Bank texting your team trusts

Meet text banking software that turns your existing number into client-ready messaging - secure, auditable, and in your daily tools - so advisors reply fast without losing oversight.

AI Agentic Workflows

Read all about our commitment to security, industry-leading integrations, and how we're building trust and partnerships to support your restaurant communications.

View all templatesWhy SMS for banks works

Company-controlled texting

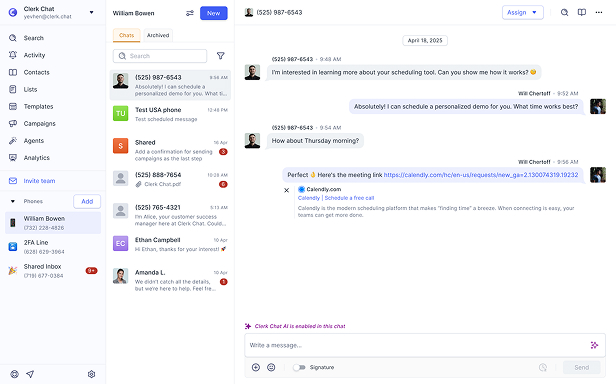

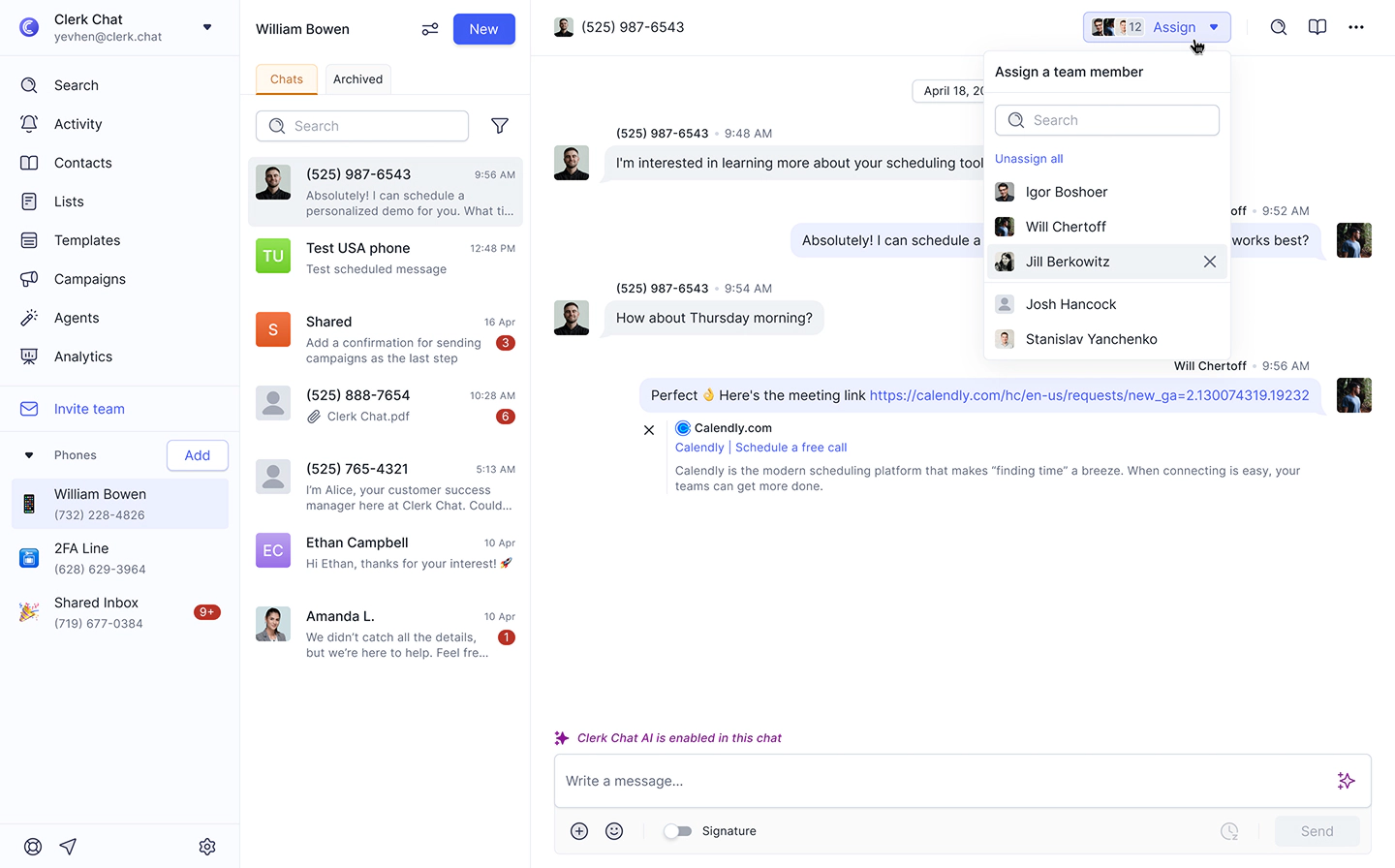

