SEC Text Messaging: The Rules for Compliant SMS

By Team Clerk Chat

- Published: July 23, 2024

Free 10DLC Whitepaper

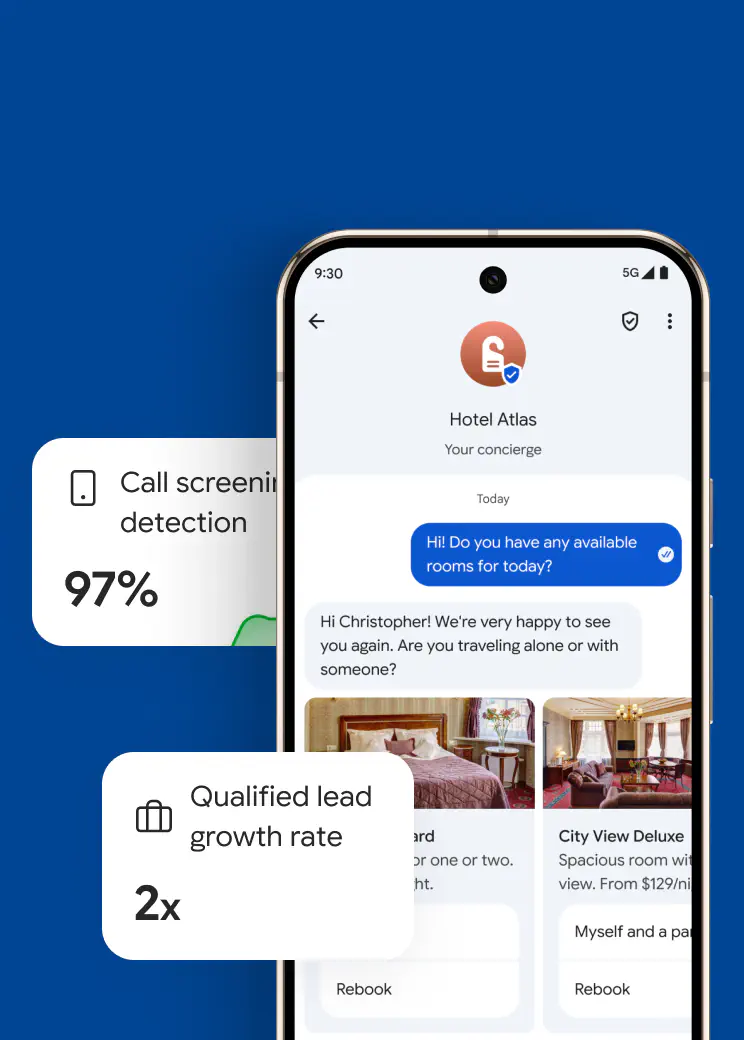

How much do you know about SEC text messaging compliance? If the answer is _not much, _now is the time to act. Messaging apps are exploding into every industry, with companies from all landscapes investing in everything from transactional text messages to SMS appointment reminders.

However, while texting is an excellent way to reach customers wherever they are, turbocharge your marketing strategies, and even improve customer service, it comes with some challenges.

For instance, if you’re using text in the financial industry, you’ll need to make sure you’re adhering to SEC texting rules, which govern how you store and archive your messages.

Just as violations of TCPA regulations and issues with 10DLC SMS compliance can lead to serious fines and reputational damage, SEC violations can cause huge problems for your business.

There’s plenty of evidence to prove this, from the $6.5 million fine imposed against Senvest Management in 2024 for SEC non-compliance, to the $81 million in penalties against eight financial entities introduced in 2023.

Simply put, you can’t afford to ignore compliance.

Have questions about compliance? We’re here to help.

Let’s chat.

What are SEC Text Messaging Rules?

SEC, or the Security and Exchange Commission, and FINRA (The Financial Industry Regulatory Authority), set specific rules about how companies can use SMS and messaging apps to communicate.

