The Guide to Text Message Archiving for Financial Advisors

By Team Clerk Chat

- Published: June 14, 2024

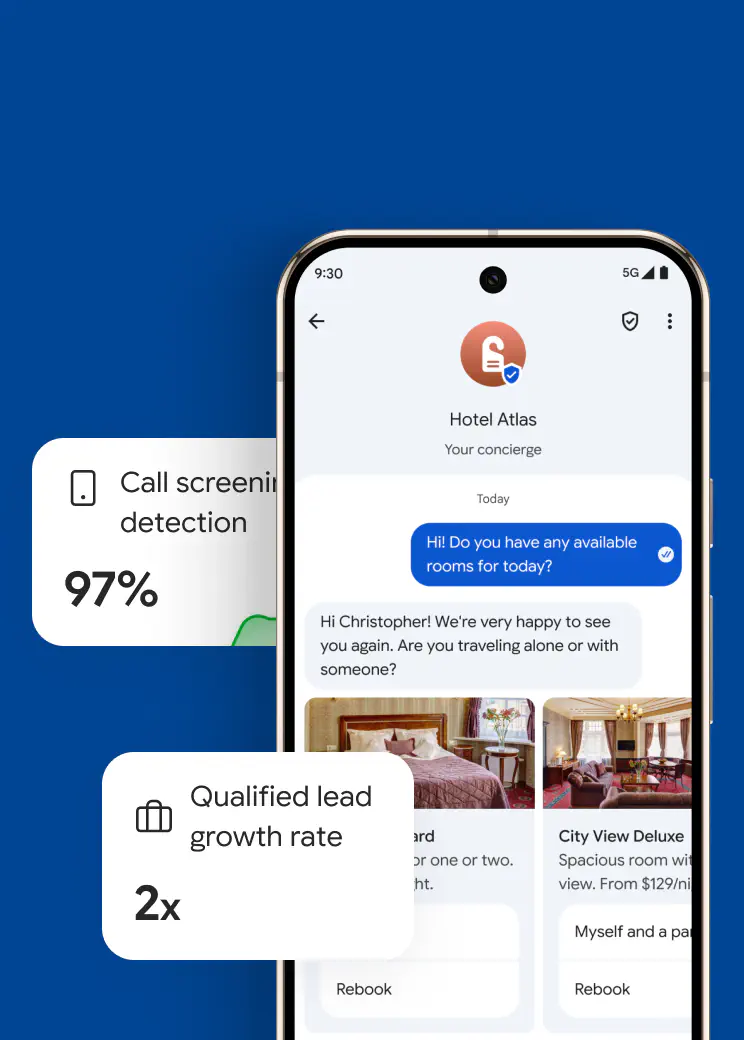

Investing in the right approach to text message archiving for financial advisors is more important than you’d think. Text has emerged as a valuable way for companies in every industry to communicate with clients, deliver exceptional customer service, and even increase sales.

In fact, 97% of companies say they communicate more effectively with customers after they launch SMS initiatives. Unfortunately, while texting is a reliable, convenient, and intuitive way to connect with clients, it’s also a communication method fraught with challenges for regulated companies.

If you’re investing in finance SMS solutions, you need to ensure you’re adhering to the regulations imposed by industry bodies like FINRA or the SEC.

Fail to collect, store, and manage your messages effectively, and you risk massive fines, loss of customer trust, and even legal repercussions.

So, how do you protect yourself, your company, and your customers?

Archiving for your business text messages.

Learn moreMitigate risk

Export conversation logs

Protect sensitive data

Simple integration

Text Message Archiving for Financial Advisors: SMS Compliance

SMS compliance is a complex concept that’s increasingly gaining more attention as companies and consumers embrace more convenient messaging-based communication strategies.

In every industry, any company investing in SMS marketing, two-way text conversations with customers, and text-based customer service will have specific compliance requirements to consider.

Text message archiving for financial advisors is just one of a series of compliance and security methods finance companies need to consider. Beyond effective text messages archiving, companies will also need to ensure they’re adhering to a range of other rules related to opt-in text message requirements, data protection standards, and more.

