Text Messaging for Credit Unions

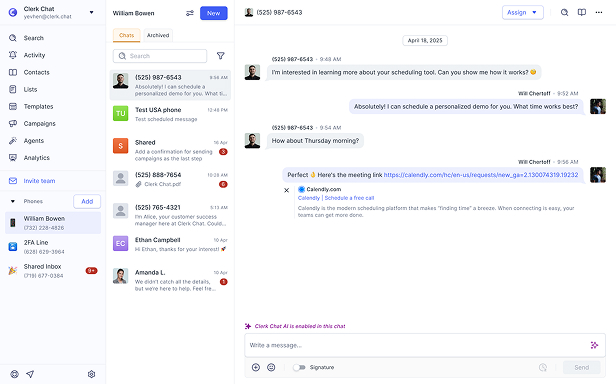

Secure business text messaging solution for credit unions with built-in compliance archiving for Smarsh, Global Relay, and Azure Storage.

Use cases

See how leading credit unions automate critical workflows while building deeper member relationships through conversational messaging.

Loan servicing & origination

«Application Received: Hi Sarah, we received your auto loan application for $25,000. We'll review it within 24 hours. Track status: [link]»

Payments management

«Friendly Reminder: Hi Mike, your loan payment of $458 is due in 3 days. Reply PAY to process now or DATE to reschedule.»

Fraud prevention & security

«Card Blocked Notice: Your debit card ending in 4782 has been blocked for safety. New card ships today. Questions? Call 555-0100.»

Credit union text messaging that delivers

Secure compliance

Every message stays audit-ready with our texting service for credit unions featuring automated archiving and encryption protocols.

Double authenticate sensitive transactions while members securely request and receive documents through compliant two-way text conversations daily.

Get started

Member experience

Transform member service with instant account alerts, application processing, and payment reminders through our SMS marketing platform credit unions trust.

Deliver loan documents, status notifications, and personalized support via integrated text and payment solutions members actually want.

Get started

Operational excellence

Cut processing time dramatically with our business text messaging solution for credit union teams managing collections and loan origination.

From inbound and outbound MMS to automated workflows, your finance SMS platform handles routine tasks while staff focuses elsewhere.

Get started

Revenue growth

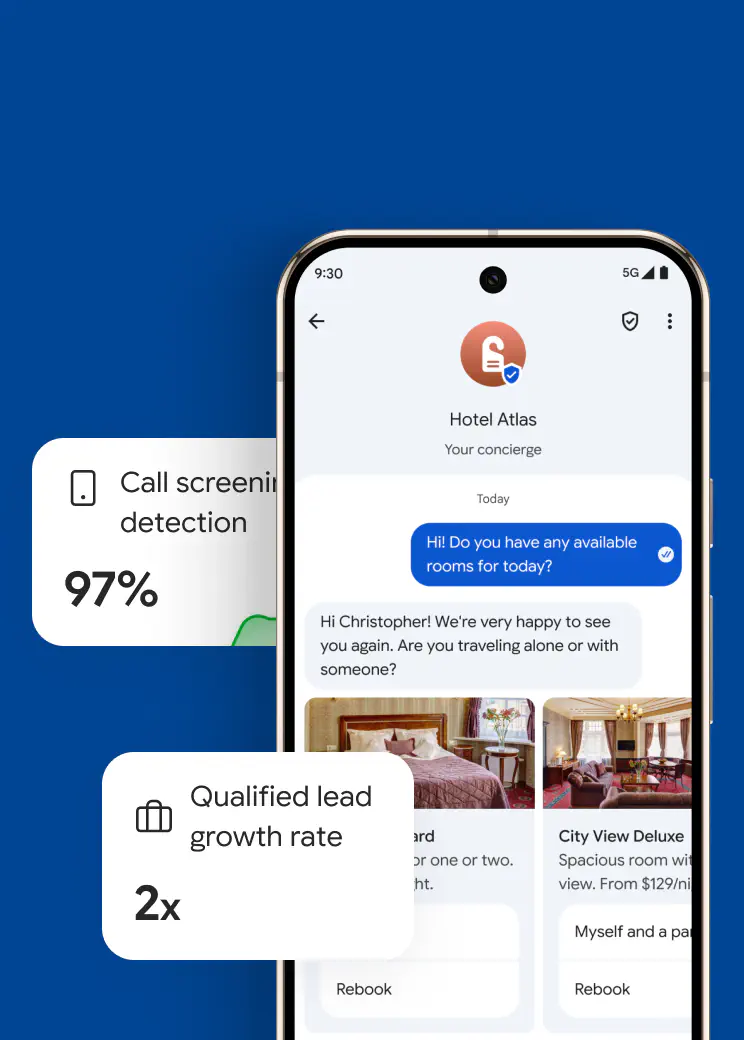

Drive conversions with AI SMS technology that qualifies leads, schedules appointments, and identifies insurance text messaging opportunities automatically.

