Finance SMS that won’t trigger security flags

Spin up finance SMS on the number you already have - no swaps, no new tools. SOC2-ready controls, opt-in/opt-out by default, and deep integrations with Teams, Smarsh, Salesforce, and APIs.

Use cases

From compliance alerts to portfolio updates, enable secure client communications across all financial touchpoints.

Investment updates

«Market Alert: Your watchlisted stock XYZ has reached your target price of $150. Log into your secure portal to review your investment strategy. 📈»

Payment reminders

«Your loan payment of $1,248.50 is due in 3 days. Reply YES to process automatic payment from your registered account, or visit [Link] to explore payment options. 🔔»

Security verification

«For your security: We've detected a new device login to your account. Enter code 847591 to verify this attempt, or reply BLOCK to deny access. 🔐»

Secure SMS service for financial industries

Compliance & supervision

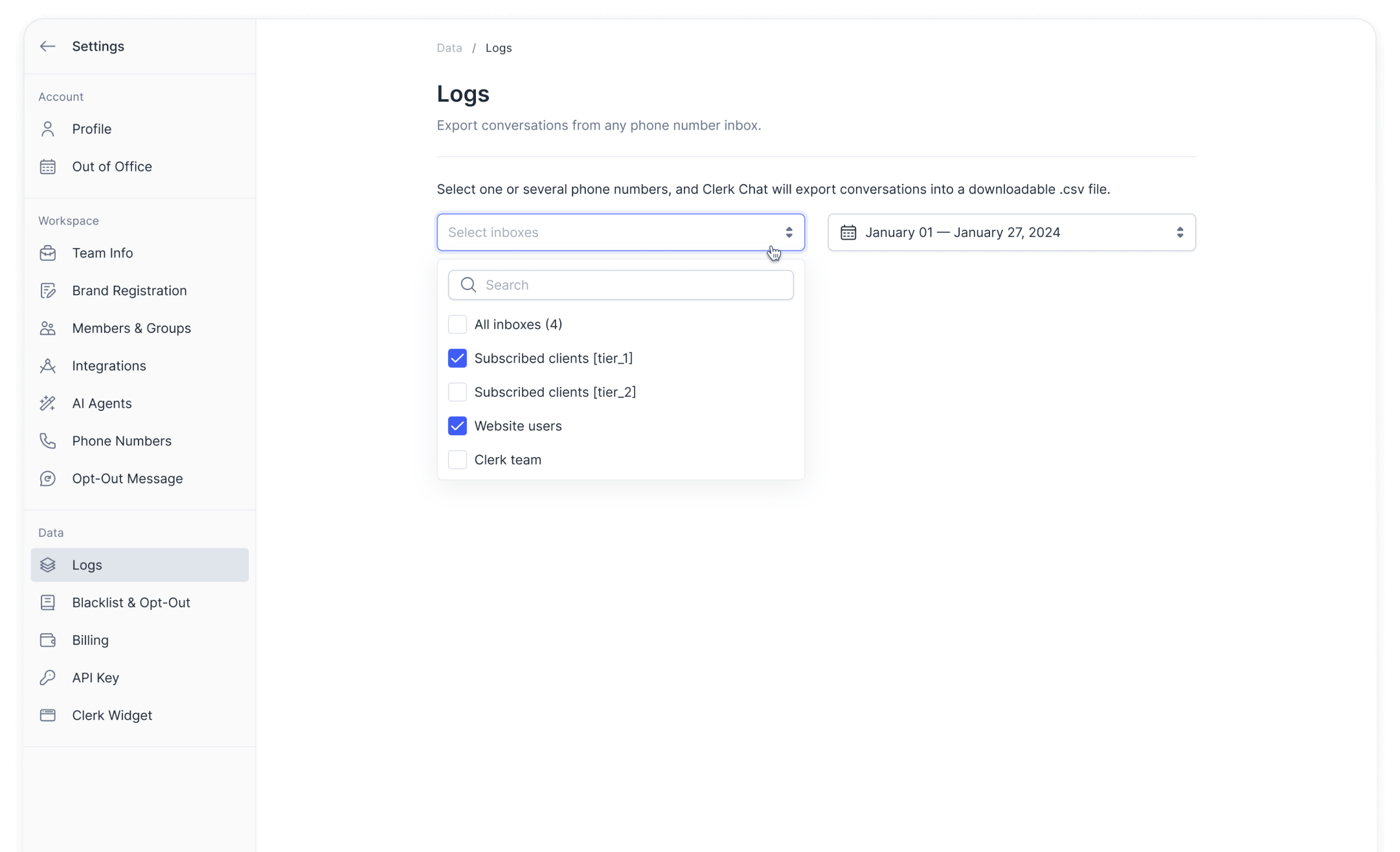

Meet SOC-level expectations with audit trails, access controls, and 10DLC guardrails. Export records for Smarsh or your archive, enforce quiet hours, and keep every conversation traceable without slowing frontline teams.

Get started

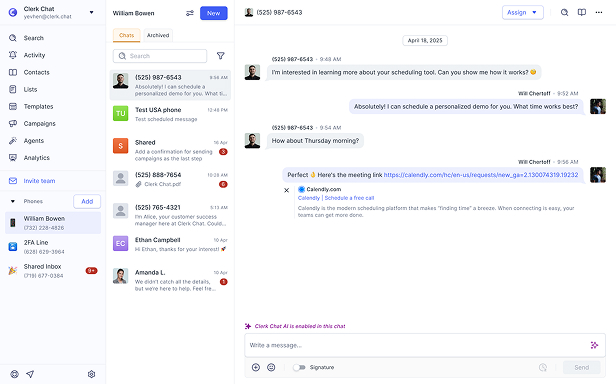

Company-controlled messaging

Stop shadow texting. Route every message through the company number with roles, ownership, and audit logs. Centralized SMS for finance keeps data under your controls, not scattered across personal devices.