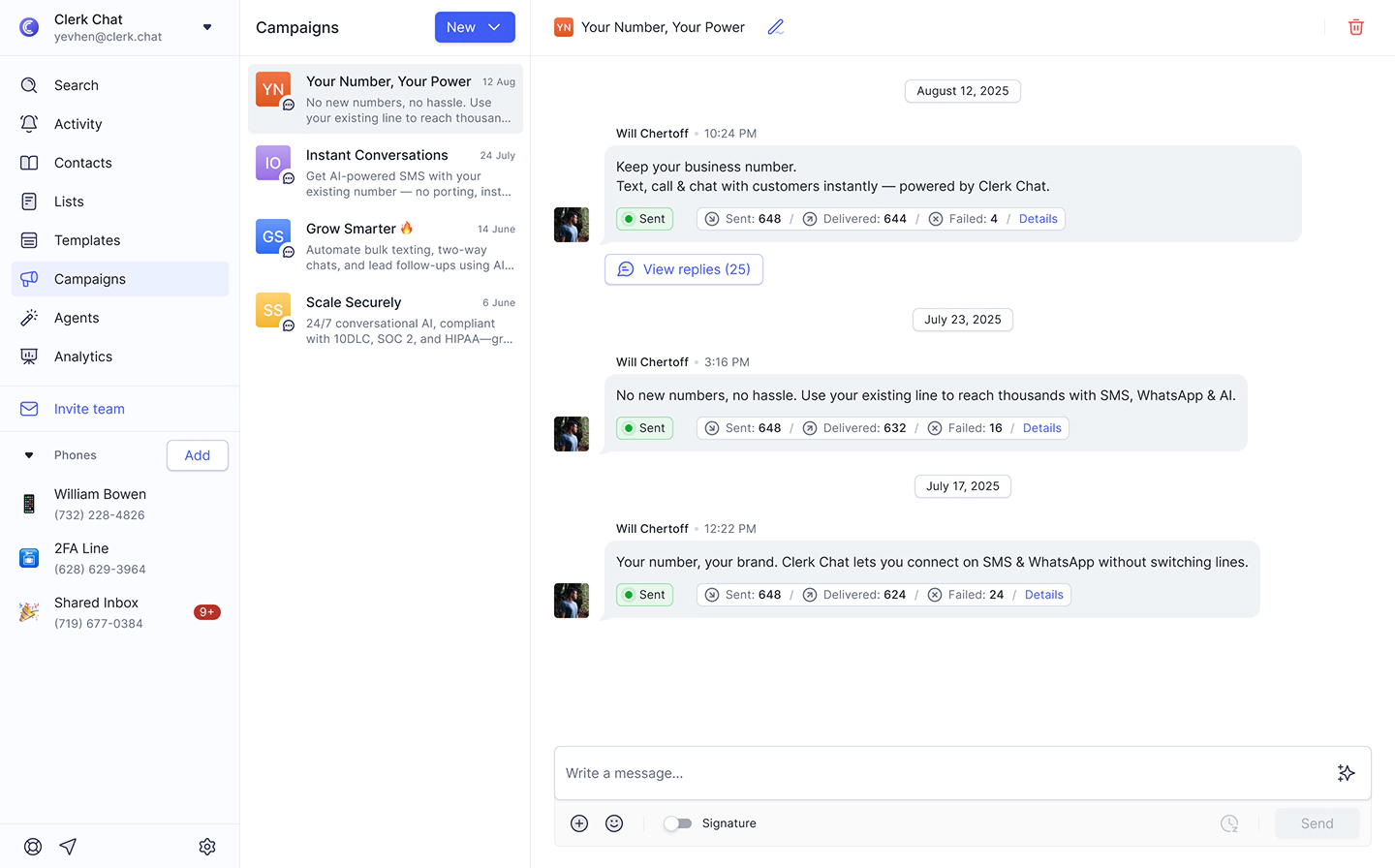

Route every client conversation through your institution’s number with roles, ownership, and audit logs. End personal-phone texting. With banking SMS, supervision stays simple while advisors keep quick, conversational back-and-forth.

Get started

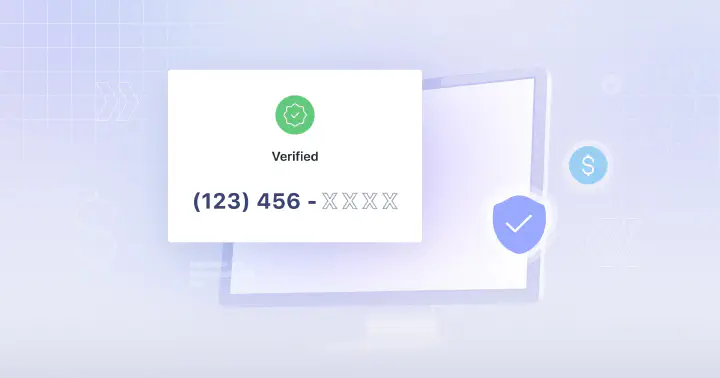

Verified rich messages

Use branded profiles, verified senders, and interactive cards where supported; fall back to SMS/MMS when needed. Text message banking feels app-like, so clients confirm, pay, or schedule without long explanations.

