How Can Financial Firms Use RCS CTA Buttons To Improve Client Engagement?

By Igor Boshoer

- Published: October 30, 2025

RCS (Rich Communication Services) transforms plain-text SMS into interactive, branded client experiences. For financial institutions, this means you can:

- Send secure, branded account alerts

- Offer one-tap scheduling for advisor meetings

- Share investment updates or policy renewals with a built-in “Learn More” button

- Deliver fraud alerts where clients can confirm or report suspicious activity instantly

With Clerk Chat, financial firms can add custom CTA buttons to every RCS message, giving clients a clear next step and reducing friction in compliance-heavy communications.

In this article:

What makes RCS different from SMS in financial services?

Traditional SMS is limited to plain text, which makes client interactions clunky. RCS adds:

- High-res visuals (e.g., branded compliance disclosures or product overviews)

- Clickable buttons (Book an appointment, View Account, Confirm Transaction)

- Branded sender names (so clients trust the source)

- Read receipts and typing indicators (for transparency)

For banks, insurers, and wealth management firms, this means RCS can deliver secure, actionable messages that clients actually respond to.

RCS messaging gives your firm secure, compliant, and actionable conversations. Every alert, update, or reminder can include a one-tap CTA.

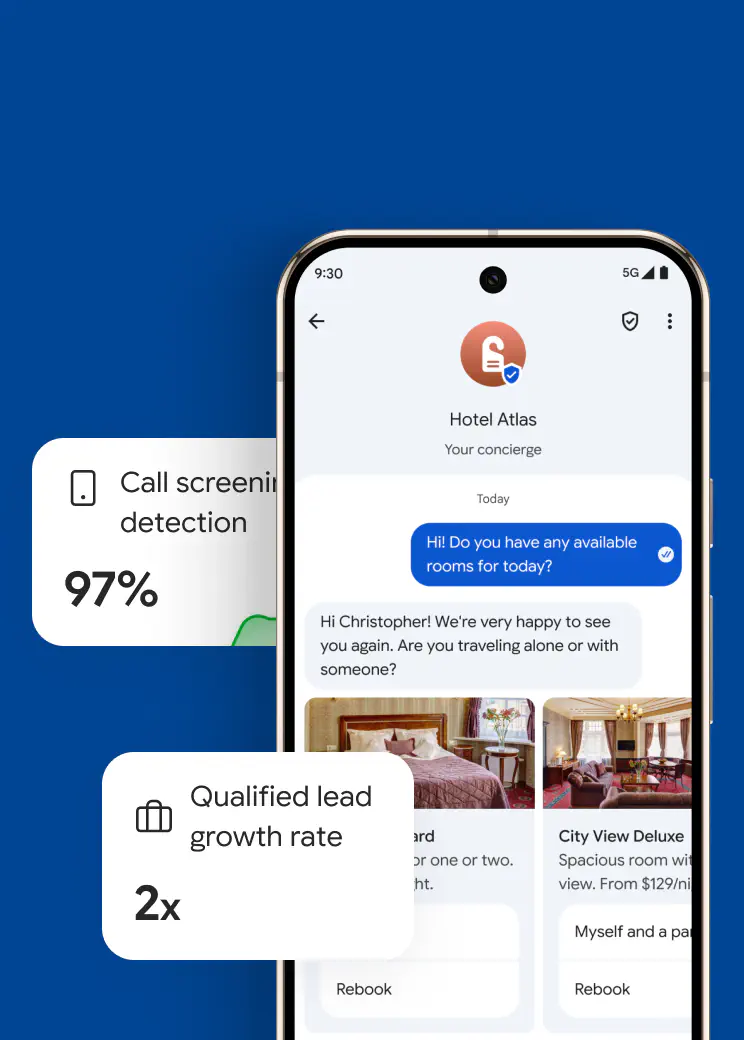

How do RCS media cards help financial institutions?

Media cards combine visuals, text, and CTAs inside one message, like a mini landing page in a text thread.

Financial firms can use them to:

- Display market updates with charts and a “View Full Report” button

- Share loan or mortgage options in a swipeable carousel

- Highlight new insurance products with a “Get Quote” button

- Provide educational content (like “What to do if you spot fraud”) with a “Learn More” CTA

Every card can have its own button, so clients go from seeing information to taking action in one tap.

