Marketing for Tax Professionals: Adding SMS and Messaging to your Tax Marketing Strategy

By Team Clerk Chat

- Published: August 2, 2024

Marketing for tax professionals can be complicated. Not only do you need to figure out how you’re going to effectively reach as many potential clients as possible, and which channels you’re going to use, but you need to ensure you’re not exposing yourself to any compliance mishaps too.

An effective marketing strategy is the key to bringing more clients to your door, improving your relationships with existing customers, and differentiating yourself from the competition. Investing in personalized messaging campaigns and SMS strategies is an excellent way to reach customers wherever they are, and increase engagement.

However, you need the right plan to ensure you’re implementing your messaging strategy correctly, and combining it efficiently with your other promotional efforts.

Here’s your guide to effective tax marketing, and how you can bring the benefits of SMS into the mix.

Marketing for Tax Professionals: Getting Started

Before you dive into your marketing strategy, there’s a few essential steps you should take to set yourself up for success. Preparation is the key to exceptional advertising, whether you’re using conversational AI for finance service promotion, SMS, or social media.

Step 1: Identify your Target Audience

Understanding your target audience and what they actually want and need from your company is how you ensure you develop marketing campaigns that resonate with the right people (and drive positive results). Consider the services you offer as a tax professional, and what kind of customers are most likely to benefit from them.

For instance, do you offer tax preparation services for solo entrepreneurs and small businesses, or do you typically work with larger organizations? What kind of challenges do your customers typically face when handling taxes, and how will you help them overcome them?

Once you’ve identified your target audience, ask yourself:

- Where do they look for tax information? Are these the kind of customers who are likely to look for a tax specialist on social media, via Google, or through recommendations?

- How do they communicate? Do your ideal customers prefer to communicate through Zoom, SMS, phone calls, social media, or do they want to chat with you in-person?

- What are their demographic characteristics? Where are your customers located, how old are they on average, and what’s their education level or income bracket?

Step 2: Research Tax Marketing Compliance

One of the reasons marketing in the tax industry and other finance-focused sectors is so complicated, is that there are a lot of compliance standards to be aware of. The compliance standards you need to adhere to can vary depending on numerous factors.

However, the chances are you’ll need to invest in an SMS archiving solution like Global Relay or Smarsh to ensure you can keep accurate records of conversations. You’ll also need to ensure you obtain consent to send marketing messages to your audience and implement measures to ensure those marketing messages are honest, truthful, and accurate.

If you decide to use SMS messaging and phone calls for marketing purposes, you may need to invest in 10DLC registration, and ensure you’re following the right guidelines for how and when you can communicate with your customers.

You’ll also need an SMS marketing platform like Clerk Chat that supports SMS compliance standards, and integrations with tools like Smarsh. Doing your research into compliance standards first will ensure you don’t make any mistakes that could harm your reputation or lead to hefty fines.

Step 3: Invest in the Right Technology

The technology you’ll need when investing in marketing for tax professionals will also vary depending on your marketing strategy. If you’re investing in social media and email marketing, you might want to experiment with automation tools.

If you’re using an AI powered SMS strategy, you’ll need a messaging platform that allows you to plan and send campaigns, leverage tax, finance, and insurance SMS templates, and monitor the results of your campaigns. It also makes sense to look for marketing solutions that integrate with other tools you use for things like team collaboration, project management, and archiving.

Investing in other tools, such as content marketing calendars, scheduling tools, and analytical platforms, can help you take your marketing strategy to the next level.

Tax Advertising Ideas: Top Strategies for Tax Professionals

While coming up with tax advertising ideas can seem tricky at first, the truth is there are various effective strategies you can use for tax services advertising.

Using SMS for finance conversations with clients is one of the best options, but there are various other ideas you can explore such as:

Word of Mouth Marketing

Word of mouth marketing is powerful for tax professionals. Studies show that 92% of people trust recommendations from family and friends more than advertising. All you really need to implement a strong word of mouth marketing strategy, is an excellent approach to customer service, and a way to encourage your customers to advocate for your brand.

If you offer your customers great experiences, such as instant 2-way text messaging support when they need help with their accounts, or access to personalized offers, they’ll be more likely to rave about your services to their contacts anyway.

However, you can boost your chances of leveraging word of mouth marketing by creating loyalty programs and referral campaigns that reward customers for their advocacy.

Content Marketing and Website Promotion

The best marketing for tax professionals almost always demands a strong website. Your website is where your customers will find out about your services, access contact details so they can book appointments with your teams, and sign up for your email and mass texting service.

You can boost the visibility of your website by using content marketing and search engine optimization techniques. This basically means creating content that’s designed to target the questions your customers are already asking about tax.

The more excellent content you create, the more likely your customers will be to find you online. Plus, great content has a significant impact on your company’s brand reputation. It’s a great way to position yourself as a tax thought leader.

Social Media Marketing

Social media is another great tool for tax marketing. Over 5 billion people worldwide have their own social media account, and they use these accounts not just to connect with friends and loved ones, but to track down services and information too.

The key to success with social media marketing is knowing which channels to use. If you’re focusing on businesses, channels like X, LinkedIn, and Facebook make the most sense. If you’re trying to reach individuals, you could branch out to Instagram and TikTok.

Just as you might experiment with various tax or insurance text message marketing campaigns, experiment with different strategies on social media. Create different types of content, like images and videos, and use both paid and organic campaigns.

