Insurance SMS Software for Better Client Engagement

Discover the power of insurance text message marketing with Clerk Chat. Engage clients, streamline processes, and boost satisfaction effortlessly.

Use cases

Explore how text messaging for insurance helps agencies boost response rates, save time, and grow revenue.

Policy renewals

«Your auto insurance policy expires on [Date]. Renew now to maintain continuous coverage and save 5% with early renewal discount! Reply YES for details. 🛡️»

Claims status updates

«Your claim #[Number] has been approved and processed. Payment will be issued within 3-5 business days. Questions? Reply HELP to connect with your agent. ✅»

Appointment reminders

«Reminder: Your policy review meeting with [Agent Name] is tomorrow at [Time]. Reply C to confirm or R to reschedule. We look forward to serving you! 📅»

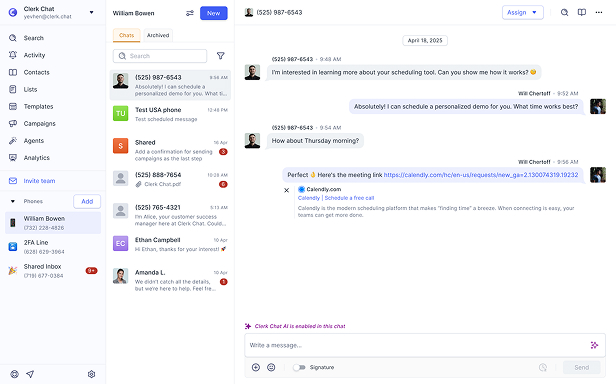

Our platform is built for insurance text message marketing

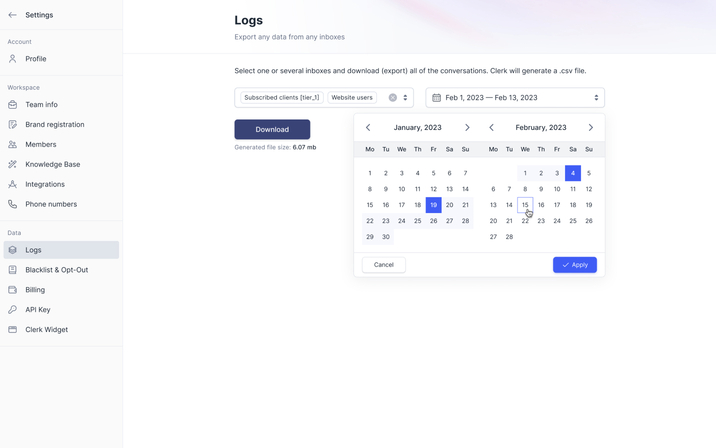

Effortless compliance and security

Keep your communications fully compliant with industry regulations using Clerk Chat.

Archive message logs with ease and protect sensitive client data, simplifying audits and maintaining top-tier data security.

Get started

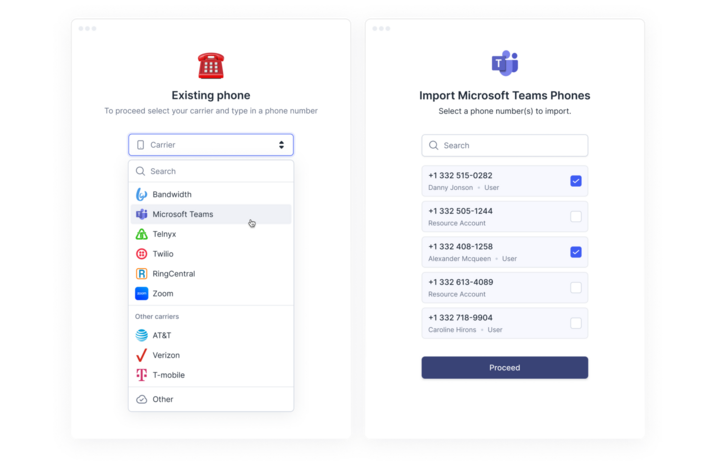

Seamlessly integrate your existing number

Easily connect your current phone number with Clerk Chat.

Keep your insurance text message marketing unified while maintaining your existing carrier. Clerk Chat ensures your messages are secure and compliant across all major VoIP platforms.