Similar to other SMS regulations, the SEC texting rules require financial companies and institutions to store records of all text-based communications for a specific time period. These records need to be available at any time for auditing purposes.

Alongside requiring companies to preserve and maintain electronic communications data, SEC also requires companies to ensure they can monitor and track misconduct among employees. This is a trickier process than it seems now that so many team members are using non-employer-controlled channels like WhatsApp to discuss business.

The Most Common SEC Texting Penalties

Typically, SEC and FINRA penalties are divided into two categories. The first category involves using private devices and messaging apps for communications. For instance, you might be hit with a SEC fine if your team members use their own personal, unmonitored devices for AI-powered SMS conversations with customers.

Using common messaging applications like WhatsApp can also lead to violations of SEC text messaging rules, as these platforms generally don’t support comprehensive archiving.

The second category involves inadequate record retention. Failure to archive all conversations is the most common reason for significant fines. Many companies fail to effectively archive all of their digital communications in a comprehensive way.

You might archive conversations with customers, but fail to keep track of SMS appointment reminders or responses to common questions like FAQs. SEC even imposes fines against companies that fail to implement strategies that give them complete “oversight” over their communication strategies.

On a broad level, however, SEC texting rules simply require companies in the financial industry to take a more comprehensive approach to text message archiving, and monitoring.

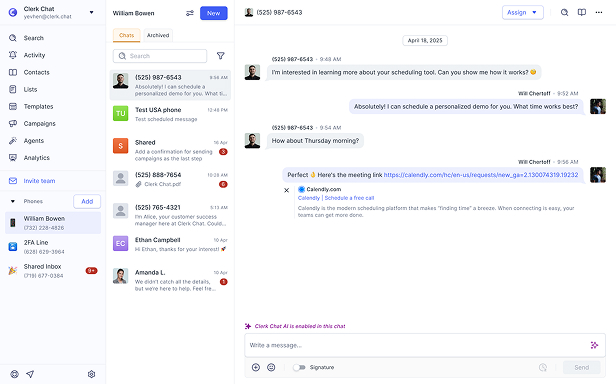

Clerk Chat offers the ability to export all conversations via a CSV file, and conveniently you’re also given the option to select phone number inboxes and date ranges if you don’t have a need or requirement for all conversations to be easily saved or accessed.

FINRA and SEC Texting Fines

FINRA and SEC archiving requirements are very similar. However, which organization imposes fines and the penalties they’ll be given varies based on numerous factors.

FINRA fines vary based on the severity of the violation, any harm caused to the investors, and previous violation history. SEC, on the other hand, generally enforces fines against institutions that manipulate the market, fail to keep accurate records, or allow employees to use off-channel, unmonitored communication methods.

When it comes to messaging, especially SMS for the finance industry, SEC violation fines can be notoriously severe. In 2023, nine Wall Street companies were fined more than $549 million for using off-channel, unmonitored communications, such as texting and WhatsApp.

The fine was issued because the companies were unable to retain all work-related communications, by failing to implement controls for how teams used messaging applications.

In 2022, 16 Wall Street firms were charged $1.8 billion in fines by the SEC for similar violations – their employees were using private texting apps for off-channel communications, without comprehensive archiving strategies.

In February 2024, the SEC announced settlements with eight entities, combining a total of $81 million for alleged failure to maintain electronic communications.

As you can see, as a financial company, whether you’re using text advertisements or SMS-based customer support techniques, you need to choose a conversational messaging platform that provides options for compliance to avoid serious financial repercussions.

How to Ensure SEC Text Messaging Compliance

Since the majority of the SEC text messaging rules revolve around keeping accurate records of digital communications, the best way to avoid fines and reputational damage is with the right archiving strategy. Investing in a comprehensive archiving solution for financial advisors will ensure you can capture all of the core messages that SEC and FINRA may need to audit.

The chances are you already have an email archiving system in place. However, full compliance means ensuring you’re capturing all forms of digital communication data, from SMS conversations to conversations hosted over WhatsApp.