Our text messaging for credit unions includes pay by text features, campaign performance insights, and engagement improvement analytics.

Get started

Jeff Gelwix

Jeff GelwixPresident @ Sonic Drive-in

Clerk Chat is a beautifully built solution that is flexible, customizable, intuitive, and perfect for collaboration. We love the Clerk Chat platform, but what we love even more is how amazing and caring the team behind it is.

Read more on Trustpilot

Cruz M.

Cruz M.Professional Independent Marketer

As a marketing professional, I had trouble communicating with my contractors because we used Slack and Teams, but they weren't always online. I spent months looking for a tool to help me send text messages or WhatsApp messages to them so they could log in to Zoom and Google Meets. Plus, Clerk Chat also allows me text my clients that I have on HubSpot CRM.

Read more on G2

Katrina Bogany

Katrina BoganyPresident of Fab Finishes, Inc.

Clerk Chat is truly the missing piece of the puzzle with Teams! It makes Teams a complete communications solution, by adding the vitally important SMS texting functionality to the platform. In addition, Clerk Chat’s support is excellent.

Read more on Trustpilot

#ScheduleDemo

Instant, secure, 1:1 and multiplayer messaging. No APIs, no developers, no fuss.

This ensures that customers receive swift responses, while also preventing any team member from becoming overwhelmed.

Payment Reminder: Hi [Name], your loan payment of $[Amount] is due tomorrow. Reply PAY to process or HELP for options. -[CU Name]

Account Alert: [Name], your checking balance fell below $100. Transfer funds at [link] or reply BALANCE for details. -[CU Name]

Loan Application Update: Great news, [Name]! Your auto loan is approved for $[Amount]. Visit [link] to review terms or call us. -[CU Name]

Document Request: Hi [Name], we need your income verification to complete your application. Upload securely: [link]. Questions? Reply HELP. -[CU Name]

Fraud Alert: URGENT: Unusual charge of $[Amount] at [Merchant]. Reply YES if authorized or NO to freeze card immediately. -[CU Name]

Appointment Confirmation: [Name], your appointment with [Staff] is confirmed for [Date] at [Time]. Reply CHANGE to reschedule. See you soon! -[CU Name]

New Service Promotion: [Name], you qualify for our 2.99% home equity line! Calculate your savings: [link]. Reply STOP to opt out. -[CU Name]

Payment Received: Thanks [Name]! We received your payment of $[Amount]. New balance: $[Balance]. Set up autopay: [link] -[CU Name]

Branch Closure Notice: [Name], our [Branch] location closes early at 2PM today for training. ATM available 24/7. Other locations: [link] -[CU Name]

Member Anniversary: [Name], happy 5-year anniversary with [CU Name]! You've earned exclusive member rewards. Check them out: [link] Thank you! -[CU Name]

Credit union success stories

Discover how credit unions nationwide boost member satisfaction and streamline operations with conversational messaging strategies that actually work.

Why Finance Teams are Adopting Conversational AI

Learn all about the rise of conversational AI in financial services, and the impact it can have on your business, with this expert guide from Clerk Chat.

SEC Text Messaging: The Rules for Compliant SMS

What is SEC text messaging, and how do you stay compliant in the modern world of messaging? Learn how to avoid hefty fines with this guide from Clerk Chat.

The No Nonsense Guide to SMS Compliance and Why it Matters

Is your company up to date with the latest SMS compliance rules? If not, you could be putting your business at risk. Learn how to navigate the latest laws with this guide.

Customers ❤️ Clerk Chat

Case studies

Over 4 billion conversations happen across the leading messaging platforms today. Meet your customers across the channels they prefer, instantly.

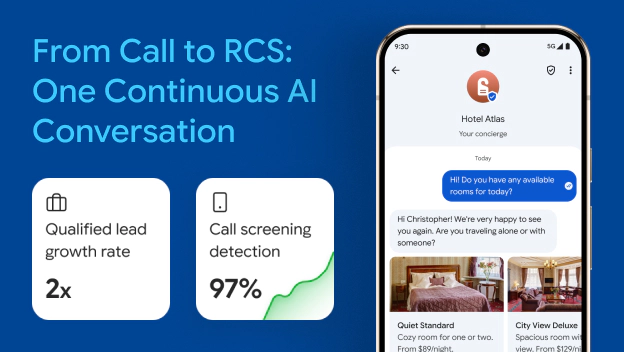

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AI

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AIClerk Chat deployed an AI agent that operates across voice, and RCS messaging as a unified experience, sharing the context across both channels to render a delightful customer journey. For this implementation, the AI agent was deployed to qualify leads for a major telecommunications provider.