Get started

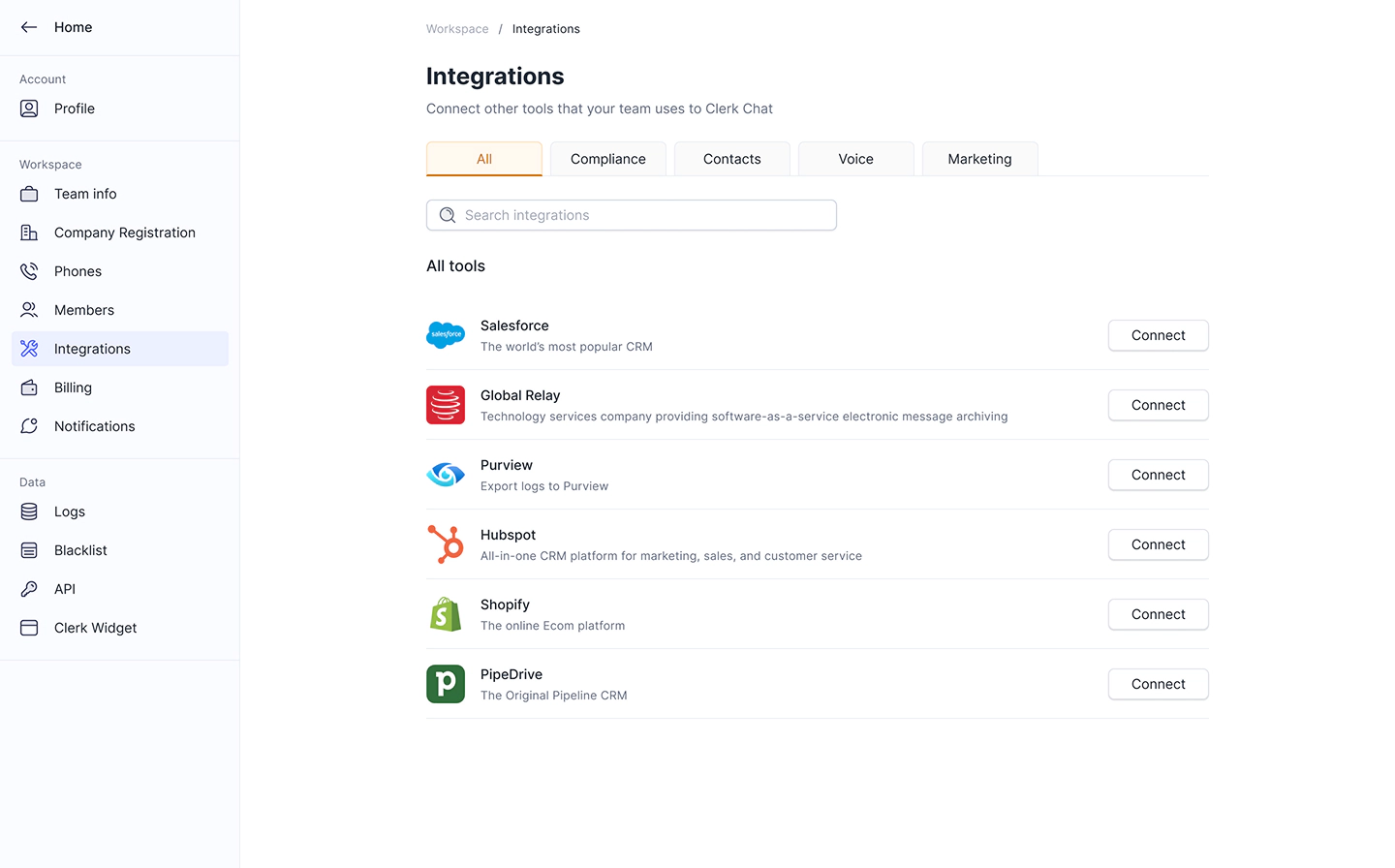

Works in your stack

Message inside Microsoft Teams, Webex, Salesforce, or our web app - no extra tabs. APIs and webhooks tie into workflows so your financial messaging services stay connected, searchable, and governed.

