate with eDiscovery tools such as Smarsh, Global Relay, and Purview, to ensure communication data flows cleanly into existing compliance and archiving systems.

Omnichannel continuity that actually works

Customers move between channels constantly, texting in the morning, calling at lunch, responding via the app on the train home. A conversational AI engine doesn’t treat those as separate tickets; it recognizes the entire sequence as one conversation with one intent. Clerk Chat’s voice and AI messaging agents actually collaborate across workflows, reducing lost context.

That continuity removes almost all of the friction (and most of the compliance risk) tied to fragmented communication threads.

👉 Learn how Clerk Chat supports conversational AI in financial services

Learn moreIs conversational AI compliant in financial services?

This is one of the most important questions financial services teams ask when evaluating conversational AI, and for good reason. This is an industry where compliance means everything.

Financial services organizations operate in an environment where communication and recordkeeping are inseparable. Customers want to message their financial provider as easily as they message anyone else, while regulators expect every interaction to be captured, time-stamped, secured, and available for review. That tension isn’t going away.

The real question isn’t whether conversational AI can be compliant in financial services—it’s whether the system was built with compliance in mind from the start. Platforms like Clerk Chat are designed to help institutions meet regulatory expectations while still delivering modern, responsive communication.

Regulatory expectations keep tightening

Regulatory bodies like the SEC and FINRA are clear. If a financial services org communicates with customers, especially about financial products, accounts, or advice, it must retain complete, accurate records.

This typically includes:

- Complete message and call archives

- Accurate timestamps

- Immutable records

- Verifiable identity

- No off-channel communication

Secure messaging and AI platforms for financial services must include strong governance controls. With tools like Clerk Chat, teams gain eDiscovery integrations, role-based access controls, and straightforward export options that make audits far less disruptive.

Secure recordkeeping and archiving are essential

A compliant conversational AI system needs to:

- Store transcripts in auditable, exportable format

- Feed records into archiving tools

- Preserve full data

Many general-purpose AI chat tools fall short here because they prioritize convenience over supervision. Platforms like Clerk Chat integrate directly with archiving solutions such as Smarsh and Global Relay, helping financial services teams avoid the risks associated with fragmented or “shadow” communication.

Consent, privacy, and identity verification must be handled automatically

The rules around texting customers are strict, and carriers enforce them just as aggressively as regulators. A compliant AI system must consistently manage:

- Opt-ins and opt-outs

- Required disclosures

- Rate and frequency limits

- Identity verification steps

- Channel-specific messaging rules

Clerk Chat supports customizable compliance messages at the phone number level, allowing teams to tailor disclosures, manage consent, and maintain clean records across different business units or use cases.

AI must know when not to answer

Not every conversation should be automated. In financial services, some inquiries require human judgment—especially those involving regulated advice, potential fraud, unusual account activity, or emotional distress.

A compliant conversational AI system recognizes these boundaries. It knows when to pause automation and escalate the conversation to a human, passing along full context so the transition is seamless.

That’s the difference between AI that simply responds and AI agents designed for financial services. With Clerk Chat, automation comes with guardrails you control—supporting efficiency without sacrificing oversight or trust.

Real use cases for conversational AI in financial services

Financial services teams are adopting conversational AI to reduce friction across common workflows, without increasing risk. While use cases in banking and wealth management have grown quickly, the same patterns apply across lending, insurance, fintech, and advisory services.

At its core, conversational AI in financial services helps organizations handle high-volume interactions, guide customers through complex processes, and deliver timely, relevant communication at scale.

Below are several of the most common ways financial services teams are using conversational AI today.

