The Ultimate TCPA Compliance Checklist for SMS Success

By Team Clerk Chat

- Published: June 21, 2024

Free 10DLC Whitepaper

Are you planning on calling your customers to let them know about your latest promotions and deals, or implementing text marketing strategies to boost conversions? Either way, you’re going to need a TCPA compliance checklist.

Texting and calling your customers is an excellent way to boost engagement, strengthen relationships with your target audience, and even improve customer service. However, whether you’re using 2-way text messaging or automated campaigns, there are rules you need to follow.

Regulatory guidelines like the TCPA (Telephone Consumer Protection Act) are designed to give consumers control over who contacts them, when, how, and why.

Fail to adhere to these guidelines, and you’ll risk huge fines, not to mention the loss of your customer’s trust.

Fortunately, this TCPA compliance checklist will give you the step by step guidance you need to protect your business, while investing in the transformational power of phone and SMS marketing.

What is TCPA Compliance?

TCPA, or the Telephone Consumer Protection Act, is the legislative statute, passed in 1991, that regulates telemarketing, auto-dialed, and pre-recorded calls, as well as automatic text messages (not including transactional SMS messages).

It requires all companies who plan to connect with customers over the phone with the intent of making a sale to follow specific rules. Achieving TCPA compliance involves implementing a range of strategies into your approach to customer communication.

For instance, you’ll need to obtain consent to contact each customer, ensure you’re only reaching out to customers at specific times, and respecting the restrictions of the “Do Not Call” list.

TCPA compliance aligns with various other regulatory guidelines that companies need to adhere to when calling or texting customers, such as using an A2P 10DLC compliant number, and adhering to call and SMS archiving and retention rules.

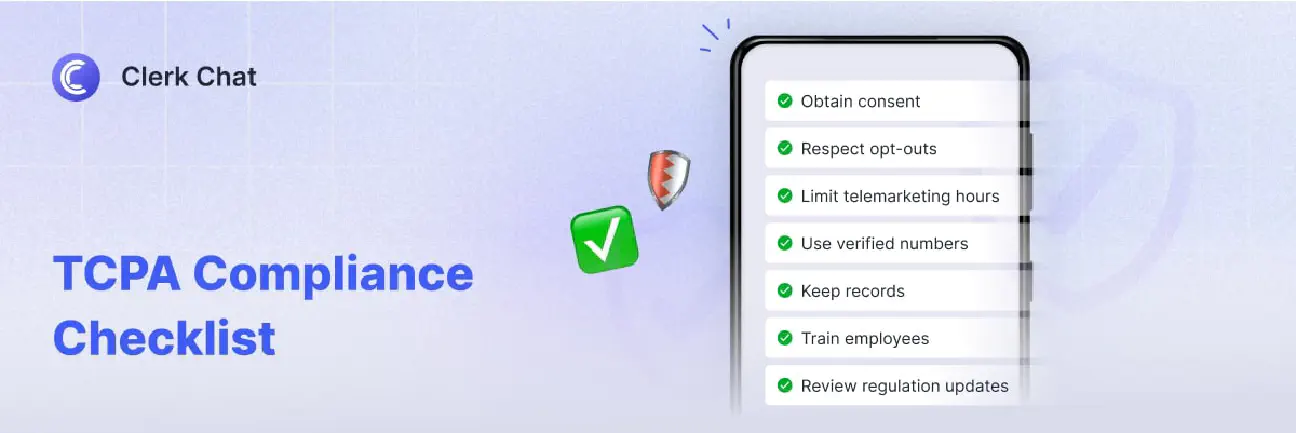

TCPA Compliance Checklist: SMS and Call Best Practices

Maintaining full compliance for text messages, phone calls, and other communication strategies can be more complex than it seems. It’s easy for a company to accidentally breach TCPA rules, because their automated messaging system sends an SMS at the wrong time, their phone number doesn’t adhere to 10DLC compliance standards, or an employee makes a mistake.

The following TCPA compliance checklist will help you to identify the key steps you need to take, to avoid paying fines, and losing customers.

1. Always Obtain Consent

Obtaining consent is central to most strategies for communication compliance. Whether you’re using an SMS app for financial industries to deliver customer service, calling customers about deals, or sending automated marketing text, you need to obtain consent.