Get started

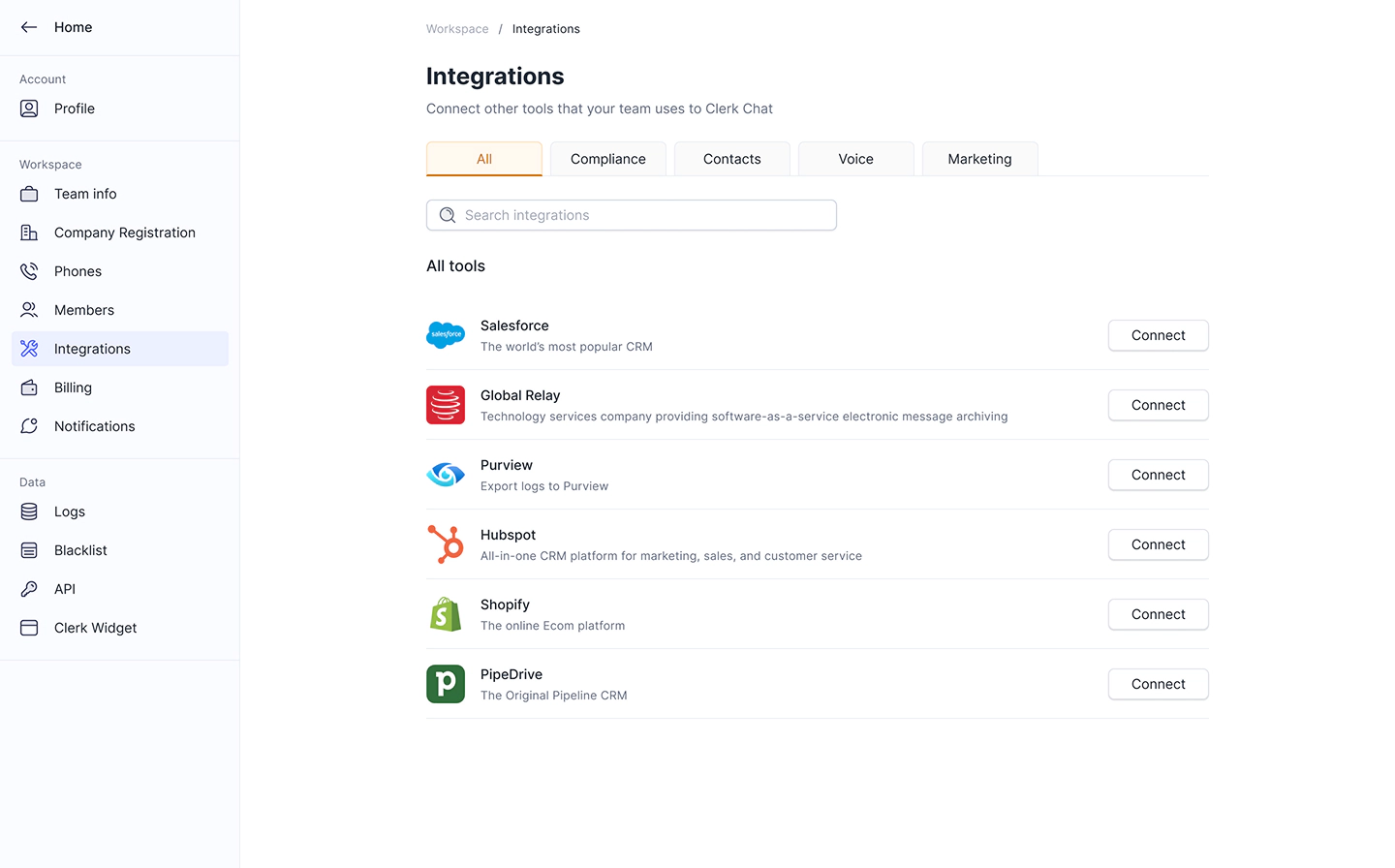

Works in your stack

Message in Teams, Webex, Salesforce, or the web app. APIs and webhooks trigger workflows, enrich contacts, and mirror records to archives - so text banking software lives where your team works.

Get started

Compliance without drag

Opt-in enforcement, quiet hours, access controls, and records come standard. Aligned with SOC 2, ISO 27001, and GDPR. With SMS for banks, advisors move fast and compliance reviews stay clean.

Get started

Jeff Gelwix

Jeff GelwixPresident @ Sonic Drive-in

Clerk Chat is a beautifully built solution that is flexible, customizable, intuitive, and perfect for collaboration. We love the Clerk Chat platform, but what we love even more is how amazing and caring the team behind it is.

Read more on Trustpilot

Cruz M.

Cruz M.Professional Independent Marketer

As a marketing professional, I had trouble communicating with my contractors because we used Slack and Teams, but they weren't always online. I spent months looking for a tool to help me send text messages or WhatsApp messages to them so they could log in to Zoom and Google Meets. Plus, Clerk Chat also allows me text my clients that I have on HubSpot CRM.

Read more on G2

Katrina Bogany

Katrina BoganyPresident of Fab Finishes, Inc.

Clerk Chat is truly the missing piece of the puzzle with Teams! It makes Teams a complete communications solution, by adding the vitally important SMS texting functionality to the platform. In addition, Clerk Chat’s support is excellent.

Read more on Trustpilot

#ScheduleDemo

Instant, secure, 1:1 and multiplayer messaging. No APIs, no developers, no fuss.

This ensures that customers receive swift responses, while also preventing any team member from becoming overwhelmed.

{BankName}: A {Type} of {Amount} at {Merchant} on {Date} {Time}. Card ending {Last4}. If this wasn’t you, reply FRAUD. Reply STOP to opt out.

{BankName} security: Did you attempt a {Type} for {Amount} at {Merchant}? Reply YES or NO. We’ll pause the card until you confirm. Reply STOP to opt out.

{BankName}: Your balance on {AccountNickname} is {Balance}. Add funds or set alerts to avoid fees. Manage here: {ShortLink}. Reply STOP to opt out.

{BankName}: Your {Product} payment is due on {DueDate}. Pay now at {ShortLink} or reply HELP for options. Thank you. Reply STOP to opt out.