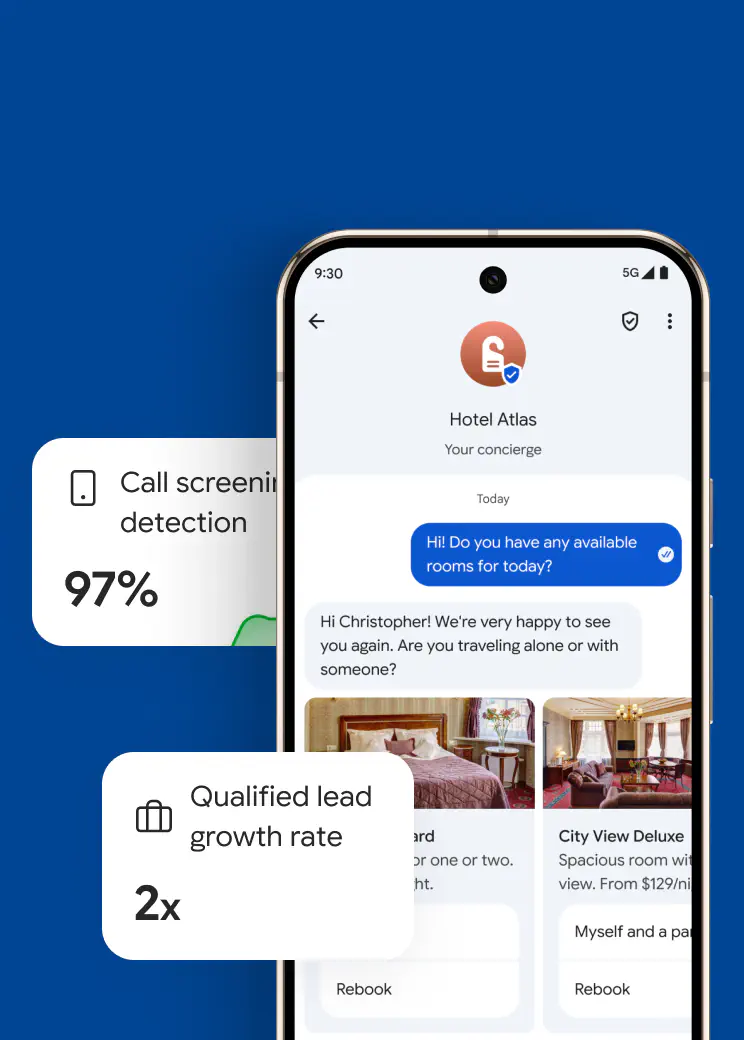

Lead qualification for wealth advisors

Wealth management is relationship-driven, but the early stages are often dominated by intake, scheduling, and pre-qualification. Conversational AI agents can manage this initial phase by:

A conversational AI agent can handle the opening rounds:

- Collecting income ranges and asset details

- Asking risk-tolerance or goal-setting questions

- Scheduling a meeting directly on the advisor’s calendar

- Logging everything neatly so the advisor isn’t flying blind

This allows advisors to start conversations with context, while reducing administrative overhead.

Personalized financial guidance

Once basic qualification is complete, conversational AI can support personalized guidance at scale. Using signals such as spending patterns, transaction history, and past interactions, AI agents can:

- Identify emerging financial needs

- Prompt goal-setting conversations

- Suggest relevant products or next steps

- Proactively check in when behavior changes

This kind of timely, contextual engagement improves customer experience while supporting retention and long-term value.

Automated mortgage, loan, and claims assistance

Anyone who’s been through a mortgage process knows it’s an endurance test. Banks ask for the same information in different formats, agents send reminders manually, and customers bounce between channels trying to figure out which step comes next.

Conversational AI in financial services simplifies this into a guided, linear flow:

- Pre-screening questions

- Eligibility checks

- Document collection

- Clear explanations of next steps

Even claims processes, notoriously painful in insurance, are becoming easier. Customers can start a claim, get status updates, and escalate if needed, all through a simple chat interface. If something gets stuck, AI in customer service agents pass the issue to a human, with the full context already attached.

Appointment scheduling and reminders

Scheduling is foundational across financial services, from advisors and loan officers to claims specialists and support teams. Coordinating appointments across channels can quickly become complex. Conversational AI simplifies this by managing scheduling and reminders in a consistent, automated way.

AI tools can:

- Offer available times without exposing internal calendars

- Send confirmations and rescheduling links

- Send meeting reminders

- Sync everything automatically with internal systems

Beyond scheduling, conversational AI can support onboarding by sharing setup guidance, terms and conditions, and troubleshooting steps as customers activate new accounts or services. It can also prompt customers to complete key actions, such as setting up recurring payments or enabling authentication.