Email Marketing

Email marketing is one of the best strategies to combine with SMS for small business owners, as it helps to ensure you can reach your customers wherever they are. Email marketing has one of the highest ROIs of any marketing strategy, and it’s relatively easy to set up and implement a campaign.

While SMS marketing does deliver higher open rates, implementing an email strategy to send transactional and promotional messages to customers regularly, is still a good strategy. It’s particularly useful in cases where text messages failed to send to your target audience.

Just like with SMS marketing, the key to success with email marketing for tax professionals is personalization. Segment your audience so you can send them messages relevant to their needs and interests and avoid sending content too often.

Traditional Marketing

Not all marketing needs to be digital, or SMS based. Depending on your business, you might find that more traditional advertising ideas deliver great results.

For instance, you could consider television or radio advertising to reach local audiences, or use postcards and flyers to connect with clients via direct mail. The biggest challenge here will usually be ensuring you adhere to compliance standards, by keeping track of all of your campaigns.

However, you can look into strategies that will help you streamline messages archiving for financial experts, and connect digital records with external marketing records.

The Benefits of SMS Marketing for Tax Professionals

Although there are many marketing ideas for tax business leaders to consider today, SMS marketing is perhaps the most powerful option of all. First, SMS messages are more likely to capture the attention and engagement of your customers than any other type of message.

Around 98% of people who receive an SMS message will open it within 90 seconds. Plus, there are endless tools and solutions like Clerk Chat that can help you schedule SMS campaigns and automate your strategy, putting your growth on autopilot.

On top of that, SMS gives you a great way to impress your customers. Around two-thirds of customers say they would switch to a company that offered text messaging for communication.

With SMS, you can introduce new levels of:

Tax Preparation Marketing

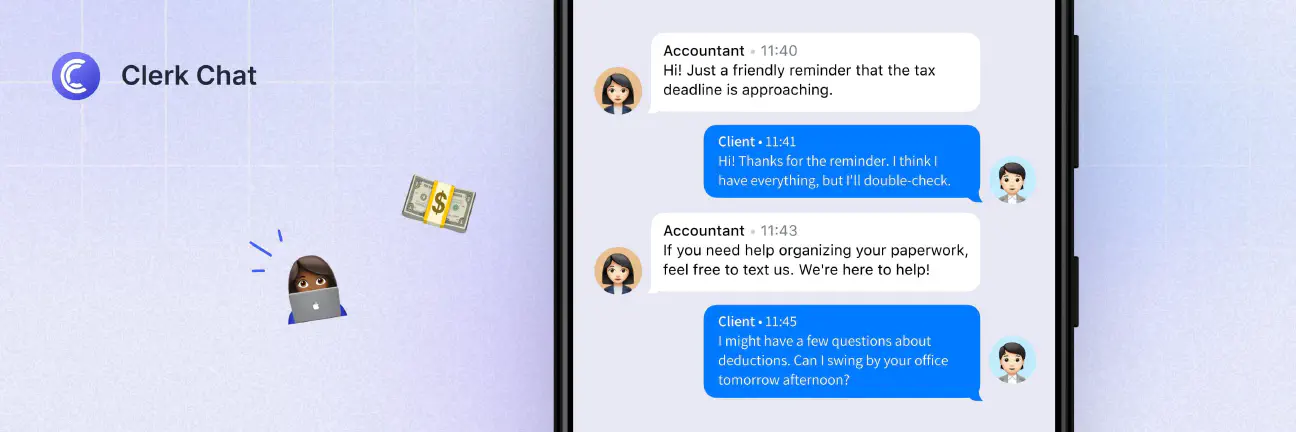

SMS strategies are an excellent way to issue tax preparation guidance and insights to your target audience. Once you know how to schedule SMS messages, you can automatically send personalized recommendations and tips to your customers when their tax deadlines are approaching.

Your SMS strategy can guide customers back to your website, let them know more about the services you offer, and even encourage them to book appointments.

Customer Service and Support

SMS is also a fantastic tool for delivering amazing experiences to your tax customers. You can use transactional SMS messages to automatically confirm appointment bookings with your customers and provide them with insights on how to prepare for their appointments.

SMS solutions can be used to send deadline reminders to customers, or allow customers to access either human or AI support when they have questions about their services. You can even use SMS appointment reminders to ensure you don’t miss out on opportunities.

Service Promotions

Finally, with shared accounts on an SMS marketing platform, all of the team members in your tax company can send promotional messages to your customers about their latest services and solutions. You can promote everything from your tax preparation services to consulting services.

You could even consider creating comprehensive campaigns, texting from different numbers to promote specific team members, or using different marketing strategies based on the target audiences you’re trying to reach.

Implement SMS Marketing with Clerk Chat

While there are plenty of ways to invest in marketing for tax professionals, SMS marketing is one of the best ways to ensure you can optimize customer engagement, differentiate yourself from the competition, and increase conversions.

All you need is the right platform to put your strategy into action. Clerk Chat offers all of the tools businesses need to create powerful SMS campaigns, tuned to the needs of your customers, and your brand. Our solution integrates with tools for archiving, like Smarsh and Global Relay, as well as existing business software like Microsoft Teams.

Plus, Clerk Chat makes it easy to collect campaign data, personalize your marketing campaigns for different audience segments, and automate campaign delivery.

Take your tax marketing strategy to the next level with Clerk Chat today.

In this article:

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.