Notably, implied consent and express consent aren’t the same thing. If a customer shares their contact details with you to download a whitepaper from your website, this is a form of “implied” consent. You can assume they don’t mind you contacting them, because they’ve given their details.

Implied consent is only enough, however, for human-to-human conversations, such as when your customer service team calls a buyer. TCPA requires all companies to acquire explicit or “express” consent when they’re automating communication methods.

This means a company either needs to check a box or sign a document to show they’re happy to hear from you. In some cases, it’s even necessary to send a secondary “opt-in text message” to your customer, to confirm they’re happy for you to stay in touch.

To ensure you’re obtaining consent correctly:

- Include a consent request on all forms obtaining customer information

- Don’t rely exclusively on “implied consent”

- Keep records of consent forms and documents

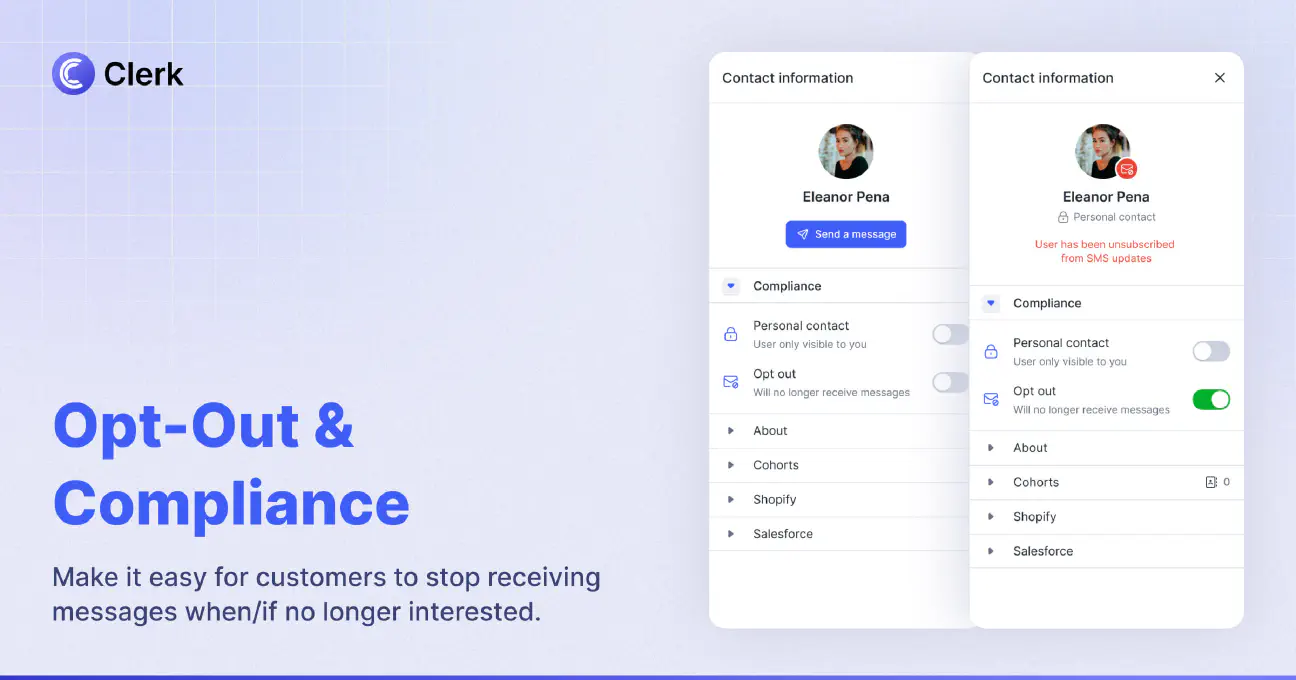

2. Honor Opt-Out Requests and the DNC Registry

This is another crucial component you might overlook with your TCPA compliance checklist. Simply obtaining consent to communicate with your customer isn’t enough. You also need to allow your customers to change their mind, and stop receiving messages or calls from you.

TCPA guidelines do require companies to offer customers an easy way to opt-out of messages whenever they choose. Plus, if you don’t offer customers an opt-out option, you run a risk of having your number reported to the FCC for spam.