Inbound support for everyday banking questions

Agents get buried under questions that AI can resolve in seconds. Balance checks, document requests, transaction clarifications, account-specific Q&A, these are high-frequency, low-complexity interactions that don’t require human empathy so much as immediate accuracy.

AI tools can provide instant access to:

- Account, credit, and daily balances

- Projected balances

- Deposits and withdrawals

- Foreign transactions

- Payments due

- Security alerts for suspicious activity

If someone says, “I need to activate my new card,” the system can do that too, instantly and securely. It doesn’t replace a banker. But it replaces the need to call one for every small task.

When something does require human review, the AI packages the context so the agent doesn’t spend the first two minutes trying to figure out why the customer reached out.

Follow-up automation and customer nudging

Customers often pause or abandon processes due to interruptions or unclear next steps, not lack of intent. Conversational AI helps maintain momentum by:

- Checking in on incomplete applications

- Sending compliant reminders about deadlines

- Highlighting missing documentation

- Providing status updates and timelines

This kind of follow-up automation supports smoother onboarding and reduces the manual effort required to keep processes moving.

Voice agents for high-volume phone lines

Voice remains a critical channel in financial services, especially during periods of high demand. Voice AI agents help manage call volume by:

- Authenticates callers before reaching a human

- Answer common questions directly

- Route based on intent instead of guesswork

- Transcribe and summarizes calls automatically

- Reduce the backlog to something humans can actually manage

For many institutions, voice automation ends up being the biggest operational unlock because it absorbs the unpredictable surges that overwhelm call centers. Plus, it actually improves customer experience.

Conversational AI in financial services powers the solutions that don’t just answer questions but solve problems. Tools that remember your last issue, surface your transaction history, and pick up where you left off, whether you’re chatting via conversational SMS or calling in from your car.

Companies can even use AI to deliver proactive service to customers, using enterprise texting apps like Clerk Chat to send instant alerts to customers about bank issues, technology faults, and new products. If you’re not using AI for customer experience already, now’s the time to start.

AI agent assistance

While customer experience is often the focus, conversational AI also improves the employee experience. AI agent assist tools prepare human agents before and during interactions by:

- Gathering and summarizing context

- Confirming identity in advance

- Surfacing relevant policies or product details in real time

This support helps agents respond faster, reduces onboarding time, and improves consistency across teams, ultimately strengthening both service quality and operational efficiency.

Yes, conversational AI supports regulated financial services.

Clerk Chat is secure, auditable communication across voice and messaging, with the controls financial services teams need from day one.

What finance teams gain from conversational AI

The funny thing about conversational AI in financial services is that most of the benefits are just practical. They show up in the places where teams have been quietly struggling for years.

Look at Choreo, the wealth management firm, they used Clerk Chat’s AI tools to build a compliant, AI-powered system that simplified everything from scheduling, to follow-ups.

Here’s what actually improves when AI handles the parts of communication that humans never had time for in the first place:

Better customer experience

This is the most obvious one. First, since this technology can improve the customer experience with auto-reply text message options and enhanced self-service, it boosts your chances of gaining loyal customers who stick with your brand for longer.

Plus, when customers get instant answers, whether it’s balance info or guidance on the next step, they stop calling three different channels in a panic. That alone cuts frustration for everyone. Teams stop firefighting, and customers stop interpreting delays as neglect.

Higher conversion and stronger retention

No-shows drop when meetings are scheduled and confirmed automatically. Loan applications don’t stall because the system keeps nudging customers until all the paperwork is in. Wealth advisors walk into calls with someone who’s already pre-qualified and ready to talk strategy.

Plus, conversational AI gives you the data and technology you need to build more powerful marketing campaigns. You can use the right platform to invest in personalized SMS marketing efforts, where you recommend specific products to customers based on their history and preferences.

Reduced support volume without reducing service

The total number of questions doesn’t change, but the burden on humans plummets. AI absorbs the predictable, repetitive parts of support, leaving agents with conversations that actually need human judgment.