Often, the best way to begin building your strategy is to examine the regulations that apply to your organization. Here are some key concepts to be aware of:

The Telephone Consumer Protection Act (TCPA)

The Telephone Consumer Protection Act regulates all telemarketing calls, text messages, and various other forms of communication. It outlines how companies can use personalized text messaging strategies to communicate and market products to customers.

A TCPA compliance checklist for a financial advisor company would include steps for everything from obtaining proper consent, to maintaining conversational records, and honoring the “Do Not Call” registry.

A2P 10DLC Regulations

A2P or application to person messaging, is commonplace in the financial industry. It’s how many financial advisors, banking companies, and investment advisors send messages to their clients that allow them to validate their identity or change passwords with two-factor authentication codes.

A2P 10DLC regulations require operators to leverage local code numbers that mobile network operators can approve for A2P messaging. If you want to use enterprise text messaging strategies to support your customers, then you need to register for 10DLC.

The Investment Advisers Act (1940)

Enforced by the Security and Exchange Commission (SEC), the Investment Advisers Act outlines which records advisors must maintain, including journals, financial statements, and general ledgers.

This applies to records stored on both digital and traditional media, making it crucial to consider whether you’re using a finance AI chatbot, text messaging strategy, or traditional communication tools (like phone calls and letters).

Markets in Financial Instruments Directive II (MiFID II)

The MiFID II regulatory framework, enforced by the European Union, aims to enhance market transparency and protect investors and their clients. Under this directive, all wealth management and financial firms must record and retain all communications connected to client orders. This includes conversations that take place over one-way or two-way text messaging.

This is an important framework to consider when investing in text messaging archiving for financial advisors. It also influences how you’ll communicate with customers, as MiFID II requires all firms to notify customers that their information and conversations will be recorded and stored.

FINRA Rule 4511 and SEC Rule 17a-4

Part of the FINRA framework implemented by the Financial Industry Regulatory Authority, Rule 4511 is a record-keeping framework specifically designed for broker-dealers. Rule 4511 requires these professionals to maintain accurate records, compliant with applicable securities, laws, and regulations, including those set forward by the SEC Act of 1934.

Under these rules, companies need to ensure they’re storing all books, and records, including text messages, in paper or electronic form for a minimum of six years.

SEC Rule 17a-4, implemented by the Security and Exchange Commission is very similar, requiring broker-dealers to retain all transaction details, SMS templates and messages, and business records for a minimum of six years.

How Financial Advisors Can Stay Compliant Using SMS

Ultimately, failure to comply with the standards set by regulatory authorities can create huge issues for financial advisors. If you’re not investing in text message archiving for financial advisors, as well as the right methods for acquiring consent and securing communications, the risks are huge.

Just as healthcare companies can be exposed to major fines and reputational damage when they don’t have the right HIPAA texting policies in place, financial firms can face similar threats. In fact, in 2022 alone, more than $11 billion in fines was levied against Wall Street firms for failure to adhere to recordkeeping rules.

Fortunately, there are steps you can take to mitigate these risks.

Step 1: Develop clear policies, and train team members.

First, make sure you have clear policies in place for how you’re going to be using text-based communications. Based on what you know about TCPA rules and the compliance guidelines above, outline clear “best practices” for your team to follow.

Make sure you identify when it’s appropriate to send text messages to your customers, which information you should include in templates, and what you need to archive and store. Train team members on the rules to follow, and let them know the dangers of non-compliance.

Additionally, make sure your employees are following best practice processes when they’re obtaining consent to schedule text messages, or communicate via text with customers. Obtaining consent to communicate with customers isn’t just important for compliance, it can also strengthen relationships with your customers, showing you value and respect their privacy.

Step 2: Choose the Right Messaging Communication Software.