Get started

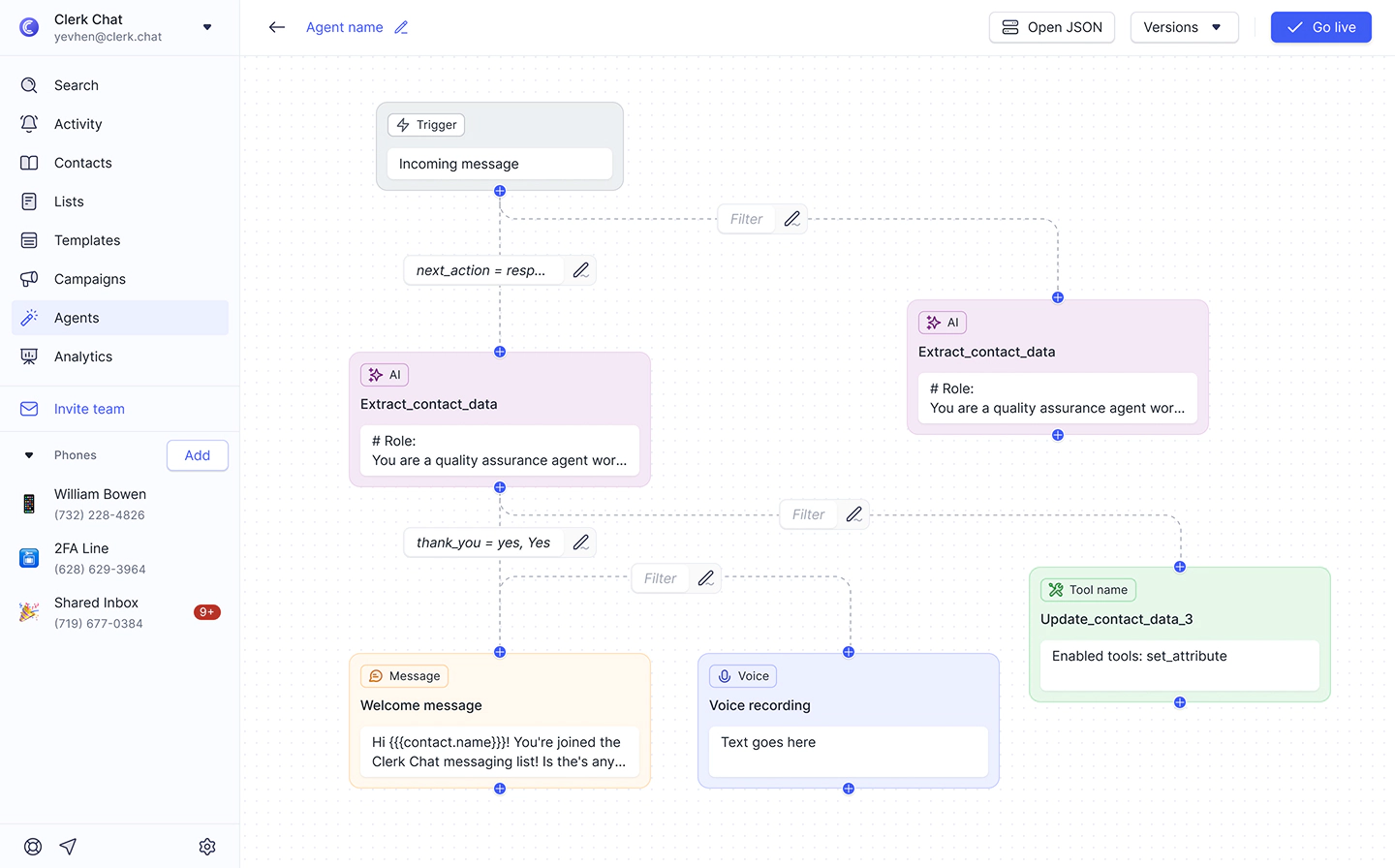

AI that knows

AI learns your products, pricing, and policies from CRM or data warehouses, replies instantly, qualifies leads, schedules callbacks, and hands off to humans with transcripts - so customers get answers without repetition.

