Conversational AI for Finance

Conversations that build trust

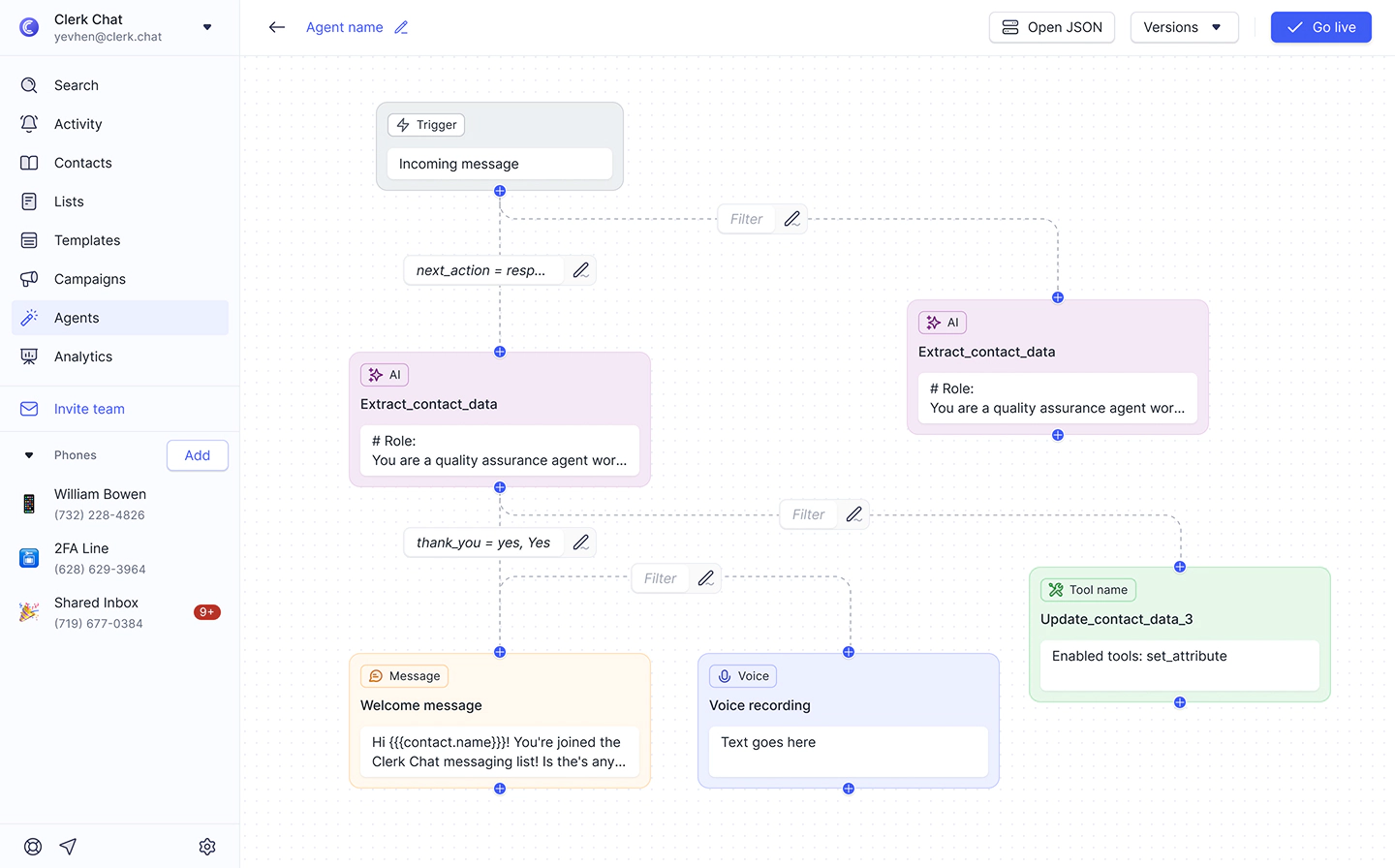

Conversational AI for finance understands intent, checks policy, and replies on-brand across text, chat, and voice - then hands off with context so advisors step in ready, not guessing.