Read Story How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messaging

How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messagingClerk Chat partnered with the Los Angeles Rams, Google, and carriers to launch the first U.S. sports marketing campaign using RCS business messaging.

Read Story How the YMCA of Northern Utah makes family communication easy and accessible

How the YMCA of Northern Utah makes family communication easy and accessibleYMCA of Northern Utah keeps parents happy with instant updates — 50+ staff sending 40K messages monthly through one platform.

Read Story

Find the right plan

Designed for every stage of your journey. Start today, no credit card required.

- Free Trial

$0

user / month

Notes:

All features

- Growth

$9.99

user / month

Notes:

Essential features

- Ultimate Popular

$19.99

user / month

Notes:

Power features

- Enterprise

Custom

user / month

Notes:

Dedicated account manager

FAQ

Have questions? We've got answers.

Find what you need quickly and clearly with our most frequently asked questions.

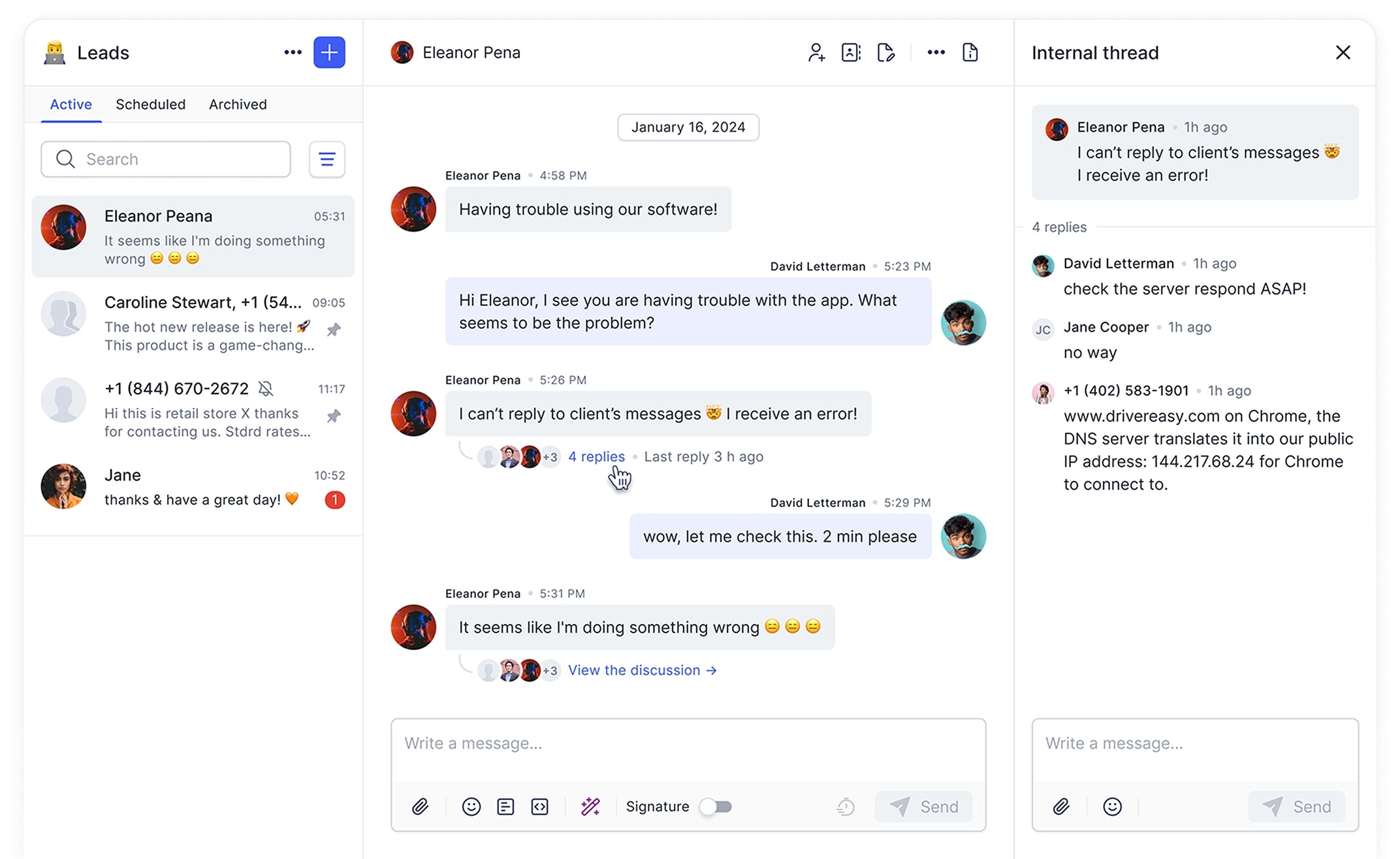

Text messaging meets members where they are—on their phones. With 98% of texts read within 3 minutes, credit unions can deliver instant account alerts, loan updates, and payment reminders without forcing members to wait on hold or visit branches. Members especially appreciate the convenience of two-way conversations for quick questions, document submissions, and payment processing. Clerk Chat's AI-powered responses ensure members get accurate answers 24/7, even outside business hours, while maintaining the personal touch credit unions are known for.

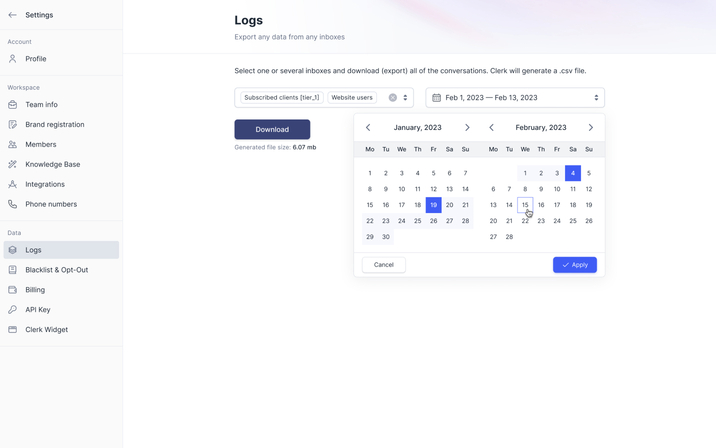