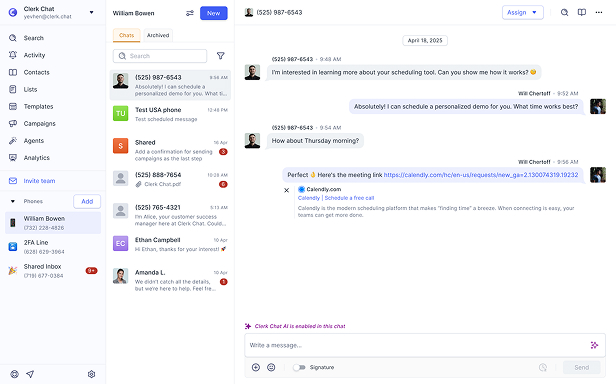

When it comes to choosing a platform, put security and compliance first. The right solution should help to enable text message archiving for financial advisors, by integrating with the archiving tools and solutions you already use.

The platform also helps to facilitate better security throughout your messaging campaigns. With Clerk Chat, you can send secure text messages, with encryption for data in transit and at-rest. You can even protect your records more effectively, with two-factor authentication.

When selecting your messaging communication software, make sure you prioritize solutions that allow you to monitor text communications and track crucial data effectively.

It’s also worth looking for:

- Integrations with other messaging platforms, tools, and services

- Connectivity for your CRM systems and other databases

- Workflow automation tools to help with monitoring messages

- AI tools so you can automatically request consent from customers

Archiving for your business text messages.

Learn moreMitigate risk

Export conversation logs

Protect sensitive data

Simple integration

Step 3: Select the Right Archiving Platform

Some SMS platforms will enable text message archiving for financial advisors with Global Relay archiving. However, you may also need to invest in an external archiving solution. Most regulations specify that firms need to retain their records using electronic recordkeeping systems.

The right platform for you will ensure you can automatically capture and securely store electronic communications in a range of formats. For instance, Clerk Chat enables Global Relay text message archiving, and works with other messaging apps, like Microsoft Teams, to enable archiving for all of your conversations.

When selecting the ideal archiving platform, look for features like:

- Support for a wide selection of devices, carriers, messaging formats (SMS/MMS/RCS), and messaging platforms (WhatsApp, SMS, Microsoft Teams).

- The ability to set custom access controls to restrict access to specific records based on employee permissions.

- Comprehensive communication capture and message threading, to ensure you can track all text-based communications in order.

- Intelligent search functionality to help you easily and quickly identify relevant conversations during investigations.

- Audit logs so you can track who in your organization has viewed, accessed, or searched for specific text message records.

Step 4: Set Custom Data Retention Policies

Finally, once you have the right technology in place, it’s important to create custom data retention policies that align with the various laws and regulations that affect your financial services company, from 10DLC compliance, to message retention laws.

Your policies should define everything from the data you need to retain to the format you need to keep that information and even how long you should be storing that data for. You may even include policies for how you’ll properly dispose of information once the retention period ends.

Ensure your data retention policies allow you to maintain detailed, accurate records of all your firm’s compliance efforts. Plus, remember to keep track of other relevant data too, such as your monitoring activities, staff training efforts, and even any corrective actions you’ve taken to address compliance issues. This will be crucial during regulatory examinations.

Preserve SMS Compliance in the Finance Industry

Staying compliant with regulatory guidelines in the finance industry requires a holistic approach. Companies need to ensure they’re investing in the right solutions for text message archiving for financial advisors, as well as implementing the correct security measures.

Fortunately, the right technology can put you on the path to success. Clerk Chat makes it easy for companies in any industry to remain compliant with a range of regulations, from TCR registration requirements, to record-keeping standards.

With Clerk Chat, you can build a robust strategy for SMS marketing, customer service, and communication, without putting your company at risk.

Take the safe approach to leveraging SMS as a financial advisor. Try Clerk Chat.

In this article:

Ready to use your business number for text messaging?

Thousands of businesses are already experiencing the power of conversational messaging through SMS. Join us. Free trial and paid tiers available.

Get Started#Subscribe

Get product updates in your inbox

Tutorials, features, and Clerk Chat news delivered straight to you.