Conversational Banking: A Guide for Finance Leaders

By Team Clerk Chat

- Published: June 24, 2024

Conversational banking is revolutionizing how consumers interact with their banks and financial service providers. While banking has been around for centuries, customers haven’t always had the best experience when interacting with their banks.

Today’s busy people don’t want to physically visit a branch or wait on hold to talk to someone about their needs. They want convenient modes of communication, like two-way text messaging, chat apps, and AI bots to streamline their experience.

Fortunately, advances in technology, from the rise of convenient finance SMS platforms like Clerk Chat, to conversational AI technologies, are opening the door to a new age of banking.

Here’s your guide to conversational banking, why it’s important in the finance sector, and how you can implement it into your customer service strategy.

What is Conversational Banking?

Conversational banking is a type of digital banking method that leverages conversational SMS, messaging apps, and often artificial intelligence, to streamline real-time interactions between financial companies, and their customers.

When implemented correctly, a conversational strategy for delivering banking services can give customers a more rewarding and convenient experience, while reducing costs for companies.

In fact, with recent evolutions in conversational AI, some institutions can use this strategy to automate common customer service tasks and provide 24/7 support to customers, without hiring additional staff. Using the right combination of technology, banks can use conversational solutions for:

- Delivering expert support and advice: Organizations can use conversational messaging tools to connect customers with advisors who can offer guidance on everything from loan applications to account set-up and investment advice.

- Customer service: With SMS and messaging tools, companies can bring a new channel to their customer service strategy. They can even use an AI chatbot for banks to automate things like customer onboarding or delivering technical assistance.

- Customer communications: With an automated system, banks can use conversational mediums to send transactional SMS messages, updates, and notifications to customers on demand. They could even use this strategy to promote offers and deals.

The Benefits of a Conversational Banking Strategy

On a broad level, a conversational banking strategy unlocks a host of benefits for today’s financial companies. It allows you to connect with customers on a wider range of channels, improving their overall experience with your brand, plus, it can lead to improvements in:

- Customer retention and loyalty: Customers want fast, convenient access to information when they contact their bank. Conversational banking, whether it involves SMS banking solutions or chatbots delivers a more convenient experience to your customers. This boosts your customer retention and loyalty rates.

- Increased customer lifetime value: Consumers that have more opportunities to interact with their banks through conversational channels, like text messaging, online chat, and social apps are more likely to engage frequently with the company. This gives you new opportunities to reduce customer churn rates, increase conversion rates, and earn trust.

- Reduced operating costs: Conversational banking can even help you to reduce costs. You can use chatbots to deliver SMS customer service automatically, reducing the need to hire additional support representatives, and giving team members more time to focus on other tasks. You can even use AI to transfer information to agents and give them more context and information they can use to resolve issues faster.

Conversational AI and Conversational Banking

Conversational banking is a term that can apply to all kinds of banking interactions that take place through digital mediums like voice, text messaging, mobile apps, and website chat apps. Evolutions in CPaaS technology and messaging platforms have enabled this form of banking for some time now.

However, the rise of artificial intelligence is taking conversational banking to the next level.

Conversational AI is the type of artificial intelligence that allows computers and bots to simulate human conversations. It’s enabled by factors like “Natural Language Processing”, which allows computers to understand human language.

The Benefits of AI in Conversational Banking

As AI in financial services continues to advance, conversational AI is what allows banks to automate certain parts of the “banking” experience for customers and deliver more comprehensive service. It enables:

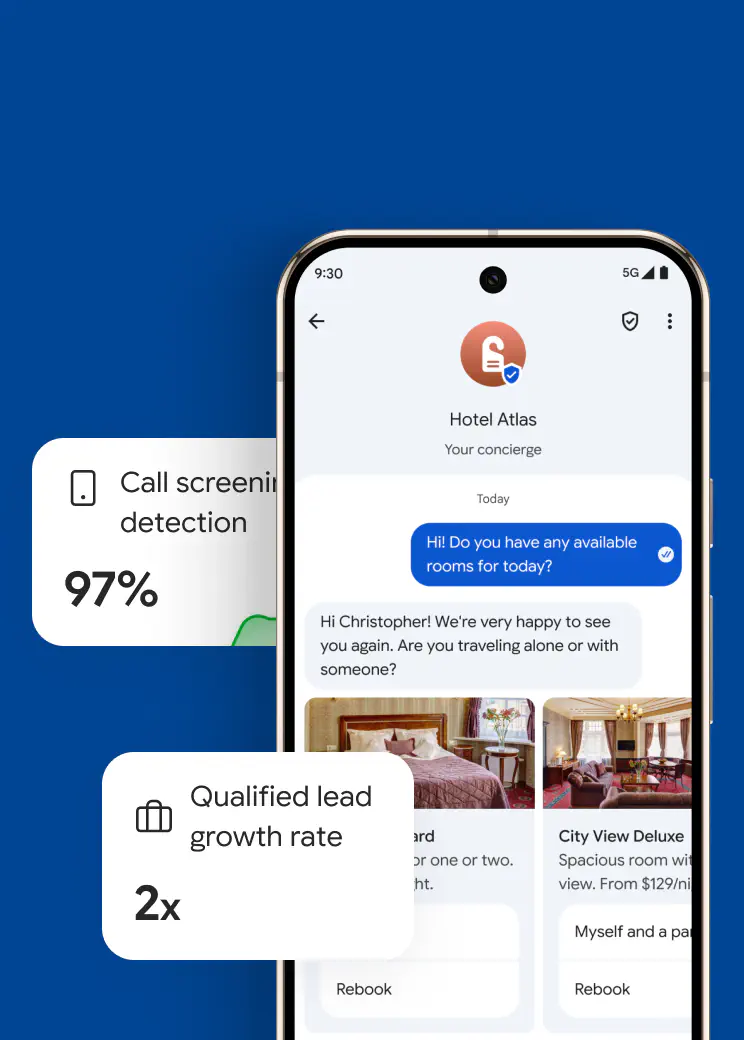

- Omnichannel support: Unlike a standard chatbot, conversational AI can be embedded into a range of channels: SMS, websites, ecommerce, and more. This means wherever customers choose to interact with your bank, you can give them the same consistent experience, with an omnichannel assistant.

- Efficient service: A finance AI chatbot or solution enabled by conversational AI makes it easier for customers to access efficient service. Not only can customers reach out to the company on any channel they prefer, but AI bots can usually sort through data and deliver answers to questions much faster than human agents.

- Global customer support: As your bank grows and scales globally, delivering personalized service to every customer would typically mean hiring employees who can speak a range of languages. However, conversational AI tools can understand and generate content in a range of languages automatically, allowing you to scale faster.

- Improved personalization: AI tools are excellent at collecting and processing data. They can gather insights about your customers from previous conversations that you can use to enhance your SMS marketing strategies, customer service efforts and more, with personalization.

- Faster response times: AI SMS, messaging, and voice solutions are available to access 24/7 and can handle numerous queries simultaneously. This usually means your customers get faster resolutions to their issues, at a time that suits them.

Plus, AI-powered conversational banking solutions can accelerate innovation, and reduce compliance risks too. AI-powered solutions can help automate SMS archiving, for compliance requirements. They can also automatically send messages to customers to help reduce fraud, through things like two-factor SMS authentication.

Additionally, because they’re constantly connecting and analyzing data, they can give you insights into customer financial habits, goals, and pain points. This means you can gather the information you need to develop new products and services, build lasting relationships, and differentiate your bank from the competition.

How to Develop a Conversational Banking Strategy

Now you know the benefits of conversational banking and conversational AI, it’s time to start creating your own strategy. Here are the steps and tools you can use for success.

Step 1: Map your customer’s banking journey

A great conversational banking experience is all about delivering convenience by communicating with customers on the channels they prefer. To find out which channels you should be using (from social media, to SMS, and online apps), you need to map the customer journey.

Examine the typical journey of your target customer, identifying all the touchpoints they generally have with your company. For instance, do they interact with bots on your website when they have questions about your products? Are they more likely to text your customer support team when they have questions, call your contact center, or reach out on specific social media channels?

Do you send personalized SMS messages to customers to introduce them to new products and services, or check in on their satisfaction levels?

As you map the customer journey, look for opportunities to enhance the experience and reduce friction points by introducing AI and automation. As an example, if customers usually ask for help on your website, installing a chatbot or offering an option for 24/7 text messaging could be a good idea.

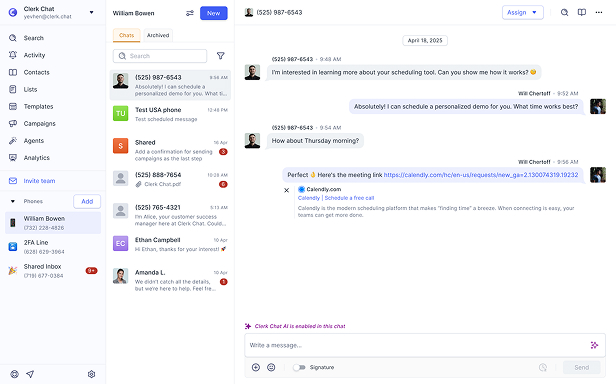

Clerk Chat offers an option for an AI sales or support agent that’s easily trained on your company documents. When set to respond immediately, the AI agent will respond to incoming messages. Alternatively, the agent can also be set on a delay with the option for a human to first review the response.