Clerk Chat takes compliance seriously with built-in 10DLC registration support and automated opt-in/opt-out management to meet TCPA regulations. Our platform integrates directly with enterprise archiving solutions like Smarsh, Global Relay, and Azure Storage, ensuring every message is logged and retrievable for audits. We provide double authentication for sensitive transactions, encrypted message storage, and secure document transfer capabilities. Plus, our platform maintains detailed logs with export functionality for regulatory reporting, making compliance reviews seamless.

Yes, Clerk Chat seamlessly integrates with major platforms credit unions already use. Our native connectors work with Salesforce for CRM functionality, Microsoft Teams for internal collaboration, and various core banking systems through our flexible API. You can sync member data, automate workflows, and ensure all text communications are logged in your existing systems. Our team handles the technical setup, and most credit unions are fully integrated within days, not weeks.

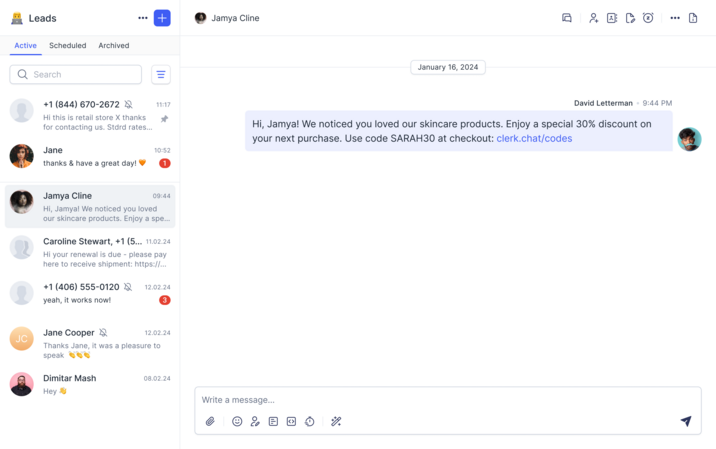

Credit unions use Clerk Chat for everything from transactional alerts to marketing campaigns. Send automated payment reminders, balance notifications, and fraud alerts. Process loan applications with status updates and document requests. Run targeted campaigns for new products, special rates, or member events using our SMS campaign tools with built-in analytics. Our platform supports both SMS and MMS, so you can include images, PDFs, and branded RCS messages for richer member experiences. Every message type includes customizable templates and variables for personalization.