{BankName}: Your {LoanType} application (ID {CaseID}) is {Status}. Next step: {NextStep}. View details or upload docs: {ShortLink}. Reply STOP to opt out.

{BankName}: Hi {FirstName}, your appointment with {AdvisorName} is on {Date} at {Time} ({Location}). Reply 1 to confirm, 2 to reschedule. Reply STOP to opt out.

{BankName}: Your new {CardType} is {Status} ({PickupLocation} / en route). Activate on arrival at {ShortLink}. Need help? Reply HELP. Reply STOP to opt out.

{BankName}: Your {Month} statement for {AccountNickname} is ready. View or download securely: {ShortLink}. Keep your details private—never share codes. Reply STOP to opt out.

{BankName}: We need {DocumentName} to continue your {Process}. Upload securely: {ShortLink}. Questions? Reply HELP. Never share passwords by text. Reply STOP to opt out.

{BankName}: Your one-time code is {Code}. Use within {TimeWindow}. We will never ask for this code in a call or link. If not you, reply NO. Reply STOP to opt out.

For banks that text better

Deep dives, how-tos, and checklists on client messaging, from compliance basics to AI handoffs. No fluff - just tactics your team will use

Why Finance Teams are Adopting Conversational AI

Learn all about the rise of conversational AI in financial services, and the impact it can have on your business, with this expert guide from Clerk Chat.

The Big Shift Happening with AI in Finance

See how AI in finance can cut risk, speed approvals, and personalize service, making life easier for your team and your clients.

10DLC Registration: What it is, Why it Matters, and How to Get Started

What are 10DLC (10 Digit Long Code) numbers and why is it important to complete 10DLC registration for A2P (Application to Person) messaging?

Customers ❤️ Clerk Chat

Case studies

Over 4 billion conversations happen across the leading messaging platforms today. Meet your customers across the channels they prefer, instantly.