Get started

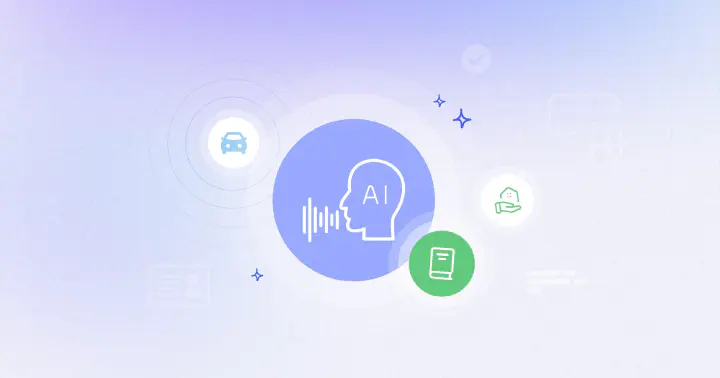

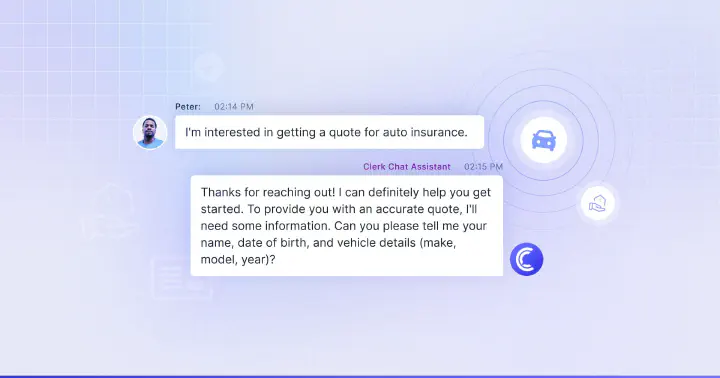

Supercharge your insurance operations with AI

Unlock the power of AI to elevate your team's efficiency.

Clerk Chat’s AI learns from your data to craft personalized, compliant insurance SMS, ensuring that every message meets the needs of your clients and aligns with your brand.

Get started

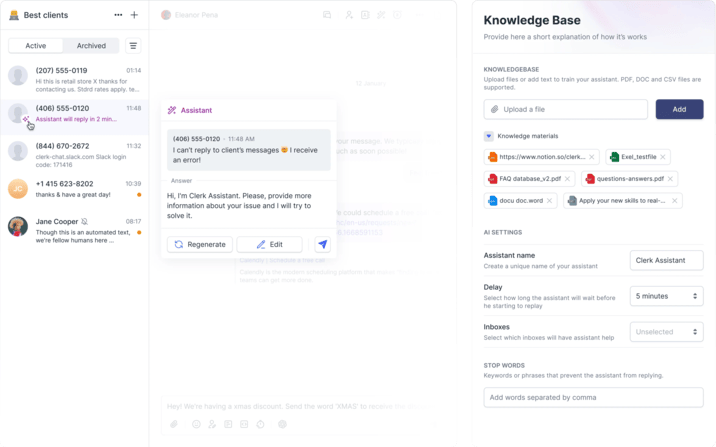

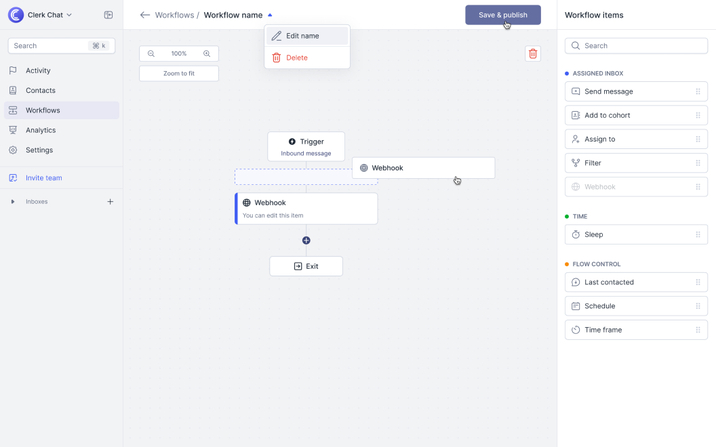

Simplify and automate client communication

Take the hassle out of client communication with Clerk Chat’s automation tools.

From appointment reminders to policy updates, automate routine tasks and focus on delivering exceptional service, knowing your workflows are seamlessly managed.

Get started

Jeff Gelwix

Jeff GelwixPresident @ Sonic Drive-in

Clerk Chat is a beautifully built solution that is flexible, customizable, intuitive, and perfect for collaboration. We love the Clerk Chat platform, but what we love even more is how amazing and caring the team behind it is.

Read more on Trustpilot

Cruz M.