Make sure your SMS templates and automated calls include instructions on how to opt-out. Remember, if a customer does opt-out, don’t make the mistake of trying to contact them again in the future because you have a new deal or a better offer.

You can only start communicating with that customer again if they actively opt in to receiving your messages or calls again. Keep the contact list you use for personalized SMS messages, customer service, and sales updated based on changing customer requests and preferences.

It’s also worth using technology to keep an eye on which customers add their number to the national “Do Not Call” registry. Some consumers may add their number to this list without first “opting out” with your company, which can put you at risk of a regulatory breach.

3. Limit your Telemarketing Hours

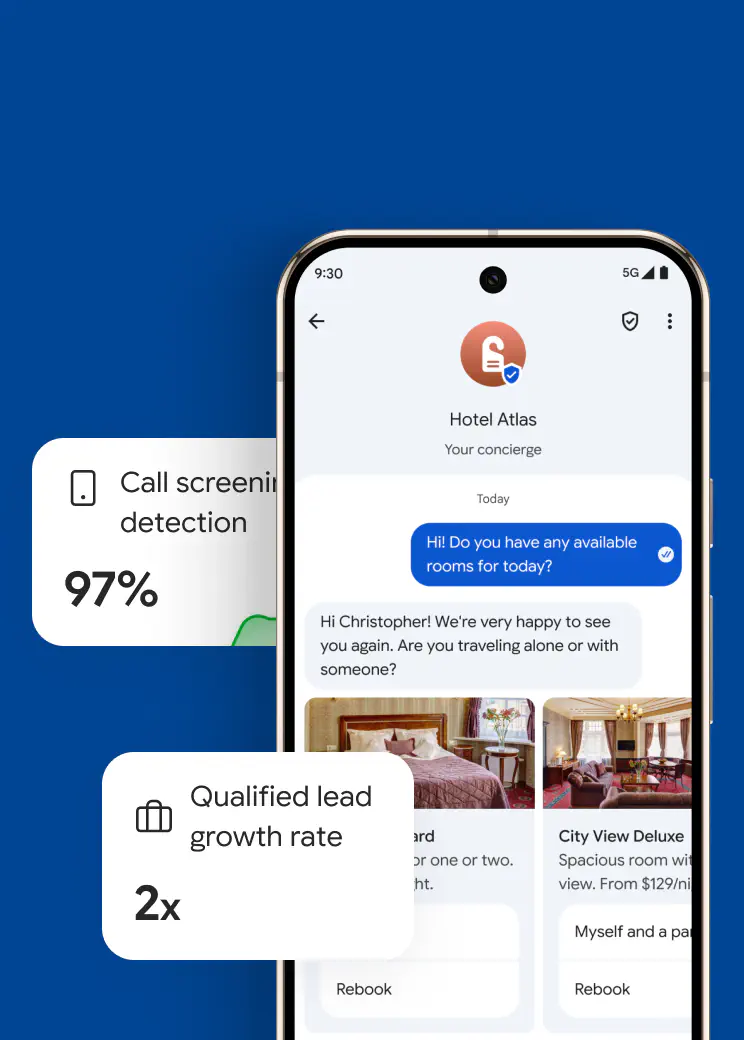

Thanks to automation, it’s easier than ever to put your customer communication and promotion strategy on autopilot, even when using calling and SMS. You can even use AI to create a financial AI bot or customer service bot that contacts customers for you.

However, if you’re going to be reaching out to customers for promotional purposes on autopilot, then you need to be cautious. The TCPA only allows companies to “solicit” customers with telemarketing calls and text messages between the hours of 8am and 9pm.

Since the specified time frame is based on your customer’s local time zone, it’s recommended to segment your customers by their location to prevent messages or calls from being sent at inconvenient times in their respective time zones.

4. Use Verified Numbers

As we noted earlier in this TCPA compliance checklist guide, the wrong number can cause serious problems for companies dealing with strict regulatory standards. TCPA requires all companies to include “proper identification” in telemarketing calls and text messages.