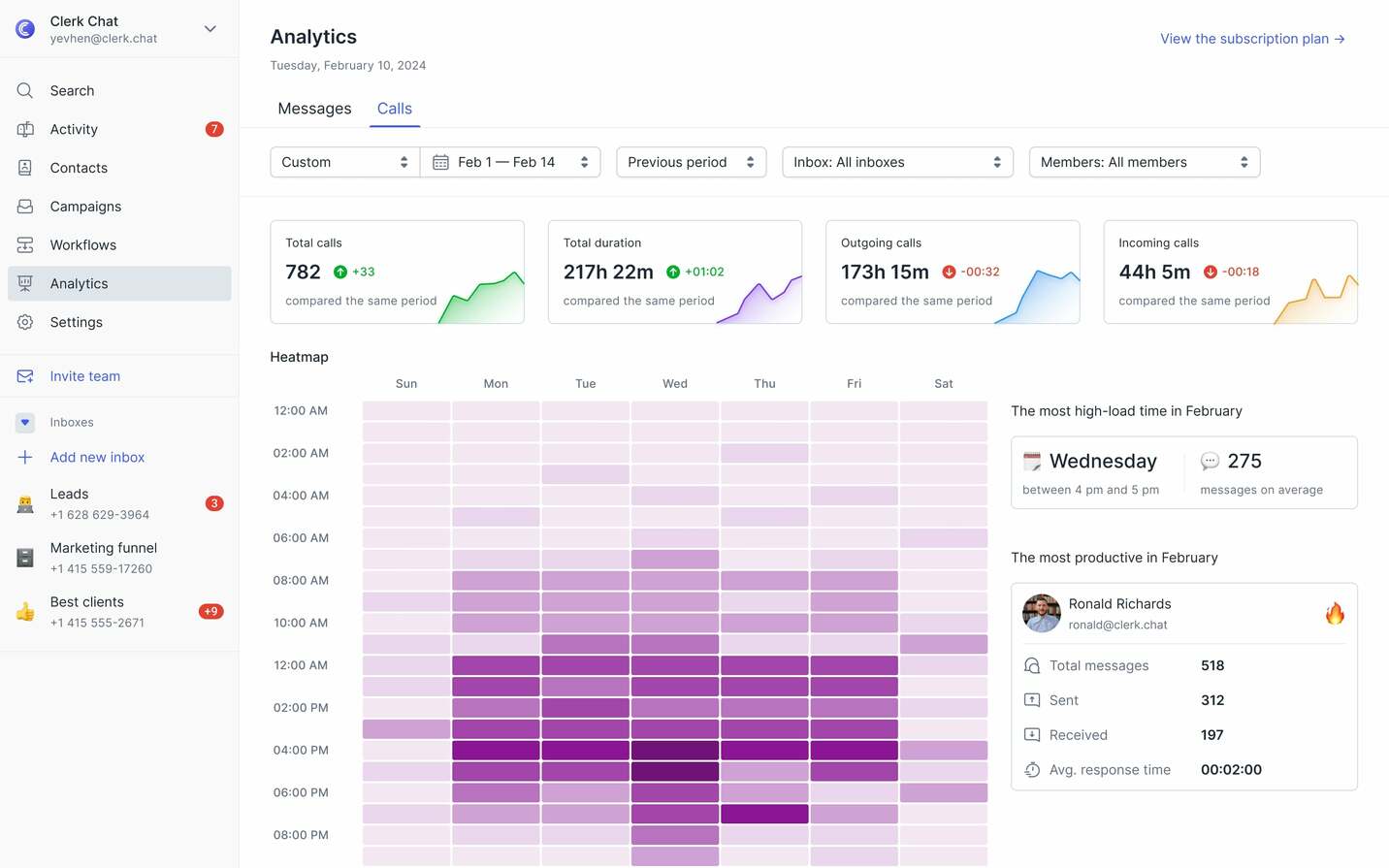

Credit unions typically see 40-60% reduction in call volume for routine inquiries, freeing staff for complex member needs. Our automated AI agents handle common questions about balances, hours, and rates instantly, reducing average handling time from 5-7 minutes per call to under 30 seconds per text. With integrated pay-by-text features, payment collection improves by 35% on average, reducing delinquencies and collection costs. Most credit unions report positive ROI within 60 days through reduced operational costs and increased member engagement in cross-selling opportunities.

Most credit unions go live within 7-10 business days. Our streamlined onboarding includes bringing your existing numbers or provisioning new ones, setting up compliance features, configuring templates, and training your team. We handle 10DLC registration, help establish opt-in procedures, and configure your archiving integrations. Your dedicated success manager guides you through launching your first campaigns, setting up AI responses, and establishing workflows. Many credit unions start with payment reminders and account alerts, then expand to marketing and member service as comfort grows with the platform.