Teams also get help on the back end. AI can record, summarize, and even surface action items after customer conversations. Chatbots can even share forms and document lists with customers and send reminders via a conversational messaging platform, to ensure companies collect critical signatures and data throughout the process.

More consistent compliance

AI doesn’t forget disclosures. It doesn’t store info in the wrong place. It doesn’t text customers from personal numbers. It follows the rules every time, which means compliance teams finally get the clean, complete archives they’ve been begging for.

Modern systems can spot unusual transaction patterns, assess risk based on AI algorithms, and automatically trigger a mobile text alert or RCS message when something’s wrong. They support two-way messaging for fraud verification and can walk users through secure ID and verification steps without needing a live agent for each case.

Better data and insights

You can’t improve what you can’t see. That’s where conversational AI in finance adds another layer of value by collecting, organizing, and analyzing customer questions and behavior.

A conversational messaging platform can offer companies access to sentiment and intent analysis tools that help them better understand their target audience. These tools can provide insights into the most common insurance SMS queries shared by customers or the types of challenges users face when setting up accounts.

The same tools can dive into customer feedback, surveys, and other data to help businesses understand which actions and strategies improve customer loyalty and which lead to higher chances of churn.

What makes Clerk Chat different

As conversational AI adoption grows across financial services, the differences between platforms tend to show up in practical ways—especially once teams move beyond demos and into real workflows. Factors like auditability, channel consistency, and integration depth become increasingly important.

Clerk Chat is built to support these real-world requirements. Rather than focusing on surface-level AI features, the platform is designed as communication infrastructure that financial services teams can rely on day to day.

Here’s what that looks like in practice.

- AI on the phone numbers you already use: Most platforms ask teams to adopt new numbers or channels. Clerk Chat lets firms attach AI agents for financial services to their existing business lines so customers don’t have to guess how to reach you.

- Voice and messaging AI on a single platform: Financial services teams often need automation across both voice and messaging. Clerk Chat supports AI agents for both, using the same numbers and compliance rules. This consistency helps maintain context across channels and simplifies recordkeeping and oversight.

- Compliance-first communication tools: The platform includes full export options for conversations, archiving integrations, enforced opt-in/opt-out logic, automatic retention rules, role-based permissions, and configurable compliance messaging for every number.

- Integrations that fit existing workflows: Conversational AI is most effective when it connects cleanly to the systems teams already use. Clerk Chat integrates with CRMs, Microsoft Teams, calendaring tools, and eDiscovery platforms, allowing communication data to flow where it’s needed without disruption.

Clerk Chat focuses on industries where compliant communication is essential, including financial services and healthcare. That focus informs product decisions—from data handling to audit readiness—resulting in a platform that’s built to hold up under real operational and regulatory scrutiny.

Getting started with conversational AI for financial services

Most financial services teams don’t need a massive rollout to get started with conversational AI. The most effective approach is usually incremental.

A simple path forward looks like this:

- Start with one high-volume workflow, such as loan intake, advisor scheduling, or inbound support

- Enable AI on a single channel (often SMS, RCS, or voice)

- Configure compliance settings so opt-ins and disclosures are handled automatically

- Connect the systems your team already relies on so information flows where it should

From there, expand based on results. One successful workflow often reveals several others where conversational AI can improve consistency.

Financial services teams are beginning to adopt more advanced agentic AI, internal copilots, deeper personalization, and standardized approaches to compliant communication. Platforms like Clerk Chat are built to support that evolution, helping teams adapt without constantly reworking their infrastructure.

For teams exploring what conversational AI could look like in their organization, starting small and building deliberately is often the most sustainable way forward.

Will’s latest superpower is building innovative AI solutions to add value for clients. He's passionate about all things AI, entrepreneurship, and enjoys staying active with sports and outdoor activities.

In this article:

- What is conversational AI in financial services?

- Why financial services are turning to conversational AI

- What conversational AI in finance looks like across channels

- Is conversational AI compliant in financial services?

- Real use cases for conversational AI in financial services

- What finance teams gain from conversational AI

- What makes Clerk Chat different

- Getting started with conversational AI for financial services

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.