Trusted by 1000+ brands

From startups to the Fortune 500, Clerk Chat is the most compliant and intuitive way for your team to unlock conversational messaging.

Conversational AI for finance, done right

With conversational AI for finance industry, clients get faster clarity, ops gets traceability, and your stack stays intact - no new numbers, no maze of tools.

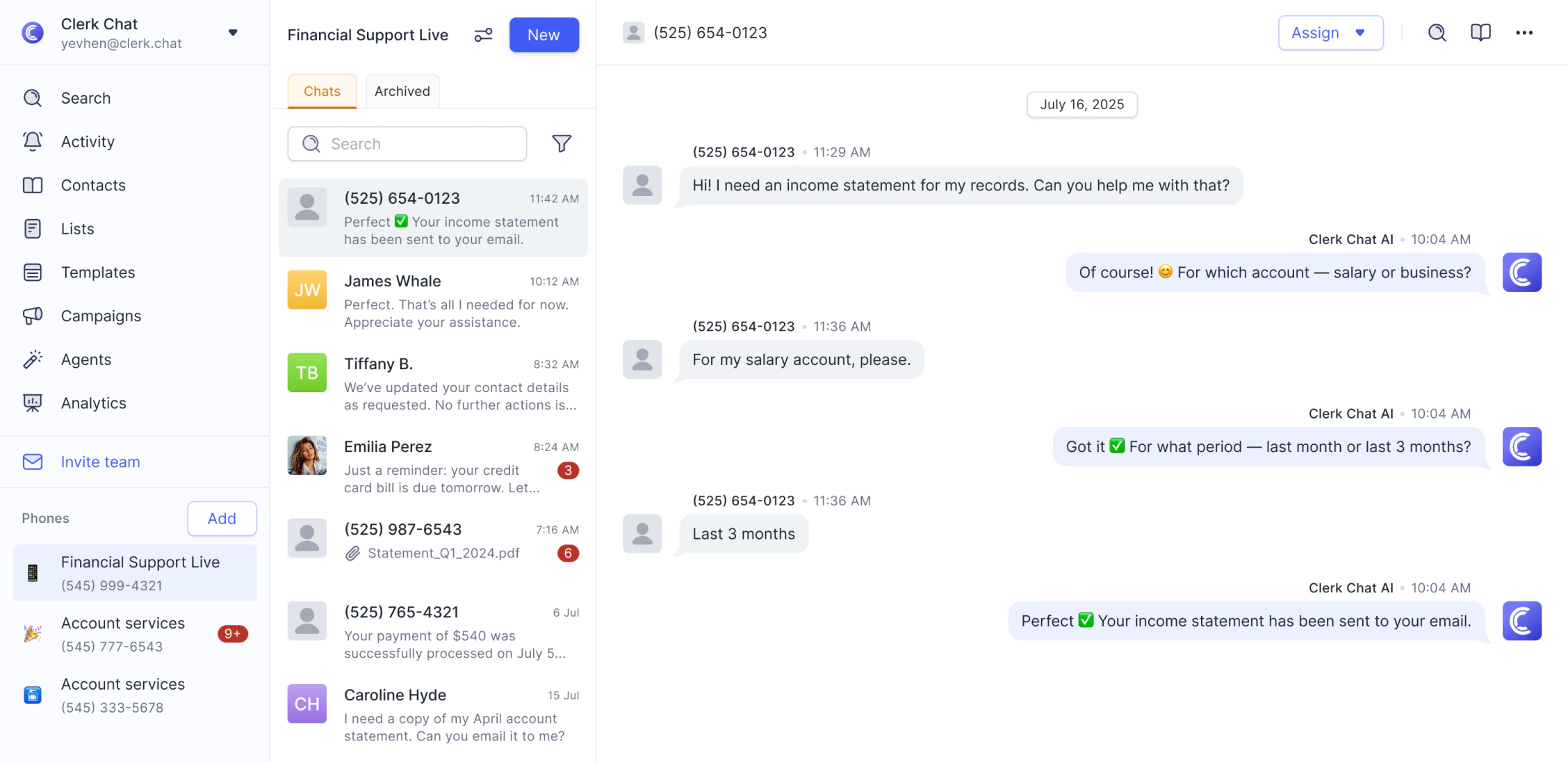

Policy-aware automation

The assistant reads intent, verifies identity, and follows your playbooks - fees, limits, disclosures - before it acts. If judgment’s needed, it pauses and escalates, leaving a clean trail for review.

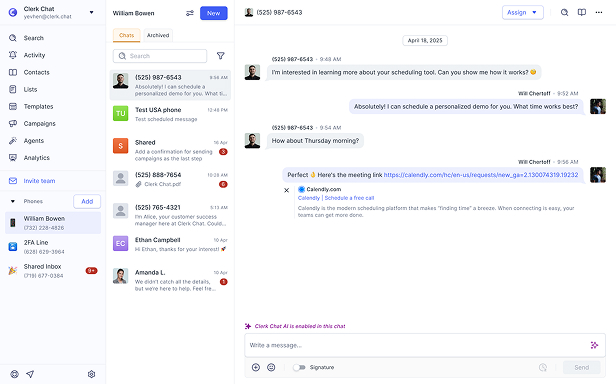

Human handoff, done right

Every escalation includes the reason, verification status, and a condensed transcript. Advisors open the thread, see what’s already covered, and continue the conversation without repeating a single question.