Have questions about compliance? We’re here to help.

Let’s chat.

Ideally, the right archiving solution should be able to:

- Capture all forms of text messages: An excellent archiving solution should integrate with your messaging platform, like Clerk Chat, to capture every message sent and received. This includes opt-in text messages, opt-out messages, A2P SMS messaging, direct conversational text messaging, and messaging through channels like WhatsApp.

- Unified communications archiving: While some companies do use different tools to archive different types of data, having a unified platform makes it easier to keep track of everything. A solution like Smarsh or Global Relay can integrate with SMS platforms like Clerk Chat, as well as online messaging apps like WhatsApp, phone systems, and more.

- Enable retention rules: The right archiving solution will allow you to retain text messaging data for a specific period of time, based on compliance guidelines in your industry. Some types of messages may need to be retained for longer periods than others.

It’s also worth looking for an archiving solution that makes it easy to search through content and surface records when necessary. This will ensure you can quickly respond to audit requests, which is crucial for adhering to SEC text messaging rules.

Advanced eDiscovery features and filters for keywords, phrases, and proximity will help businesses to sidestep the risk of expensive litigation, and help you keep employees and teams in check.

Optimizing Compliance in the Finance Industry

Aside from implementing the right archiving strategies to stay compliant with SEC texting rules, there are other steps financial leaders should be taking to protect their organizations. Whether you’re collecting SMS leads for marketing, or using SMS for customer service, make sure you:

Assess other Essential Compliance Guidelines

SEC texting isn’t the only thing you’ll need to think about in the financial services industry. You may also need to consider 10DLC registration requirements if you’re using SMS marketing. Additionally, if you use phone systems, including voice calls, fax, and text for solicitation, you’ll need a comprehensive TCPA compliance checklist.

Conduct extensive research to determine which regulatory guidelines apply to your communication efforts. You may find that you need to take extra steps to protect your business when you’re using automatic texting campaigns for marketing or obtaining consent for communications.

Implement Policies for Employees

Creating comprehensive policies for employees to follow when using text messaging applications and communication software can help you to avoid a lot of problems. For SEC text messaging compliance, make sure all of your team members are keeping records, regardless of the app or device.

To ensure compliance with other texting policies, it’s also worth making sure you have policies in place for dealing with opt out message requests, protecting sensitive data, and using security measures like multi-factor authentication.

It can also be helpful to implement measures that prevent team members from using dangerous, unmonitored or encrypted applications or devices. Ensure your employees know the repercussions of being unable to monitor and record conversations.

Review Compliance and Security Strategies Regularly

Compliance guidelines in the communication and financial landscapes are constantly changing. Even if you’re already using something like Global Relay texting and archiving solutions, you may need to review and update your strategies and policies over time.

Keep a close eye on the regulatory landscape, paying attention to everything from archiving requirements, to how and when you need to obtain consent to send specific messages to consumers. Review your retention and eDiscovery solutions regularly, and make sure that you’re backing up all essential data in case of a technical issue.

Remember, if your archiving system stops working properly, this doesn’t necessarily mean you won’t be hit with a fine if you violate SEC text messaging rules.

Managing SEC Text Messaging with Clerk Chat

SEC texting rules are just one set of guidelines financial companies need to be aware of when they’re implementing SMS into their marketing and communication strategies. There are plenty of regulations out there that influence how you should be managing your messaging strategies.

Failure to comply with any of these regulations doesn’t just put you at risk of significant fines, it could lead to legal repercussions and damage to your brand’s reputation.

That’s why it’s so important to choose a messaging platform that puts compliance and security first. With end-to-end encryption, customizable policy rules, and support for archiving platforms like Global Relay and Smarsh, Clerk Chat protects businesses from messaging violations.

Find out how our intuitive SMS solution can help you adhere to SEC text messaging guidelines, and protect your business. Request a demo of the Clerk Chat system today.

In this article:

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.