Get started

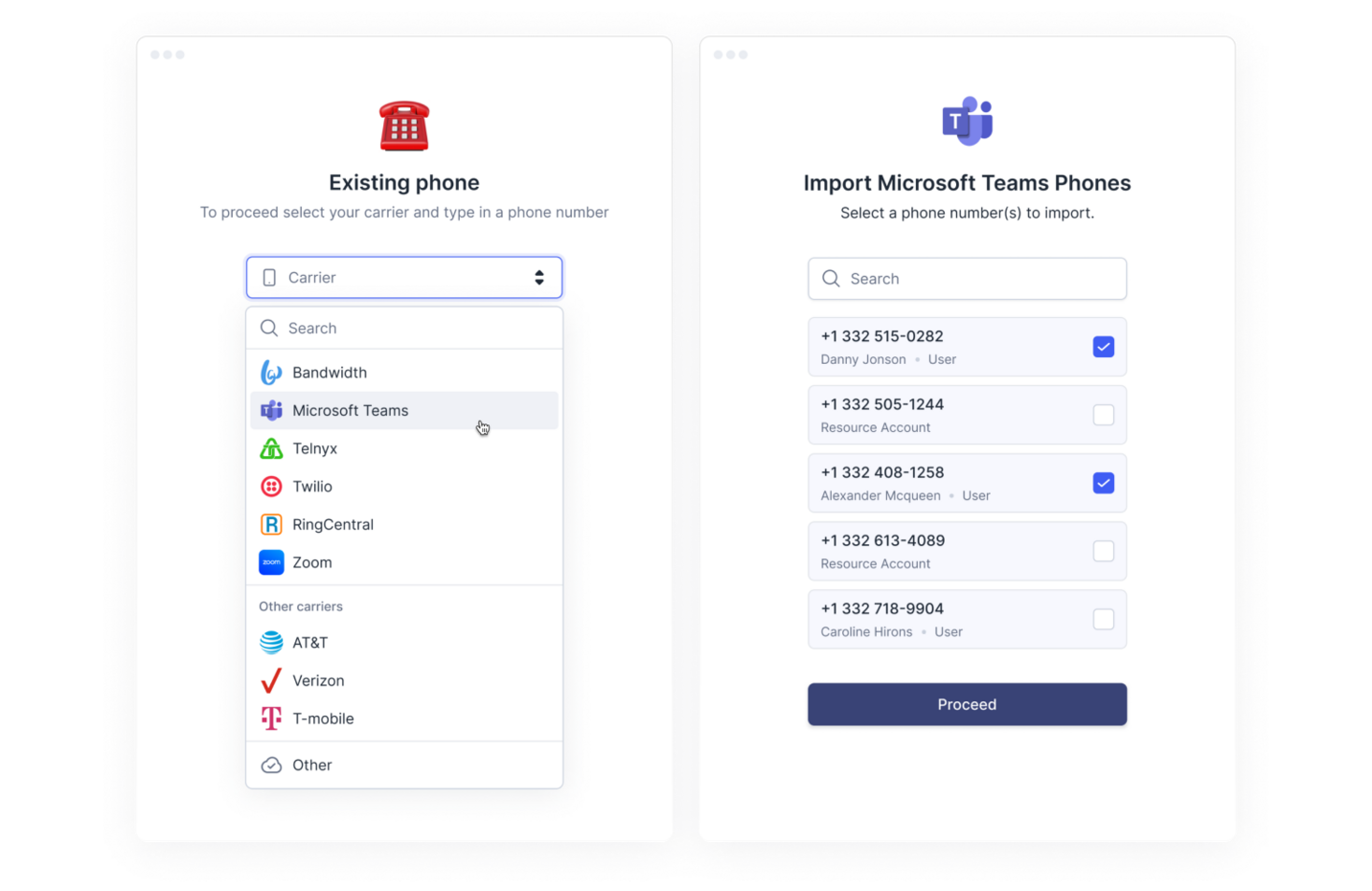

Fast rollout

Turn on texting for the number your company already owns - no swaps. Enable SMS/MMS, add RCS where available, and track outcomes. Proven finance SMS that goes live fast and scales cleanly.

Get started

Jeff Gelwix

Jeff GelwixPresident @ Sonic Drive-in

Clerk Chat is a beautifully built solution that is flexible, customizable, intuitive, and perfect for collaboration. We love the Clerk Chat platform, but what we love even more is how amazing and caring the team behind it is.

Read more on Trustpilot

Cruz M.

Cruz M.Professional Independent Marketer

As a marketing professional, I had trouble communicating with my contractors because we used Slack and Teams, but they weren't always online. I spent months looking for a tool to help me send text messages or WhatsApp messages to them so they could log in to Zoom and Google Meets. Plus, Clerk Chat also allows me text my clients that I have on HubSpot CRM.

Read more on G2

Katrina Bogany

Katrina BoganyPresident of Fab Finishes, Inc.

Clerk Chat is truly the missing piece of the puzzle with Teams! It makes Teams a complete communications solution, by adding the vitally important SMS texting functionality to the platform. In addition, Clerk Chat’s support is excellent.

Read more on Trustpilot

#ScheduleDemo

Instant, secure, 1:1 and multiplayer messaging. No APIs, no developers, no fuss.