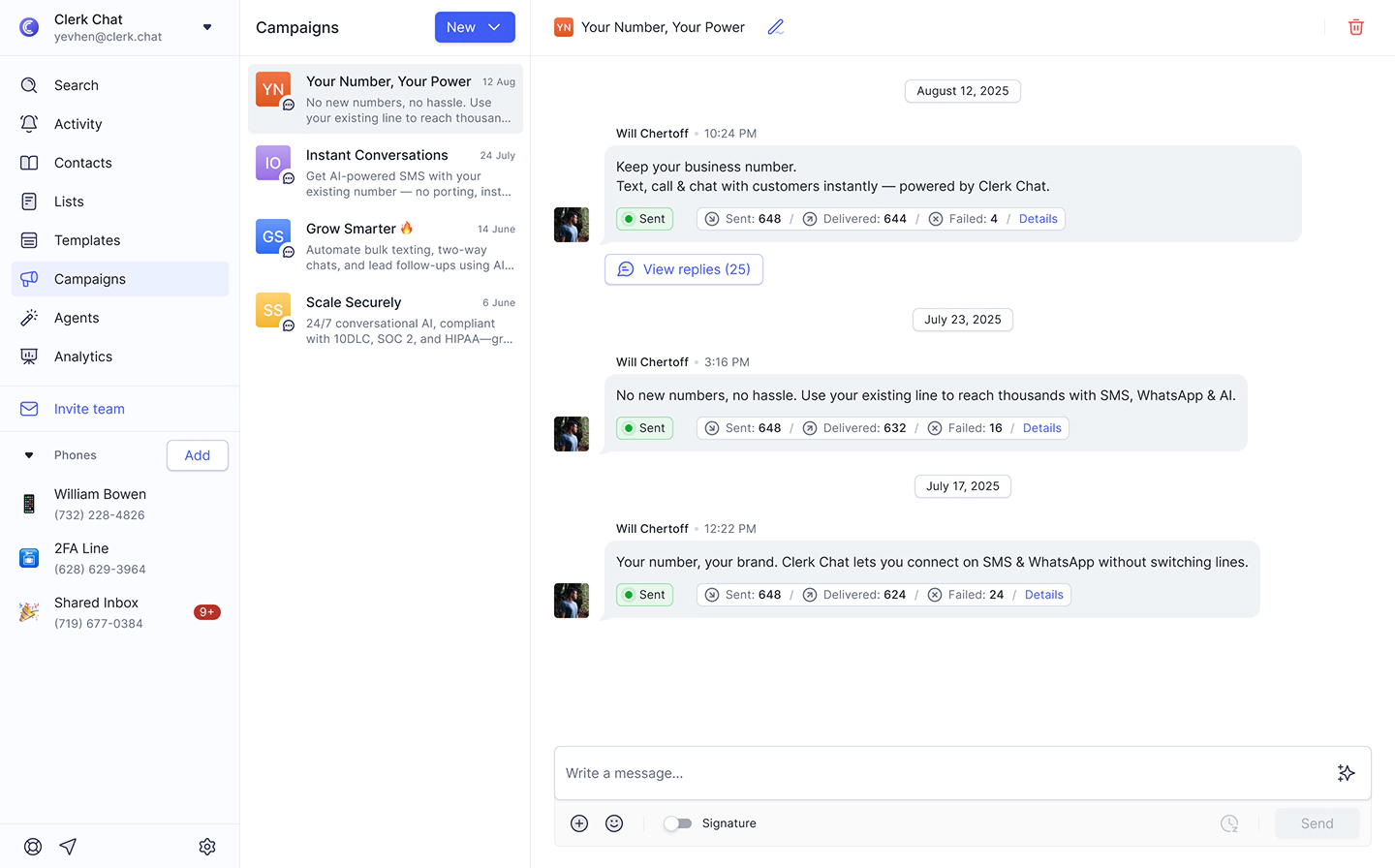

Works where you work

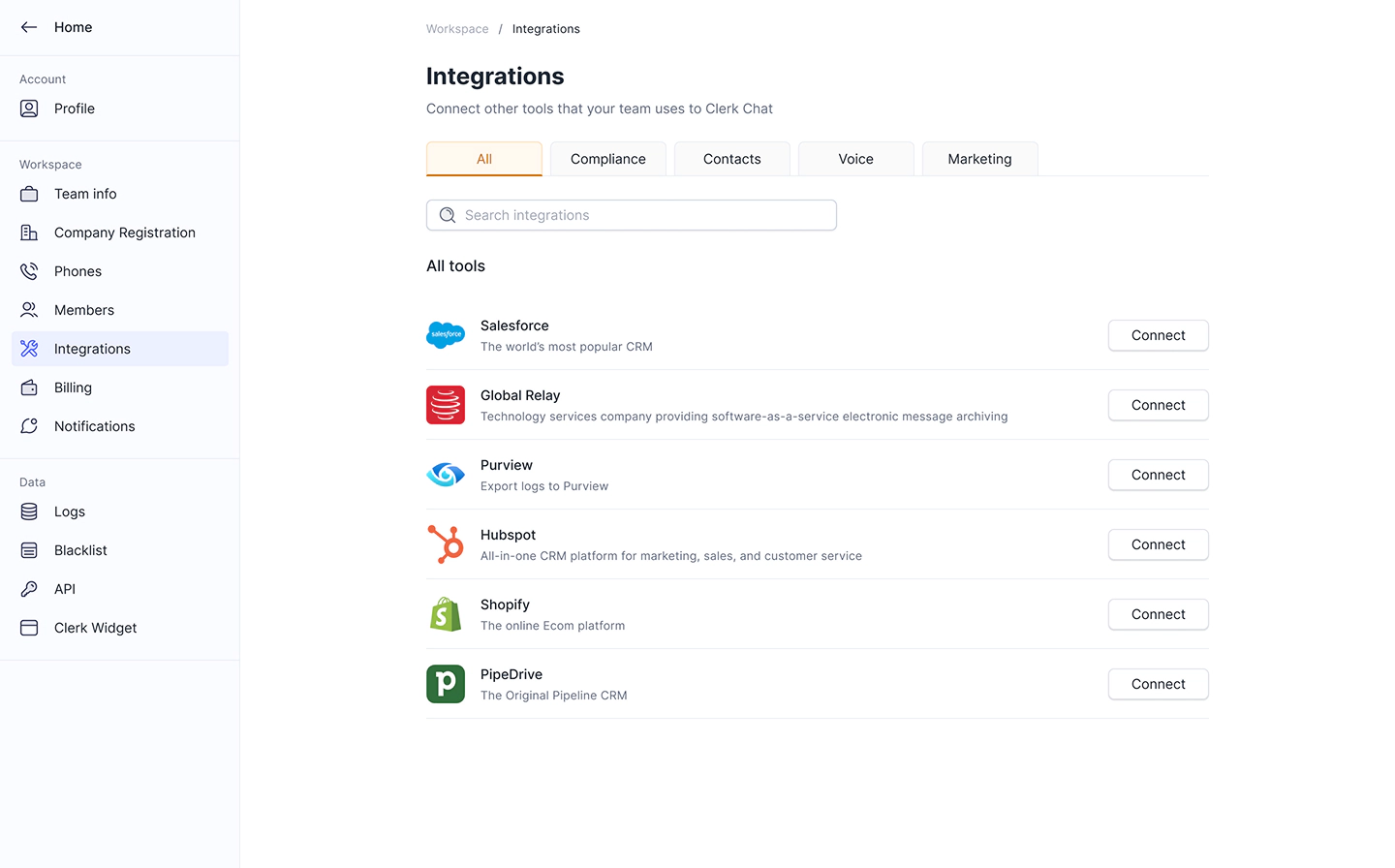

Run conversations in Microsoft Teams, Slack, Salesforce, or the web app. APIs and webhooks trigger workflows, enrich contacts, and mirror records to archives your compliance team already trusts.