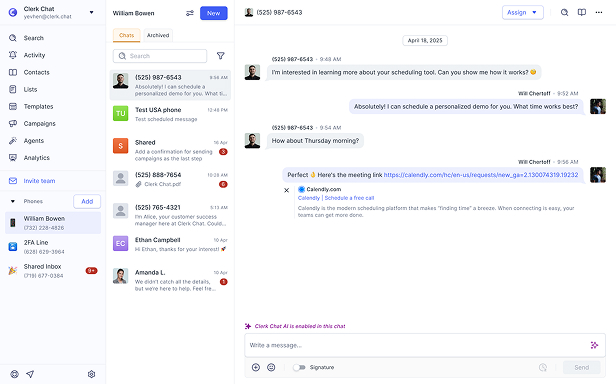

This essentially means you need a verified number. You should already have a verified number if you’re using a text messaging solution that supports 10DLC registration, like Clerk Chat.

10DLC asks companies to verify their legitimacy when they apply for a code for things like application to person messaging. Clerk Chat prioritizes 10DLC compliance by allowing you to enable an existing business phone number for text marketing, or activate a new one.

This means if you want to learn how to text from a landline that’s already approved for 10DLC registration, you can. Or you can choose to create a new number verified by the campaign registry.

5. Keep Comprehensive Records

Most compliance checklists for TCPA overlook this step, but it’s more important than you’d think. TCPA does require companies to retain records of the consent they’ve obtained to communicate with customers. Plus, if you obtain accurate records, you can protect yourself from a range of issues.

For instance, in some cases, prior written consent from a customer can supersede Do Not Call list rules. This means you might be able to avoid a fine, even if a customer launches a complaint against you. For a comprehensive approach to text messaging security and compliance, make record-keeping a priority for your team.

Use a solution like Clerk Chat to combine SMS integrations with the other tools you use to collect customer consent, store customer records, and more, for a comprehensive approach to managing your data. Make sure you review that data regularly, and ensure your details are up to date.

6. Train Your Employees on Compliance Standards

Human error is one of the biggest factors that can harm a company’s compliance strategy. Team members who don’t fully understand how to use things like Global Relay, text message automation strategies, and outbound dialers according to compliance rules can easily make mistakes.

Comprehensive training ensures you’re less likely to face hefty fines just because your employee accidentally does something wrong. Make sure your team members know:

- When to use auto-dialing tools: In some cases, auto-dialers can be dangerous to use if a contact list hasn’t been updated for a while. Automatically calling customers who have joined the DNC list or revoked their consent can lead to fines.

- How to keep customers informed: Ensure employees know how to request consent from customers during initial conversations, and how to keep them informed about their options to revoke consent or opt-out of calls.

- When to schedule automated messages: Make sure your team members know how to set up automated workflows based on a customer’s location and time-zone. Regularly review automations to ensure they adhere to compliance guidelines.

7. Stay Up to Date

Finally, remember that communication compliance guidelines and regulations are constantly evolving. Over time, you may need to update your TCPA compliance checklist based on new updates imposed by regulatory authorities. Alternatively, you might need to consider combining your approach to TCPA compliance with other strategies.

For instance, if your banking and investment company starts offering support and guidance to customers over SMS, you’ll need to invest in text message archiving for financial advisors, and ensure your policies here align with TCPA rules.

Using a flexible messaging platform that allows you to update your policies, automations, and strategies based on your evolving needs will help to preserve ongoing compliance.

Enable TCPA Compliance with Clerk Chat

A TCPA compliance checklist is important for any company that plans on using text messaging, or calls for promotional purposes. Ultimately, the goal of TCPA is to protect consumers, and give them more control over who has permission to contact them (and when).

Failure to adhere to the rules implemented by this statute doesn’t just put you at risk of hefty fines, it can also cause significant damage to your reputation, resulting in a loss of customers.

Make sure you protect your business from the side-effects of non-compliance, with the right messaging solution. Clerk Chat puts compliance first, by prioritizing 10DLC support, enabling archiving, simplifying automated opt-in requests, and more.

Plus, we ensure your business is defended against other potential risks, with a comprehensive approach to privacy and security.

Don’t expose your company to unnecessary threats. Use Clerk Chat to launch a compliant messaging strategy for your brand.

In this article:

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.