Cruz M.Professional Independent Marketer

As a marketing professional, I had trouble communicating with my contractors because we used Slack and Teams, but they weren't always online. I spent months looking for a tool to help me send text messages or WhatsApp messages to them so they could log in to Zoom and Google Meets. Plus, Clerk Chat also allows me text my clients that I have on HubSpot CRM.

Read more on G2

Katrina Bogany

Katrina BoganyPresident of Fab Finishes, Inc.

Clerk Chat is truly the missing piece of the puzzle with Teams! It makes Teams a complete communications solution, by adding the vitally important SMS texting functionality to the platform. In addition, Clerk Chat’s support is excellent.

Read more on Trustpilot

#ScheduleDemo

Instant, secure, 1:1 and multiplayer messaging. No APIs, no developers, no fuss.

This ensures that customers receive swift responses, while also preventing any team member from becoming overwhelmed.

Policy Renewal Reminder: "Hi [Client Name], your [Policy Type] insurance policy is due for renewal on [Date]. Reply 'YES' to renew or 'CONTACT' to discuss options."

Claim Status Update: "Dear [Client Name], your claim [Claim ID] has been processed. Check your account for details or contact us for more information."

Coverage Update: "Alert: Your insurance coverage has been updated. Review your new benefits and limits at [Link]. Contact us if you have any questions."

Premium Payment Reminder: "Hi [Client Name], your premium payment of [Amount] is due on [Date]. Ensure timely payment to maintain your coverage."

Policy Document Available: "Notification: Your policy documents are now available online. Access them at [Link] and contact us if you need assistance."

Emergency Contact Update: "Hi [Client Name], we noticed your emergency contact information is outdated. Please update it at [Link] to ensure we can assist you effectively."

Customer Feedback: "Hi [Client Name], we value your opinion. Please take a moment to share your experience with our services. [Survey Link]"

Risk Assessment Tip: "Hi [Client Name], regular home inspections can help identify risks and reduce your insurance premiums. Contact us for a comprehensive risk assessment."

Insure & secure: insurance text messaging resource hub

Discover expert insights, compliance must-dos, and best practices to transform policyholder communications.

Conversational AI for Insurance: Claiming the Opportunity

Discover how conversational AI is transforming the insurance industry, boosting CX, automating claims, and cutting costs in this guide to conversational AI for insurance.

The No Nonsense Guide to SMS Compliance and Why it Matters

Is your company up to date with the latest SMS compliance rules? If not, you could be putting your business at risk. Learn how to navigate the latest laws with this guide.

How to Leverage AI for Insurance Agents to Create Better Client Relationships

Leveraging AI for insurance agents creates automated processes, transforms policyholder engagement, improves customer experience, optimizes decision-making, and reduces risk.

Customers ❤️ Clerk Chat

Case studies

Over 4 billion conversations happen across the leading messaging platforms today. Meet your customers across the channels they prefer, instantly.