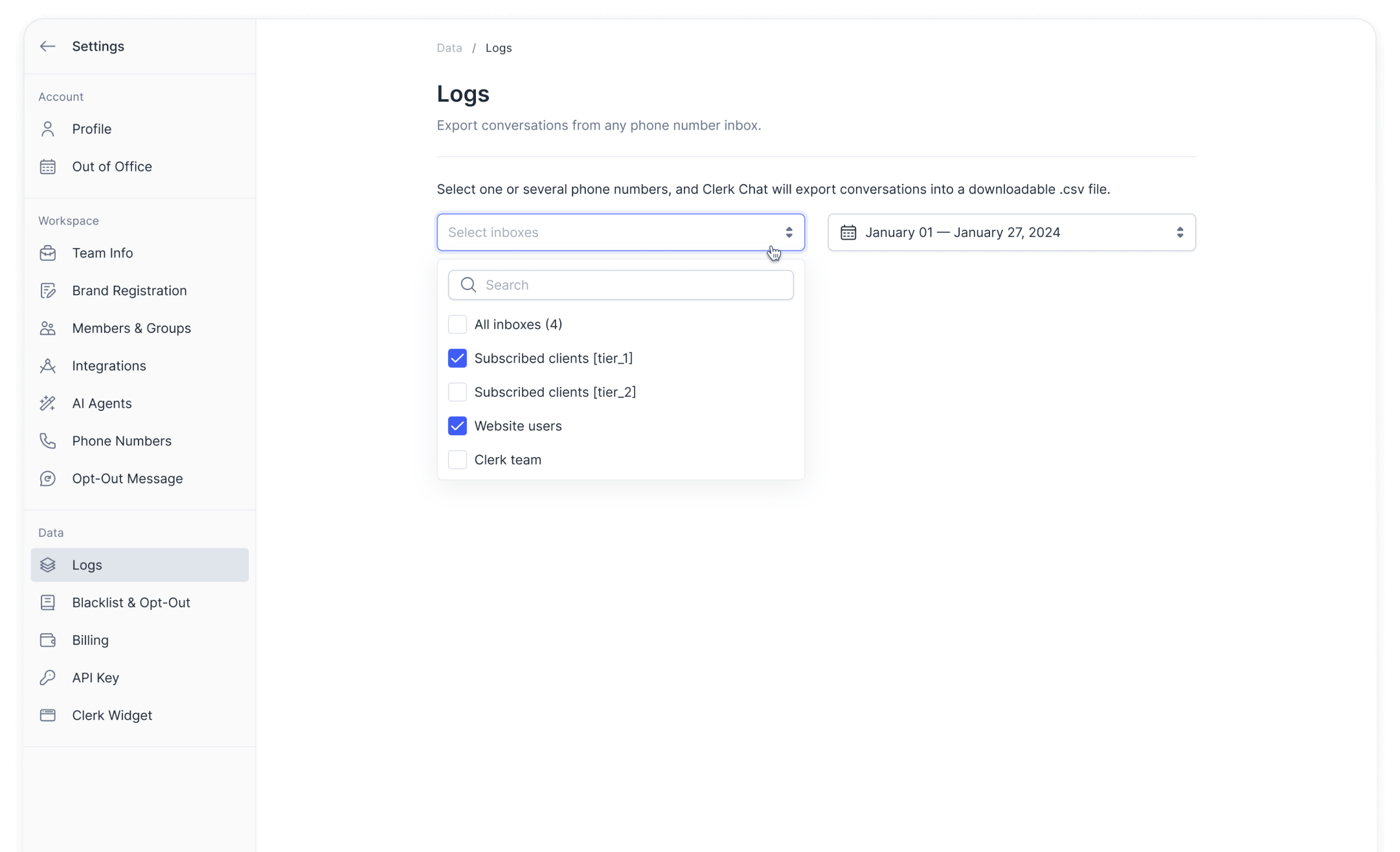

Governed from day one

Consent prompts, quiet hours, access controls, and tamper-evident logs come standard. Controls align with SOC 2, ISO 27001, and GDPR so supervision is predictable - and audits don’t derail delivery.

Customers ❤️ Clerk Chat

Case studies

Over 4 billion conversations happen across the leading messaging platforms today. Meet your customers across the channels they prefer, instantly.