Step 2: Build on your current touchpoints

Once you’ve identified the existing channels your customers use to interact with you throughout their journey, ask yourself whether there are any additional options you can introduce. If you’re already using automated text messages to interact with customers, does it make sense to explore the benefits of two-way messaging, or web and mobile push notifications?

Do your customers prefer to use other messaging apps for communication like WhatsApp or Microsoft Teams? If so, can you leverage SMS integrations on your current messaging platform to expand into a more comprehensive omnichannel strategy?

If you don’t already have your own AI chatbot active on your website, social media, and other channels, should you be offering that form of self-service?

If you’re not sure where to expand on your current strategy, analyzing your competitors, and the channels they use, or sending out surveys for direct customer insights can help.

Step 3: Prioritize compliance

Trust is crucial in any consumer contact strategy, but it’s particularly crucial for financial companies. Make sure you understand the measures you’ll need to implement to protect customer data, and stay compliant with industry standards. For instance, if you’re investing in text as a conversational banking channel, you’ll need to adhere to TCPA compliance standards.

For most messaging channels, you’ll need to ensure you get explicit consent from your customers to contact them, whether it’s for promotional purposes or customer service.

You’ll also be responsible for making sure you’re taking measures to protect customers against fraud (such as implementing two factor authentication methods), and preserve crucial data for auditing purposes. Putting security and compliance at the front of your strategy will help to protect you from issues like fines, reputational damage, and legal repercussions.

Step 4: Choose the right technology

Once you’ve identified your strategy for conversational banking and identified compliance requirements, the next step is choosing the right technology. Start by looking for a solution that supports all of the conversational challenges you want to leverage, from AI-emabled agents, to text messaging, mobile apps like WhatsApp, voice, and analytics.

Next, ensure your solution can support your messaging and texting compliance strategies, with built-in security settings, integrations with tools like Smarsh for archiving, and comprehensive access controls. Solutions like Clerk Chat can make it easy to implement the ideal conversational banking strategy with access to:

- Two-way messaging capabilities, for real-time conversations

- Conversational AI agents for automated conversations

- Flexible automation workflows and messaging templates

- Integrations with tools like WhatsApp and Microsoft Teams

- Solutions for enabling existing numbers or activating new ones

Step 5: Implement efficient automation

With the right platform in place, you’ll be able to start implementing automation and AI features that enhance your conversational banking strategy. The right platform will allow you to rapidly route conversations to the right customers and streamline tasks like conversation exporting.

You can even find solutions that allow you to automate text messages archiving for financial advisors, to help preserve compliance with industry standards.

Based on what you’ve learned about your customer’s journey, and what you know about the tasks your banking employees do every day, look for ways to streamline operations.

You might use AI and automation to simplify tasks like helping customers to open a new account, check their balance, transfer money, or make a payment. You could also use AI to automate the process of answering common customer questions.

Step 6: Gather feedback and evolve

Finally, an effective approach to conversational banking requires constant analysis, iteration, and improvement. Once you implement your strategy, make sure you’re paying constant attention to crucial metrics like conversion rates, customer satisfaction scores, and net promoter scores.

Watch how your average resolution time in the contact center evolves after you implement your new technology, and gather direct feedback from employees to find out where they’re becoming more productive and efficient.

Listen to your customers too, asking them to share their feedback on what they like and dislike about your messaging strategies, your chatbots, and your conversational tools.

Transform Conversational Banking with Clerk Chat

The era of conversational banking has officially arrived, creating more convenient experiences for both customers and companies. With the right technology, you can streamline customer service, improve consumer loyalty, and even save money on common processes.

However, the right strategy is crucial to success. You need to ensure you’re leveraging the best conversational AI tools, TCPA-compliant messaging solutions, and tools for automation.

Clerk Chat offers banking companies a comprehensive portfolio of solutions to enable and optimize conversational banking. Whether you’re looking for your own AI agent, a powerful text messaging automation solution, or an omnichannel messaging strategy, we can help.

Reach out to Clerk Chat and start your journey into the future of conversational banking.

In this article:

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.