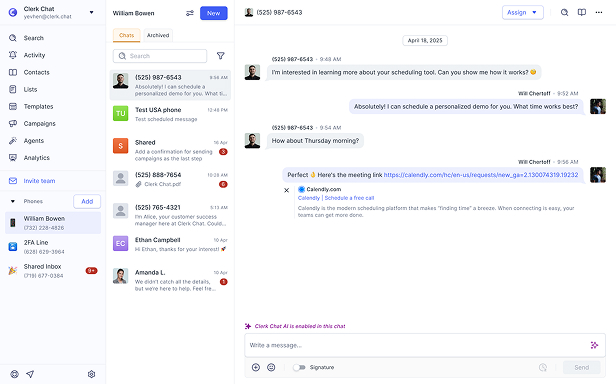

How do you add RCS CTA buttons in Clerk Chat?

You don’t need a dev team or code. Just:

- Open your RCS template in Clerk Chat

- Upload an image or build a carousel

- Add your header and body

- Select “Add Button”

- Type your CTA text (e.g., “Book Call,” “View Statement,” “Confirm”)

- Link to a URL, phone number, or calendar

- Add your template to a message or campaign

Financial advisors, relationship managers, or support teams can all build these campaigns quickly, keeping compliance intact and clients engaged.

Why do RCS CTA buttons improve client engagement in finance?

Most financial communications fail because they stop at “informing” and don’t guide the client’s next step. RCS CTA buttons fix that.

- Higher engagement: Clients confirm transactions or book calls instantly

- More conversions: Clients apply for loans or sign up for services without leaving the thread

- Lower friction: No copy-pasting account numbers or searching for logins

- Better data: Clerk Chat’s analytics track which CTAs are tapped most

What are examples of CTA button text for financial services?

Here’s how financial firms are using them:

- Banking: View Statement, Confirm Transaction, Report Fraud

- Wealth Management: Book Call, View Market Update, Meet Your Advisor

- Insurance: Get Quote, Update Policy, Renew Now

- Lending: Apply Now, Check Rates, Schedule Consultation

How can financial firms ensure compliance with RCS messaging?

This is one of the first questions a compliance officer will ask. With Clerk Chat, all RCS messages:

- Integrate with archiving systems like Smarsh and Global Relay

- Provide a full audit trail for regulators

- Allow analytics reporting to track communication outcomes

- Keep client data secure with SOC 2 Type 2 certification

So you can engage clients with RCS while staying fully compliant.

What best practices improve RCS CTA performance in finance?

A few quick tips:

- Keep CTAs short: 1–3 words (e.g., “Confirm,” “Book Call”)

- Make it relevant: Match the CTA to the content (don’t push “Apply Now” on an account alert)

- Test wording: Compare “Renew Now” vs. “Extend Policy”

- Optimize the next step: A great CTA needs a fast, mobile-friendly landing page or form

What’s next for RCS in financial services?

Financial services firms are under pressure to deliver digital-first, compliant, personalized communication. RCS, combined with Clerk Chat, helps you:

- Engage clients instantly with interactive CTAs

- Reduce fraud risk by confirming transactions in real-time

- Increase advisor productivity by automating scheduling and updates

- Stay compliant with regulations with audit-ready messaging

👉 Book a demo with Clerk Chat to see how RCS can modernize your firm’s client communications.

An innovator by nature, Igor is dedicated to translating the technical aspects of product development into actionable business strategies and sales growth. He thrives when building scalable infrastructures while leading global teams to success. In his free time he indulges in his passions for film, mathematics, and engineering. Find his tech expertise in films like The Wolf of Wall Street.

In this article:

- What makes RCS different from SMS in financial services?

- How do RCS media cards help financial institutions?

- How do you add RCS CTA buttons in Clerk Chat?

- Why do RCS CTA buttons improve client engagement in finance?

- What are examples of CTA button text for financial services?

- How can financial firms ensure compliance with RCS messaging?

- What best practices improve RCS CTA performance in finance?

- What’s next for RCS in financial services?

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.