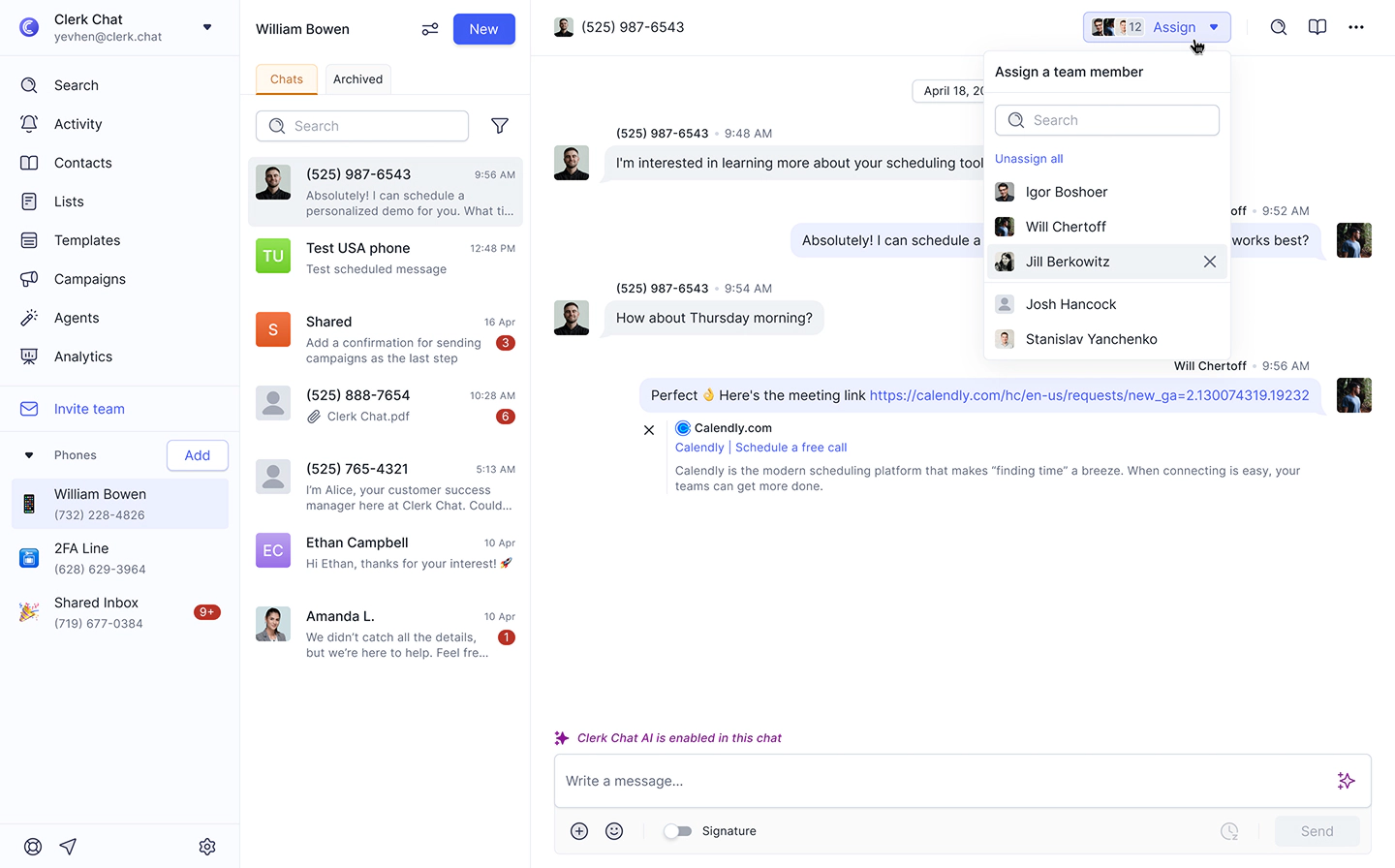

This ensures that customers receive swift responses, while also preventing any team member from becoming overwhelmed.

Appointment Reminder: "Hi [Client Name], this is a reminder for your appointment with [Advisor Name] on [Date] at [Time]. Reply 'YES' to confirm or 'RESCHEDULE' to choose a different time."

Payment Due Reminder: "Dear [Client Name], your payment of [Amount] is due on [Date]. Please ensure timely payment to avoid any late fees. Contact us if you have any questions."

Transaction Alert: "Alert: A transaction of [Amount] has been made on your account ending in [Last 4 Digits] on [Date]. If you did not authorize this, please contact us immediately."

Account Update Notification: "Hi [Client Name], your account details have been successfully updated. If you did not request this change, please contact our support team right away."

Tax Deadline Reminder: "Reminder: The tax filing deadline is approaching on [Date]. Ensure your documents are submitted on time to avoid penalties."

Security Alert: "Security Alert: Unusual login attempt detected on your account. If this was not you, please secure your account immediately by resetting your password."

Client Satisfaction Survey: "Hi [Client Name], we value your feedback! Please take a moment to complete our quick survey on your recent experience with [Service Name]. [Survey Link]"

Financial Advice: "Hi [Client Name], consider diversifying your portfolio to reduce risk and increase potential returns. Contact us for a personalized financial plan."