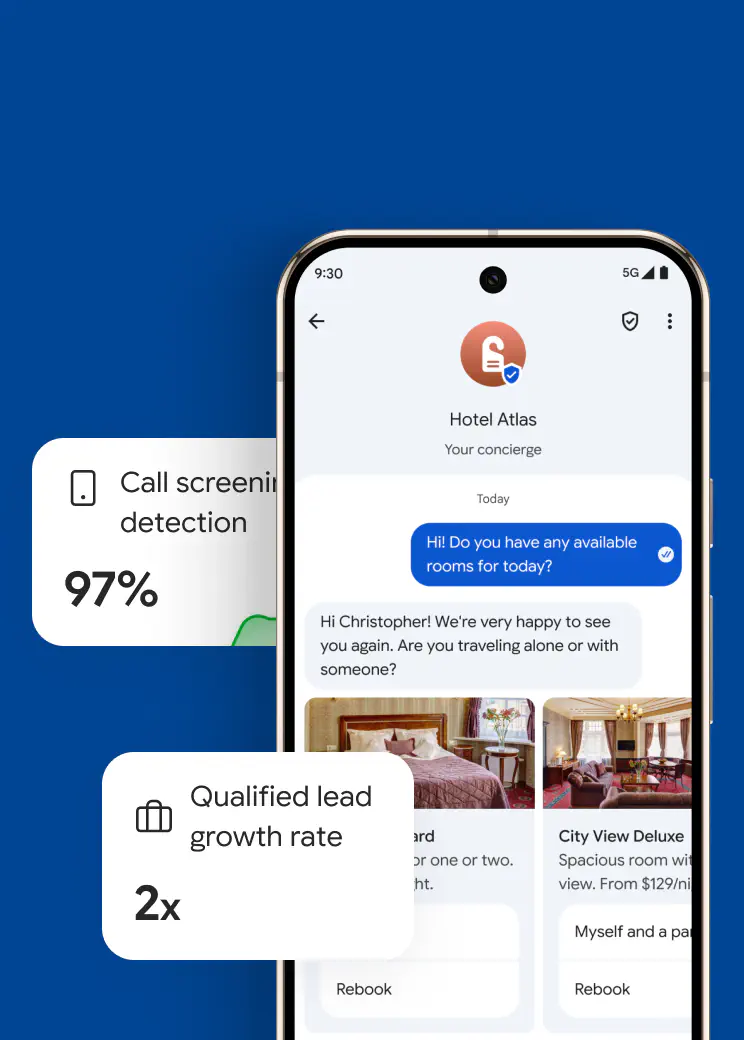

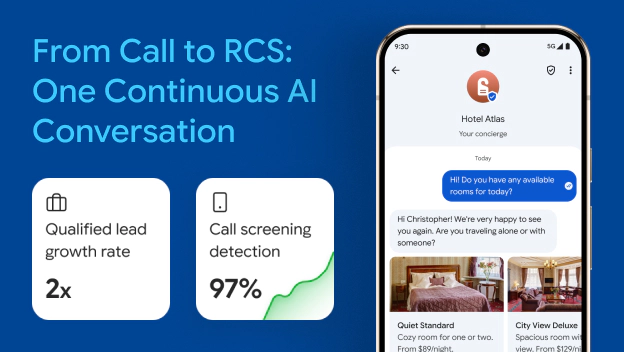

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AI

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AIClerk Chat deployed an AI agent that operates across voice, and RCS messaging as a unified experience, sharing the context across both channels to render a delightful customer journey. For this implementation, the AI agent was deployed to qualify leads for a major telecommunications provider.

Read Story How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messaging

How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messagingClerk Chat partnered with the Los Angeles Rams, Google, and carriers to launch the first U.S. sports marketing campaign using RCS business messaging.

Read Story How the YMCA of Northern Utah makes family communication easy and accessible

How the YMCA of Northern Utah makes family communication easy and accessibleYMCA of Northern Utah keeps parents happy with instant updates — 50+ staff sending 40K messages monthly through one platform.

Read Story

Find the right plan

Designed for every stage of your journey. Start today, no credit card required.

- Free

$0

user / month

Notes:

All features

- Growth

$9.99

user / month

Notes:

Essential features

- Ultimate Popular

$19.99

user / month

Notes:

Power features

- Enterprise

Custom

user / month

Notes:

Dedicated account manager

FAQ

Have questions? We've got answers.

Find what you need quickly and clearly with our most frequently asked questions.

Personal phones create blind spots. With banking SMS, every conversation runs through your institution's number, not a rep's device. You get roles, ownership, audit logs, and quiet hours; advisors keep fast, natural back-and-forth. No more 'Who has that thread?' moments - everything lives in one place your team can actually supervise.

Yes. We light up your existing business numbers and respect the call and queue logic you already run. Incoming texts route by skills, branch, or relationship owner, and handoffs keep the transcript intact. The net effect: fewer dropped balls, cleaner coverage, zero renumbering drama for clients using text message banking.