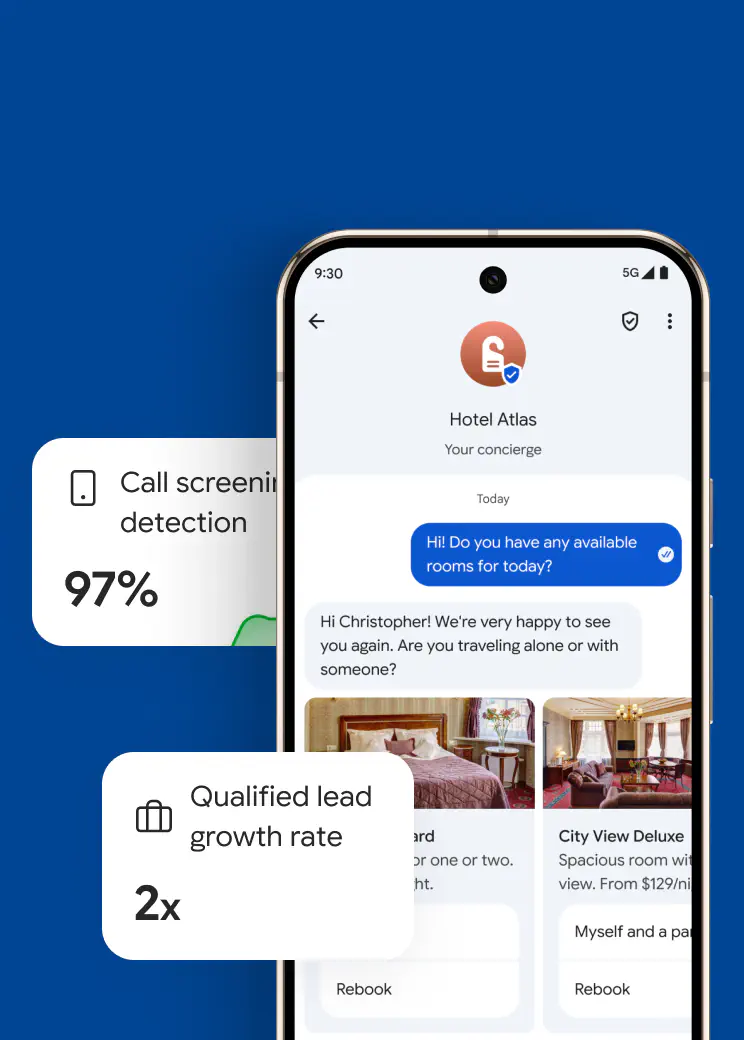

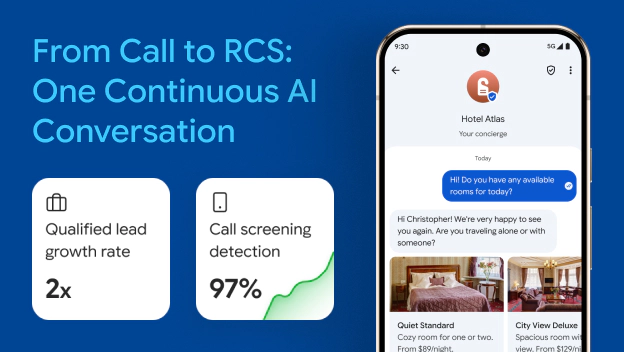

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AI

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AIClerk Chat deployed an AI agent that operates across voice, and RCS messaging as a unified experience, sharing the context across both channels to render a delightful customer journey. For this implementation, the AI agent was deployed to qualify leads for a major telecommunications provider.

Read Story How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messaging

How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messagingClerk Chat partnered with the Los Angeles Rams, Google, and carriers to launch the first U.S. sports marketing campaign using RCS business messaging.

Read Story How the YMCA of Northern Utah makes family communication easy and accessible

How the YMCA of Northern Utah makes family communication easy and accessibleYMCA of Northern Utah keeps parents happy with instant updates — 50+ staff sending 40K messages monthly through one platform.

Read Story

$1

per conversation

One conversation means 24 hours ofunlimited calls & messages with a contact

Unlimited back-and-forth calls in 24 hours

Unlimited back-and-forth messages in 24 hours

Automatic multi-channel support (SMS, WhatsApp, etc.)

FAQ

Have questions? We've got answers.

Find what you need quickly and clearly with our most frequently asked questions.

Scripts force clients down one path. Conversational AI in finance listens for intent, checks policy, and chooses the next best step. If it’s unsure, it asks once, then escalates with context so humans don’t restart the conversation.

You decide the sources: CRM fields, product docs, policy pages, pricing rules. The assistant only answers from approved data, quotes key details back for confirmation, and avoids guessing. If data is missing, it says so and routes to a person.

Yes. You set voice, phrases to use or avoid, and escalation language. The assistant mirrors that tone across SMS, chat, and voice, so clients feel one brand - not three different systems.

Access is permissioned, events are logged, and retention follows your policy. Controls align with SOC 2, ISO 27001, and GDPR. You can export conversations or forward them to your archive so supervision stays in one place.

No cold transfers. The assistant passes reason, verification status, and a short transcript. Advisors open the thread in Microsoft Teams, Slack, Salesforce, or the web app and continue - no repeated questions, no lost context.

It’s trained for financial language and confirms critical details back to the client before acting. On poor audio, it pivots to text confirmation or hands off. Clarity beats speed if there’s any doubt.

Start with a small set of intents - balance questions, appointment scheduling, document checks. Connect data, define verification rules, publish to one team, review transcripts weekly, then expand. Minimal training, fast feedback loops.

Track resolved vs. escalated, time to first answer, repeat contacts, and how often advisors start with full context. You’ll see fewer restarts, shorter queues, and cleaner reviews - signals that matter to both CX and compliance.