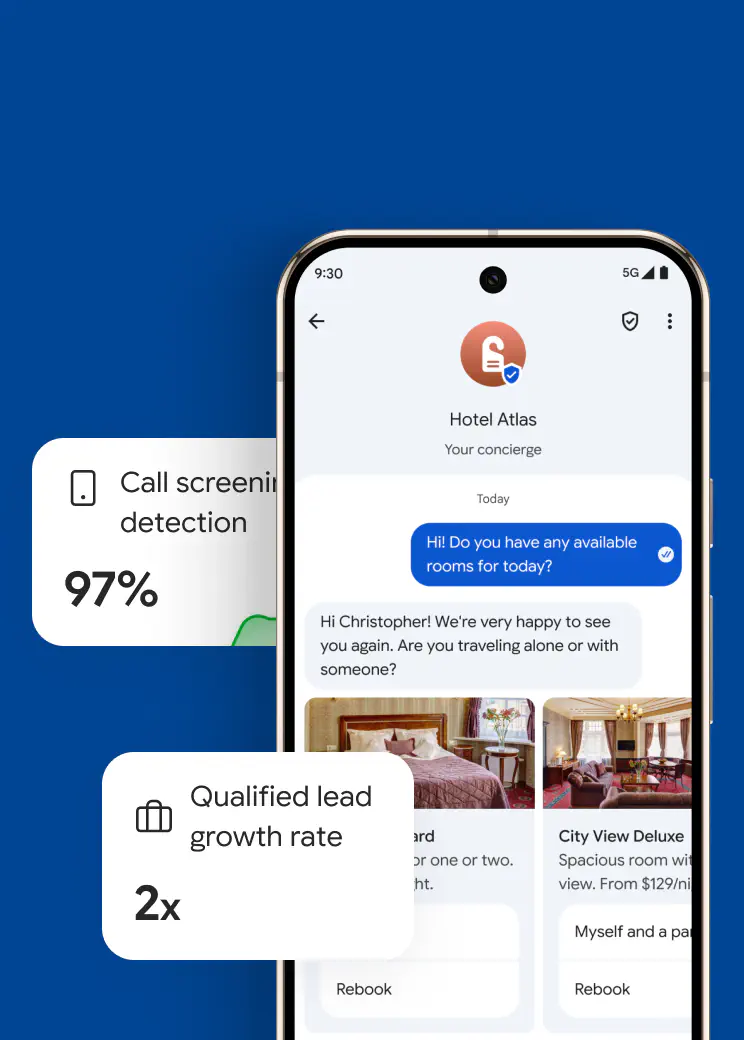

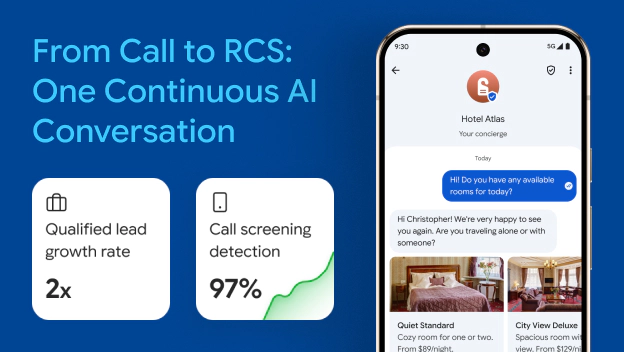

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AI

How a Leading Customer Acquisition Company 2x'd Qualified Leads with Clerk Chat's Multi-Channel AIClerk Chat deployed an AI agent that operates across voice, and RCS messaging as a unified experience, sharing the context across both channels to render a delightful customer journey. For this implementation, the AI agent was deployed to qualify leads for a major telecommunications provider.

Read Story How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messaging

How the Los Angeles Rams increased ticket sales by 60% with Clerk Chat’s RCS business messagingClerk Chat partnered with the Los Angeles Rams, Google, and carriers to launch the first U.S. sports marketing campaign using RCS business messaging.

Read Story How the YMCA of Northern Utah makes family communication easy and accessible

How the YMCA of Northern Utah makes family communication easy and accessibleYMCA of Northern Utah keeps parents happy with instant updates — 50+ staff sending 40K messages monthly through one platform.

Read Story

Find the right plan

Designed for every stage of your journey. Start today, no credit card required.

- Free

$0

user / month

Notes:

All features

- Growth

$9.99

user / month

Notes:

Essential features

- Ultimate Popular

$19.99

user / month

Notes:

Power features

- Enterprise

Custom

user / month

Notes:

Dedicated account manager

FAQ

Have questions? We've got answers.

Find what you need quickly and clearly with our most frequently asked questions.

Imagine transforming your marketing into a conversation that feels personal and immediate. That's what Clerk Chat does for you. By integrating SMS directly into your workflow, you can send reminders, policy updates, or even just a friendly 'hello' without skipping a beat. Clerk Chat helps leverage the power of both SMS insurance and finance SMS to engage clients and build trust - your clients will feel valued and informed.

You can save time and keep clients informed. Text messaging is fast and you can take advantage of customizable templates and snippets to find quick ways to connect with customers whether it be to send policy updates, accident reminders, renewal notifications, or even a personalzed offer. With Clerk Chat, your messages are seen daily, leading to more frequent responses and a more engaged customer base. It's not just messaging; it's connecting.

Absolutely! Think about it – when was the last time you ignored a text message? Texting offers an immediacy that emails can't match. With Clerk Chat, your messages land right in the palm of their hands, leading to higher open rates, quicker responses, and a more engaged customer base. It's not just messaging; it's connecting.

Yes, indeed! Scheduling messages is a game-changer for insurance agents. With Clerk Chat, you can plan a text messaging for insurance agents campaign in advance. Whether it’s appointment reminders or renewal notices, scheduling with Clerk Chat means you'll never miss an important touchpoint again. It’s all about being there at the right moment without having to constantly watch the clock.

We treat compliance like our morning coffee – absolutely essential. Clerk Chat is designed to keep you in line with all SMS regulations, ensuring every message sent is above board. From verified opt-ins to easy opt-out options for your clients, we’ve got the checks in place so you can text away worry-free.

We blend AI-driven personalization with seamless integrations into platforms like Microsoft Teams and Salesforce. This means not only do your messages get there but they resonate on a personal level—think of us as part of your team that doesn’t need coffee breaks.