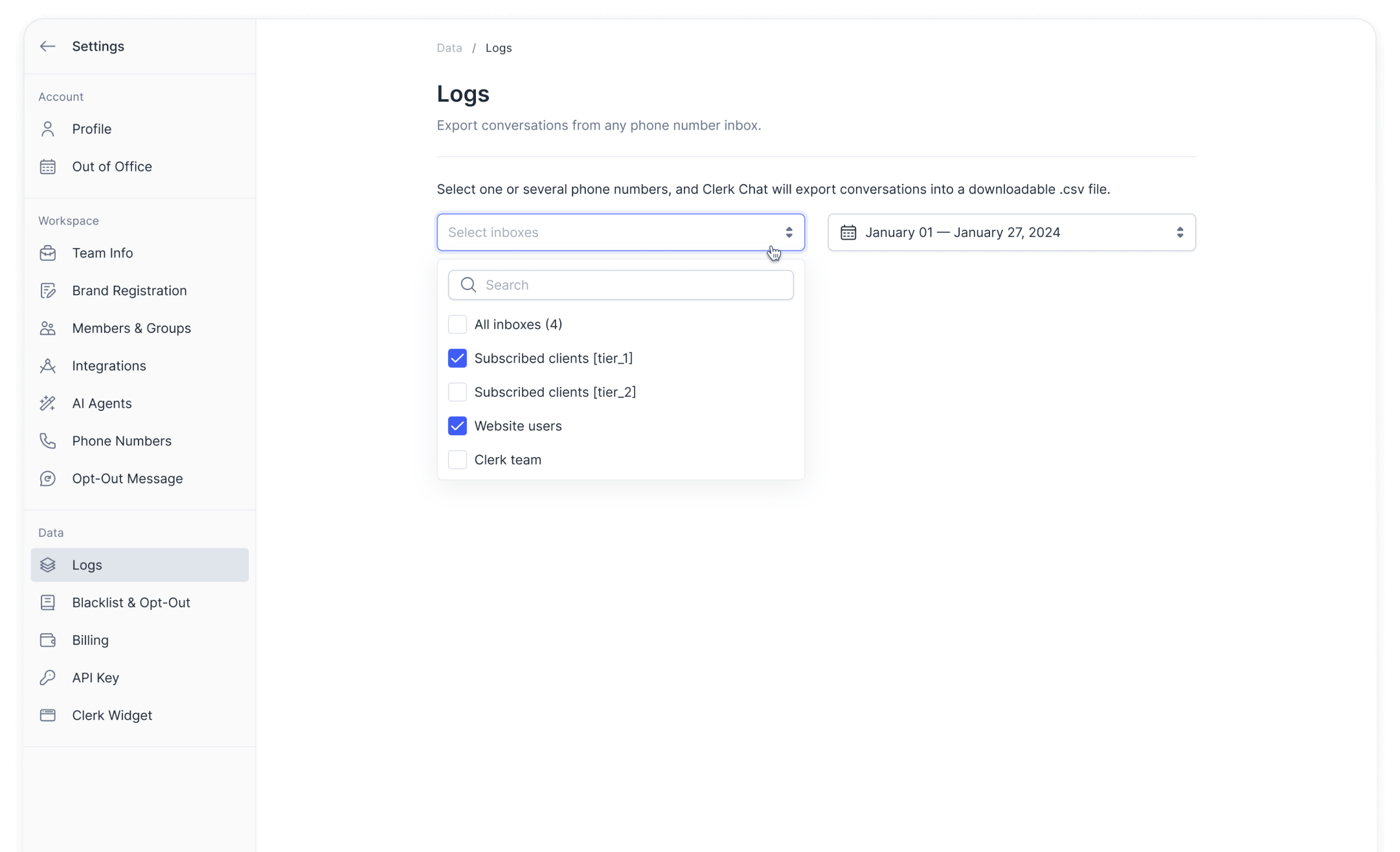

Security is table stakes: access controls, audit trails, encrypted transport, and exportable records are standard. We align to SOC 2, ISO 27001, and GDPR practices, and we'll share a security pack for review. You decide retention and who can see what; we enforce opt-ins and quiet hours so risk teams stay comfortable with SMS for banks.

It lives where your people already work. Advisors send and receive inside Microsoft Teams, Slack, Salesforce, or the web app. Admins get APIs and webhooks to trigger workflows, enrich contacts, and mirror records to supervision or archives. That's how text banking software earns adoption: no tab hopping, no retraining marathon.

Start with your institution's verified identity and consistent sender profile, then add opt-in receipts and clear opt-out handling. Templates help teams say the right thing without sounding robotic, and rate controls protect number reputation. Clients learn to trust the pattern, which is the heart of safer banking SMS at scale.

Think of AI as the punctual assistant - fast on routine, careful with anything sensitive. It confirms identity with the checks you allow, answers common questions, schedules callbacks, and routes to the right person when judgment is needed. You set tone, escalation rules, and red-lines it should never cross. Every handoff includes transcripts, so supervisors can review and coach.

Keep it. We log message content, metadata, ownership, and timestamps, then export or forward via API/webhooks into the archive you trust. Supervision sees a single, consistent record - email, chat, and text side by side - so investigations stop bouncing between systems. That's the practical path for compliant SMS banking service.

They do when used wisely. Where supported, interactive cards let clients confirm appointments, pick payment options, or tap to talk - fewer misfires, clearer intent. When a device can't handle rich features, we fall back to standard SMS/MMS without breaking the flow. Clients get a steady, predictable experience from your text message banking program.