Essential finance SMS resources

Explore our comprehensive guides on secure messaging in finance, from regulatory requirements to implementation strategies, helping you build a robust communication framework for your financial institution.

Why Finance Teams are Adopting Conversational AI

Learn all about the rise of conversational AI in financial services, and the impact it can have on your business, with this expert guide from Clerk Chat.

The Guide to Text Message Archiving for Financial Advisors

Master the nuances of text message archiving for financial advisors, with this comprehensive guide and the powerful archiving and security features of Clerk Chat.

The No Nonsense Guide to SMS Compliance and Why it Matters

Is your company up to date with the latest SMS compliance rules? If not, you could be putting your business at risk. Learn how to navigate the latest laws with this guide.

Customers ❤️ Clerk Chat

Case studies

Over 4 billion conversations happen across the leading messaging platforms today. Meet your customers across the channels they prefer, instantly.

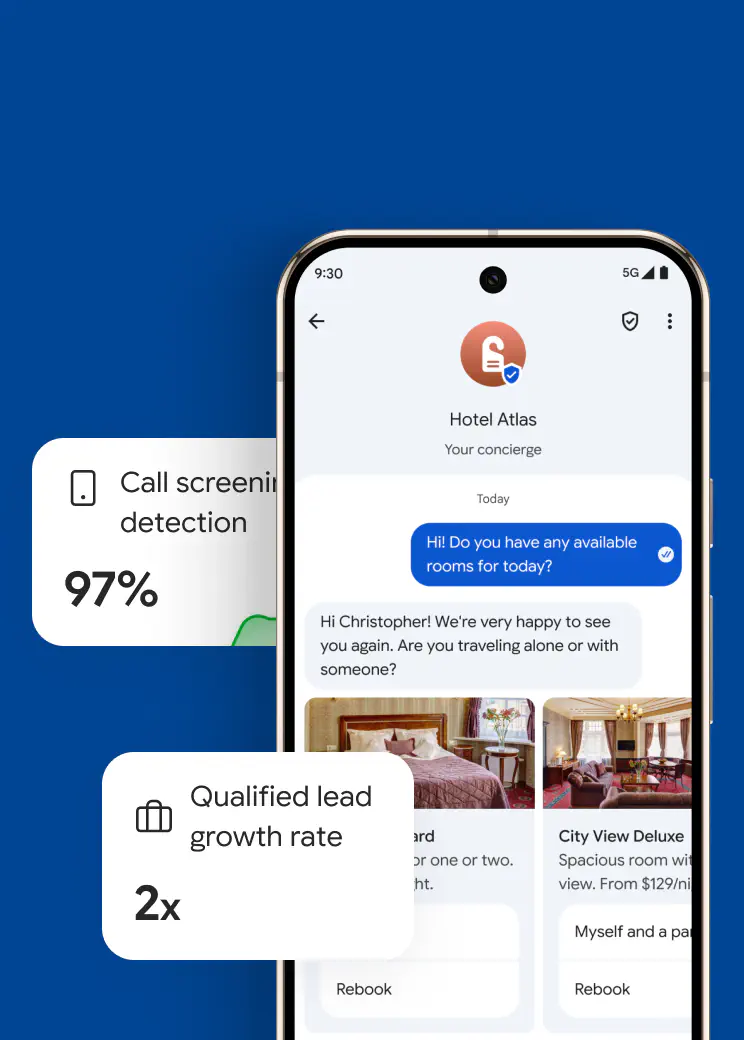

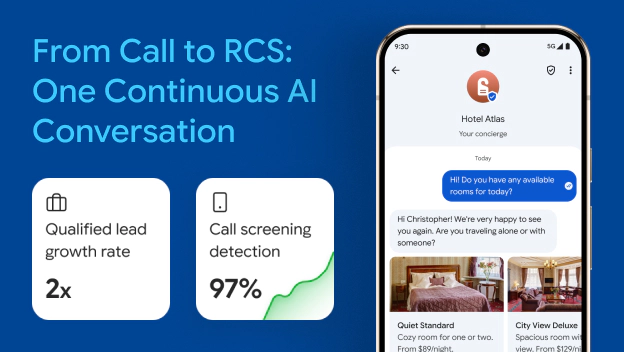

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AI

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AIClerk Chat deployed an AI agent that operates across voice, and RCS messaging as a unified experience, sharing the context across both channels to render a delightful customer journey. For this implementation, the AI agent was deployed to qualify leads for a major telecommunications provider.

Read Story How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messaging

How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messagingClerk Chat partnered with the Los Angeles Rams, Google, and carriers to launch the first U.S. sports marketing campaign using RCS business messaging.

Read Story How the YMCA of Northern Utah makes family communication easy and accessible

How the YMCA of Northern Utah makes family communication easy and accessibleYMCA of Northern Utah keeps parents happy with instant updates — 50+ staff sending 40K messages monthly through one platform.

Read Story

Find the right plan

Designed for every stage of your journey. Start today, no credit card required.

- Free

$0

user / month

Notes:

All features

- Growth

$9.99

user / month

Notes:

Essential features

- Ultimate Popular

$19.99

user / month

Notes:

Power features

- Enterprise

Custom

user / month

Notes:

Dedicated account manager

FAQ

Have questions? We've got answers.

Find what you need quickly and clearly with our most frequently asked questions.

Keep it. Clerk Chat lights up SMS/MMS (and RCS where available) on the number you already own, so there’s no messy change-over for clients. Your team can text right inside Microsoft Teams, Slack, Salesforce, or the web app - no new tool sprawl. Most teams import contacts and start sending same-day. If you’ve got multiple lines or branches, we’ll help map routing so messages land with the right team, every time.

Short answer: it’s built for regulated environments. You get verified opt-ins, clear opt-outs, 10DLC/A2P guardrails, access controls, and audit trails out of the box. We host on AWS (FedRAMP-authorized) and provide the data you need for reviews and supervision. If you follow SOC 2 practices internally, we align with that model and can share a security pack on request. Bottom line: your compliance team gets what they need without slowing frontline messaging.

Nope - and we wouldn’t ask you to. Many finance teams keep Smarsh for email while using Clerk Chat to capture and export message records. Every conversation has ownership, timestamps, and context, so you can push it via export, API, or webhook into your existing archive. That way your financial messaging services stay searchable alongside email, chats, and calls. Use the tools you’ve already vetted; we’ll fit in.

Yes, and that’s a big reason finance teams switch. With company-controlled messaging, everything flows through your number, not a rep’s device. Roles and permissions protect who can send what; shared inboxes make handoffs clean; internal notes keep context in one thread. Advisors still get fast back-and-forth, but you keep the supervision and auditability your policy requires. Fewer headaches, less 'Where’s that text?' panic.

Think of AI as your punctual assistant. It learns products, pricing, and policies from your CRM or data warehouse, then answers FAQs, qualifies leads, books callbacks, and routes to the right human when a question needs judgment. You set the rails: tone, escalation rules, quiet hours, and topics it should avoid. Every AI message and handoff is logged, with transcripts attached, so reviewers can spot patterns and coach the team. It’s SMS for finance with guardrails, not a black box.

It’s lighter than most comms projects. You’ll verify your number, connect the tools you already use (Teams/Webex/Salesforce), set roles and quiet hours, and import contacts. We’ll help you test deliverability and routing before you go wide. If you’re multi-location or multi-brand, we’ll template queues and permissions so you’re not rebuilding the same setup ten times. Most teams run a pilot in one group, then scale.

You’ve got built-in protections. Opt-in enforcement keeps lists clean, quiet hours stop late pings, and rate limits protect your number’s reputation. Templates help advisors send consistent, compliant messages without sounding robotic. If someone replies 'stop,' the system handles it instantly and updates the record. It’s finance SMS that respects both policy and people.

You see what matters: delivery, replies, and conversation ownership in real time; team performance and bottlenecks over time. Campaign views show who got the message and who responded. For AI, you can review transcripts, resolution rates, and assist-vs-handoff patterns. Export anything to your BI stack or archive so reporting isn’t trapped in yet another dashboard. This turns SMS service for financial industries into a measurable channel, not a black hole.